Elon Musk’s foray into the realm of social media with Twitter, now X, has been nothing short of tumultuous. Recently, reports have surfaced indicating that advertisers are contemplating a significant reduction in their spending on the platform.

X’s increasing emphasis on free speech, while commendable to some, has not been well-received by advertisers who fear association with controversial content. A study by Kantar revealed that 26% of surveyed marketers are planning to scale back their ad investments on the platform.

Since Musk’s group injected $44 billion into acquiring Twitter in 2022, concerns about brand safety have loomed large. While X boasts a 99% brand safety rating according to internal metrics, only 4% of marketers perceive it as “brand safe.” In contrast, 39% considered Google to be a safer advertising environment.

A New Strategy for X

To counteract this exodus of advertisers, X is exploring a novel approach: a specialized video-viewing platform for advertising. By aligning with prominent online video personalities like MrBeast, X aims to revolutionize its offerings as it pivots towards a “video first” orientation under the leadership of CEO Linda Yaccarino.

This innovative tool also positions X as a formidable competitor to YouTube, a platform facing internal discontent among content creators. X’s established user base could propel it as a potent rival to YouTube’s dominance in the video-sharing sphere.

Examining Tesla’s Outlook

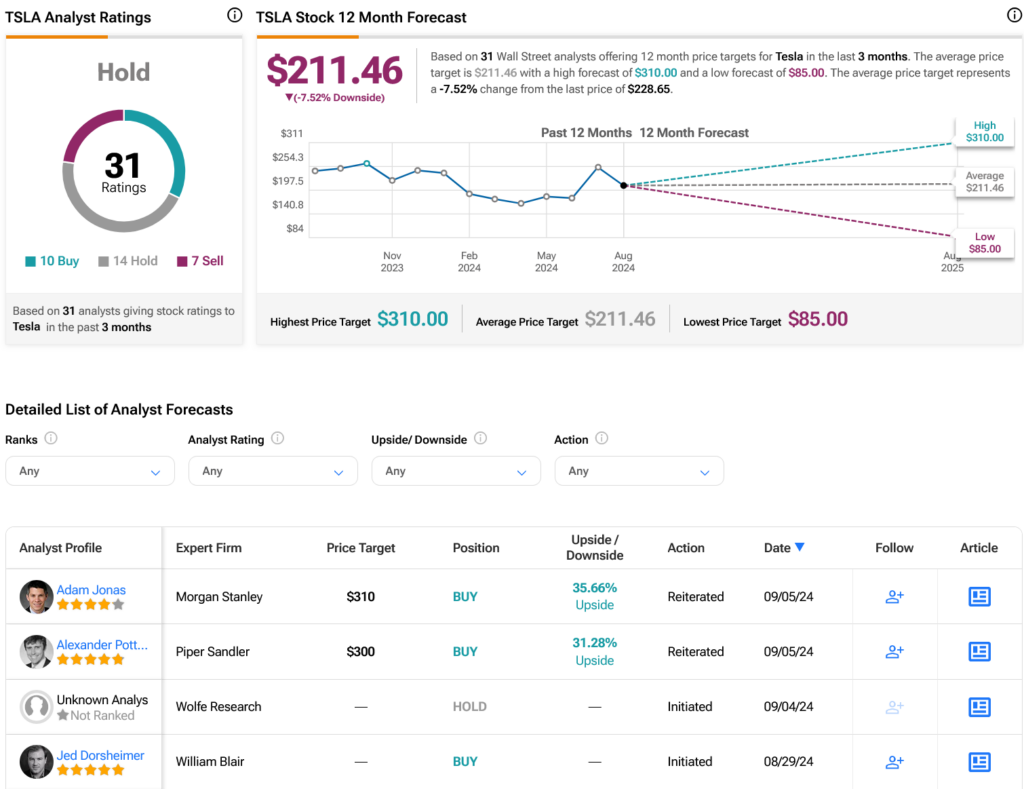

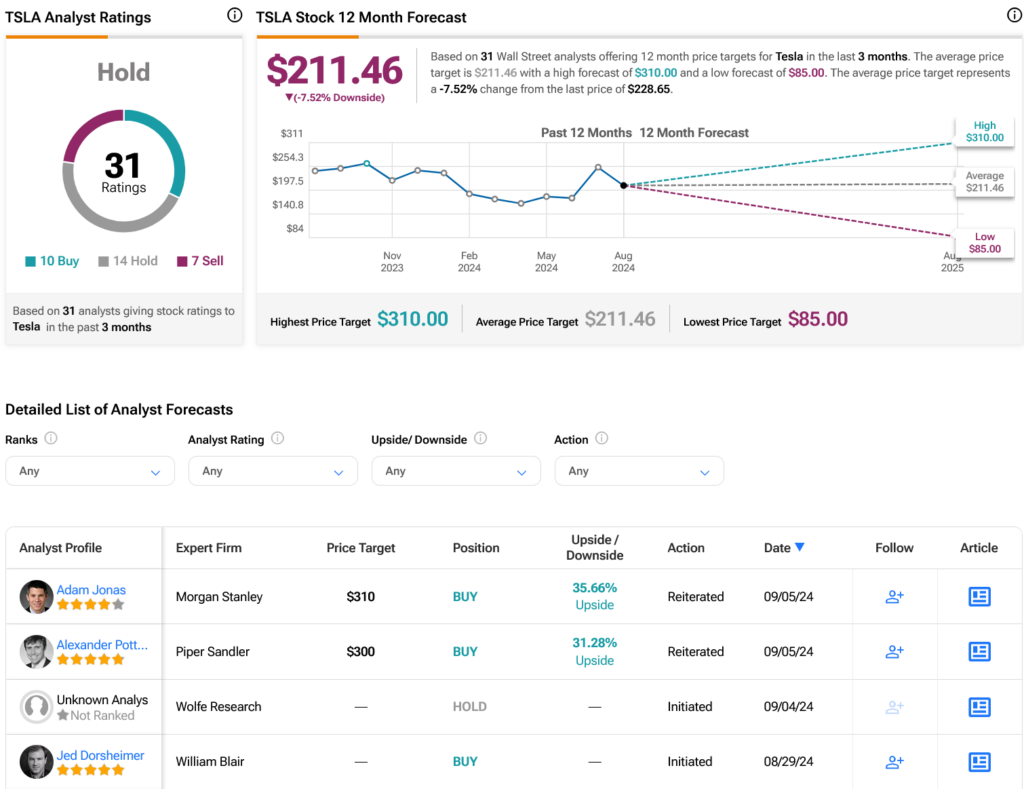

While investment opportunities in X remain out of reach for the general public due to its private status, Tesla (TSLA) stands as another venture under Elon Musk’s umbrella. Analysts have issued a Hold consensus rating on Tesla, comprising 10 Buy ratings, 14 Holds, and seven Sells within the last three months.

Following a 9.26% decline in share price over the past year, the average TSLA price target of $211.46 per share implies a potential 7.52% downside risk for investors.

Explore more TSLA analyst ratings (source)