The Dance Between Interest Rates and Small Caps

Interest rates can sway companies in various directions, affecting their bottom lines and growth trajectories. Industries heavily dependent on borrowing, such as airplane leasing, experience the direct impact through interest expenses flowing into their income statements.

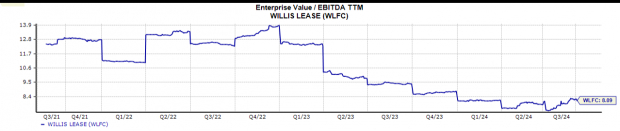

Willis Lease Finance (WLFC): Riding the Interest Rate Waves

For companies like Willis Lease Finance (WLFC), a debt load of $1.95 billion by 6/30/24 can raise eyebrows. However, if interest rates follow a downward glide, an opportunity to refinance at lower rates may arise, slashing interest expenses, and giving a boost to earnings per share. The acquisition of “greener” engines performing at 17% lower fuel consumption could further elevate lease revenue.

Investors Title Company (ITIC): Navigating Real Estate Market Volatility

Unlike the turbulence in the real estate market, Investors Title Company (ITIC) exhibits resilience with a focus on title insurance and tax-deferred real property exchange services. Targeting booming residential markets in states like North Carolina, South Carolina, and Texas, the company’s rock-solid balance sheet with $26.7 million in cash positions them well for future growth endeavors.

Unlocking Potential with Interest Rate Fluctuations

The incessant churn of mortgage financing and housing prices can either make or break companies like ITIC. Higher mortgage rates often deter potential buyers and sellers alike, creating a bottleneck in the real estate market. A gradual decline in interest rates may unravel this deadlock, fostering a surge in financing activity, a potential boon for companies like ITIC.

Conclusion

As small cap companies like Willis Lease Finance and Investors Title Company maneuver through the intricate dance of interest rates and industry dynamics, strategic positioning and financial acumen play pivotal roles in navigating uncertainties and tapping into growth opportunities.