Big tobacco giants Altria Group (MO) and Philip Morris International (PM) have witnessed remarkable stock surges of over 30% this year.

With both companies offering generous dividends and trading near their 52-week highs, they have undoubtedly captured the attention of investors. Let’s delve into whether it’s the opportune moment to invest in either Philip Morris or Altria for potentially greater highs.

Image Source: Zacks Investment Research

Positive Developments Driving Profits

One key factor buttressing the market positions of Philip Morris and Altria is the shift towards smoke-free products.

This transition has facilitated their expansion into various international markets, notably Europe, with the introduction of heated non-burn tobacco, vapor, and oral nicotine products, which has led to increased profitability. Notably, the Zacks Tobacco Industry is currently ranked in the top 10% among over 250 Zacks industries.

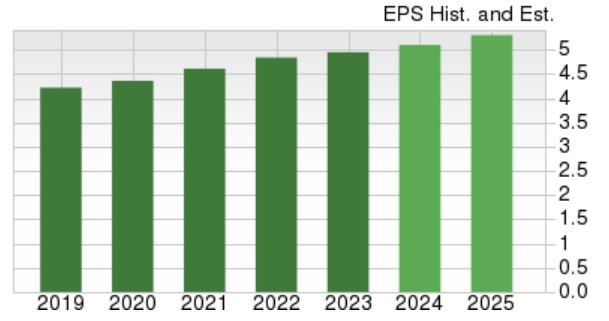

According to Zacks estimates, Altria’s annual earnings are anticipated to grow by 3% in fiscal 2024 and are forecasted to rise by a further 4% in FY25 to $5.30 per share. Moreover, the FY25 EPS projections signify a 25% increase from pre-pandemic levels when Altria recorded earnings of $4.22 per share in 2019.

Image Source: Zacks Investment Research

Robust Financial Performance

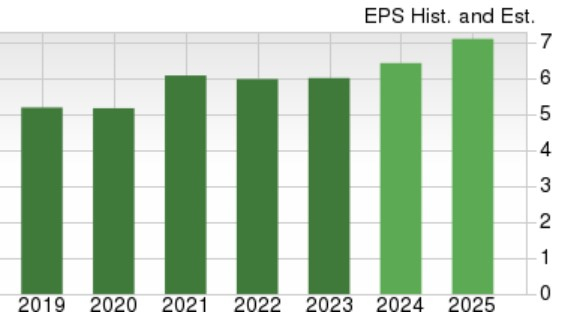

Looking at Philip Morris, its bottom line is set to expand by 7% this year, with annual earnings projected to surge by an additional 10% in FY25 to $7.10 per share. Impressively, the FY25 EPS estimates for Philip Morris depict a remarkable 37% growth post-pandemic, with earnings standing at $5.19 a share in 2019.

Image Source: Zacks Investment Research

Valuation Analysis

Currently trading at $54, Altria’s stock boasts a forward earnings multiple of 10.6X, slightly below the industry average of 12.7X. Conversely, Philip Morris shares, priced at $125, carry a forward earnings ratio of 19.5X, a premium compared to both the industry and Altria but below the S&P 500’s 23.2X multiple.

Image Source: Zacks Investment Research

Steady Dividends

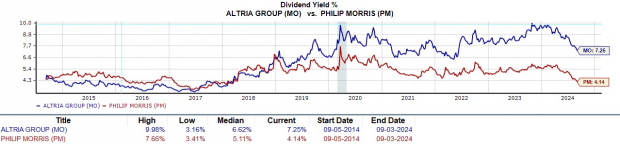

The attractive dividends offered by these tobacco behemoths have continued to captivate investors, especially in light of Philip Morris and Altria’s strong earnings outlook.

While Philip Morris currently leads in bottom-line growth, Altria’s annual dividend yield of 7.25% bolsters its more reasonable valuation. This surpasses the industry average of 5.74% and Philip Morris at 4.14%, with both surpassing the S&P 500’s 1.28% average.

Moreover, Altria reigns as a Dividend King, having raised its payout for over 50 consecutive years.

Image Source: Zacks Investment Research

Final Thoughts

Given its promising earnings outlook, Philip Morris International’s stock holds a Zacks Rank #2 (Buy) while Altria Group secures a Zacks Rank #3 (Hold).

Although earnings estimate revisions for FY24 favor Philip Morris over Altria, both these tobacco giants present compelling long-term investment opportunities with enticing dividends and reasonable valuations.