Eastman Chemical Company

EMN is flourishing amidst a sea of challenges, riding the waves of cost-cutting measures and a growth model fueled by innovation despite soft market demand in specific sectors.

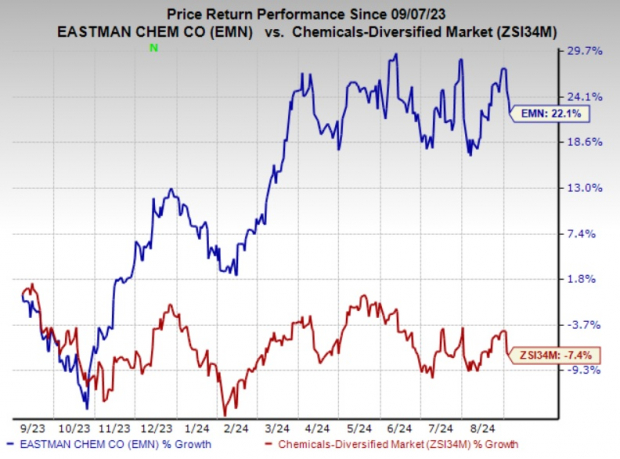

Over the past year, EMN stock has ascended by a striking 22.1%, in stark contrast to the 7.4% slump experienced by its industry counterparts.

Image Source: Zacks Investment Research

Let’s delve deeper into the reasons why this Zacks Rank #3 (Hold) stock holds considerable value in the current market landscape.

Weathering the Storm: Eastman Chemical’s Thrive on Cost-Cutting and Innovation

Eastman is reaping the rewards of its strategic cost management initiatives. The company is set to benefit from reduced operating costs stemming from its operational transformation program scheduled for completion by 2024.

EMN is proactively controlling its manufacturing and administrative expenses, having achieved approximately $200 million in cost savings in 2023, factoring in inflation. Additionally, pricing endeavors coupled with decreased raw material and energy costs are poised to fortify the company’s bottom line. Eastman’s commitment to pricing consistency and enhanced asset utilization bodes well for sustained growth.

By leveraging its innovation-centric growth strategy, Eastman Chemical aims to augment its revenues through new business ventures. Its focus on innovation and targeted market development initiatives is anticipated to bolster sales volumes, particularly within key segments such as consumer durables, building & construction, and transportation.

Furthermore, the forthcoming revenues and earnings expected from its Kingsport methanolysis facility in 2024 are poised to deliver an incremental EBITDA contribution of $50 million, underscoring Eastman’s trajectory of sustainable growth.

Eastman Chemical continues to prioritize a disciplined approach to capital allocation, placing a strong emphasis on debt reduction. In 2023, the company disbursed $526 million to shareholders through dividends and share buybacks, marking its 14th consecutive year of dividend increments. EMN foresees repurchasing shares worth around $300 million in 2024.

Navigating Turbulent Waters: Challenges on the Horizon for EMN Stock

Despite its successes, EMN faces headwinds posed by soft demand in specific markets. The company is grappling with subdued demand in building & construction sectors and cautious consumer behavior in durable goods and electronics. Demand remains lackluster in the building & construction domain across most geographic regions.

While Eastman Chemical is witnessing the conclusion of customer inventory de-stocking across multiple sectors, this trend is anticipated to persist in medical applications during the latter part of 2024. Weaker demand is forecasted to impede performance in the third quarter of the same year.

Top Performing Competitors to Watch

In the realm of Basic Materials, investors might want to keep an eye on standout performers such as Newmont Corporation NEM, Element Solutions Inc ESI, and Eldorado Gold Corporation EGO, each carrying a Zacks Rank #1 (Strong Buy).

The Zacks Consensus Estimate for Newmont’s earnings for the current year is set at $2.82, signaling a robust 75.2% surge from the previous year. NEM’s earnings estimate has seen a 16% uptick in the past 60 days, with the stock witnessing a noteworthy 35% climb over the last year.

Element Solutions has seen its consensus earnings estimate for the current year elevate by 0.7% in the last 60 days. ESI has surpassed the consensus estimate in three out of the last four quarters, delivering in-line results on the remaining occasion. On average, the company has delivered an earnings surprise of approximately 3.8% over this period.

The estimate for Eldorado Gold’s current-year earnings stands at $1.35 per share, reflecting a substantial year-over-year uptick of 136.8%. EGO has outperformed the consensus estimate for earnings in each of the last four quarters, boasting an average earnings surprise of 430.3%. The company’s shares have surged by a remarkable 73% in the previous year.

Please click here to access the original article.