A seismic shift has rumbled through the automotive landscape. Once heralded as the future, the trajectory of battery-powered electric vehicles (EVs) is now stalling. A sector that witnessed exponential growth, with EV unit sales climbing 51% year over year not long ago, has now ground to a halt. In a shocking turn, the first quarter of 2024 saw EV growth rates plunge to zero, rendering the number of EVs sold in the United States stagnant compared to a year prior.

Amid this jolt, plug-in hybrids have emerged as the new favorites, exhibiting robust growth of over 50% year over year. They now spearhead the automotive industry’s expansion in 2024. In response to this sea change, Ford (NYSE: F) has made a strategic pivot by abandoning plans for an all-electric SUV, opting instead for a plug-in hybrid model.

But what does this strategic shift mean for players like Rivian Automotive (NASDAQ: RIVN), a company banking on all-electric pick-ups and SUVs? Let’s delve deeper into the implications.

Ford’s Strategic Revamp

A few years back, Ford plunged significant resources into battery technology and EV innovations, unveiling the Mustang Mach-E and F-150 Lightning. In 2021, it earmarked a colossal $11.4 billion for new American manufacturing plants dedicated to churning out batteries and electric vehicles. Now, a paradigm shift is on the horizon.

Ford’s forthcoming SUV lineup will center on plug-in hybrids, abandoning the all-electric route. Despite this deviation, Ford’s massive investment isn’t set to go to waste—plug-in hybrids still necessitate substantial lithium-ion batteries, albeit in more modest quantities that trim costs. Consumers are echoing a preference for plug-in hybrids’ adaptability. While the demand for full EVs remains static in the US, plug-in hybrid sales surged by a striking 59% in Q1 of 2024.

Currently, consumer sentiment leans toward the flexibility of plug-in hybrids over the fully electric offerings by Rivian and Tesla. But what will this industry shift spell for these players?

The Conundrum Facing Rivian

On one hand, proponents could argue that Rivian is attuned to the environmental zeitgeist, manufacturing all-electric SUVs and pick-ups. The tide seems to be turning in favor of eco-conscious vehicles, with traditional combustion engines slated for obsolescence. However, Rivian’s exclusive focus on all-electric models excludes it from profiting in the current surge enjoyed by plug-in hybrids.

A glance at Rivian’s delivery and production data reveals a worrisome pattern. While production figures have stagnated around 60,000 vehicles yearly, deliveries have seen a tepid ascent, buoyed by liquidating excess inventory amassed in late 2023. The delivery rate has barely caught up with the production rate.

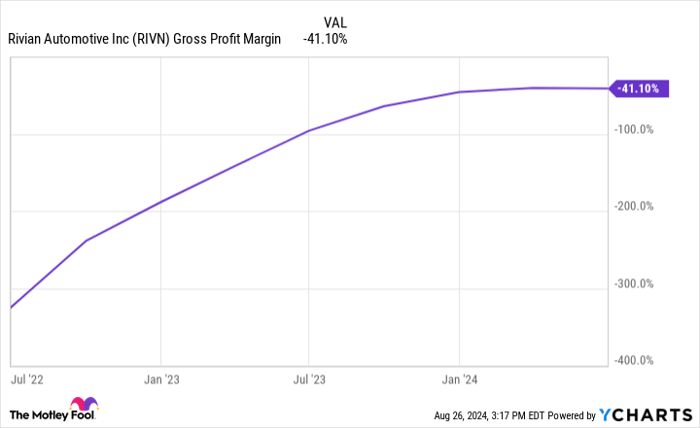

This growth standstill mirrors the surge in plug-in hybrid preference. Notably, larger vehicles like SUVs and pick-up trucks entail hefty battery requirements, translating to elevated production costs that consumers are reluctant to bear. Despite Rivian’s base price of $75,000 for a pick-up truck, the company is grappling with a shocking negative 41% gross margin.

RIVN Gross Profit Margin data by YCharts.

Assessing Rivian Stock’s Viability

The burgeoning tilt towards plug-in hybrids forebodes ominous clouds for Rivian’s future. To thrive, the company necessitates a clientele willing to splurge on premium EVs and a scale-up in production to pivot its gross margins from the red to black—an evolution akin to Tesla’s transformation during the Model 3’s mass production phase.

Introducing a new car model entails exorbitant costs, from design to supply chain logistics to capital infusion in manufacturing facilities—it’s a marathon sans shortcuts in the auto realm. With an annual burn rate of $5 billion and less than $8 billion in cash reserves, Rivian faces a formidable challenge in venturing towards plug-in hybrids without securing substantial external financing.

Merely last year, Rivian’s gross margin trajectory seemed promising though distant, hinting at upside potential and future profitability as production scaled up. Alas, the landscape has shifted towards negative gross margins, accompanied by stalled production and customer deliveries. This decline coincides with the escalating demand for plug-in hybrids in the US.

If the vortex of plug-in hybrid dominance persists, Rivian’s plight is destined to worsen. Consequently, prudent investors should steer clear of this precarious and unprofitable stock in the present climate.

Contemplating an Investment in Rivian Automotive

Before plunging into Rivian Automotive’s stock, pause and ponder:

The Motley Fool Stock Advisor analysts have pinpointed what they deem the 10 best stocks to invest in now, and Rivian Automotive did not make the list. The ten chosen stocks hold the potential for colossal returns in the imminent years.

Imagine NVIDIA’s inclusion in this list on April 15, 2005—investing $1,000 at our recommendation would have snowballed into $769,685!*

Stock Advisor furnishes investors with a user-friendly roadmap for success, offering counsel on portfolio construction, frequent updates from analysts, and two fresh stock recommendations monthly. The Stock Advisor service has outperformed the S&P 500 severalfold since 2002*.

*Stock Advisor returns as of August 26, 2024

Brett Schafer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Tesla. The Motley Fool has a disclosure policy.