The Remedy for the Oversold Blues

Amid the chaos of the consumer discretionary sector, a shimmer of hope emerges for astute investors. The mantra of buying low and selling high finds resonance in the RSI – the adrenaline of the stock market. The RSI below 30 signals a ripened opportunity, a potential treasure trove waiting to be explored.

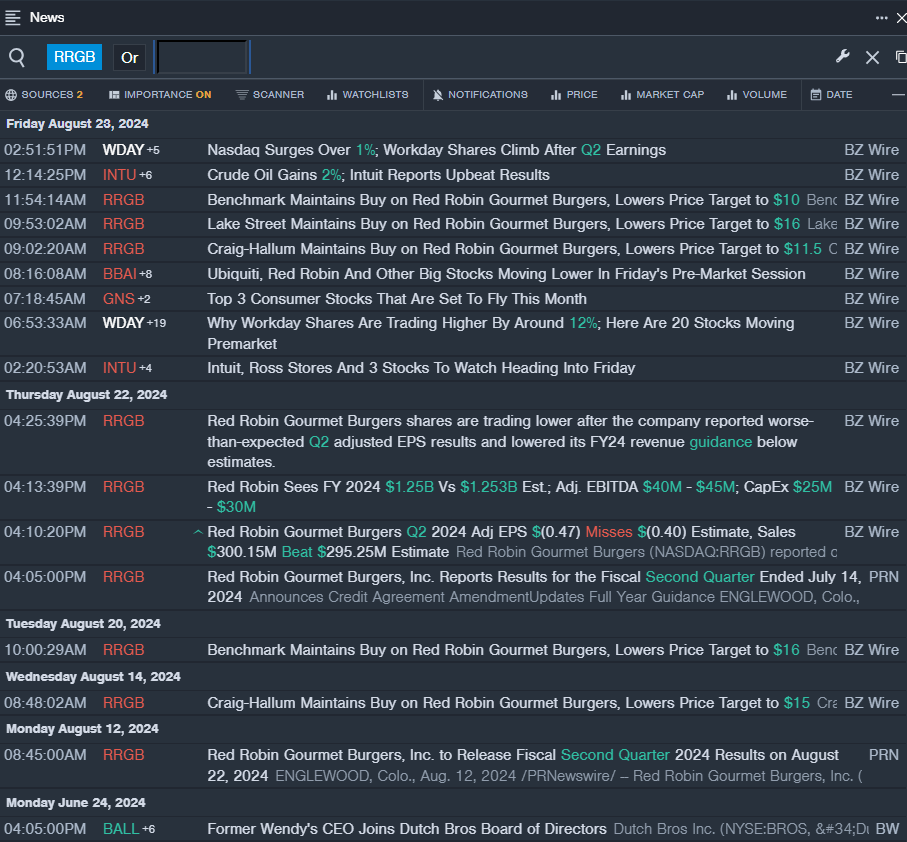

Oversold Glory: Red Robin Gourmet Burgers Inc

Red Robin Gourmet Burgers Inc’s recent financial stumble echoes across the market like a thunderclap. The company’s misstep in reporting second-quarter results sent shockwaves, causing a plummet of around 38% in its stock price within a month. With an RSI value dangling at 28.02 and hitting a 52-week low of $3.28, the stage is set for a rebound.

Advance Auto Parts, Inc: Navigating the Storm

Advance Auto Parts, Inc. finds itself in choppy waters, grappling with missed earnings projections and revised forecasts. The market’s cold shoulder led to a 26% dip in stock price within a month, hitting a 52-week low of $43.70. Despite the turbulence, an RSI value of 21.42 hints at a silver lining, a glimmer of potential amidst the clouds.

Designer Brands Inc: Crafting a Comeback

Designer Brands Inc’s recent stumbling block in first-quarter earnings resulted in a tumultuous ride for shareholders, marked by a 22% plunge in stock price over five days. With an RSI value of 29.52 and touching a 52-week low of $5.99, the company stands on the brink of a resurgence, poised for a phoenix-like rise from the ashes.