General Motors (GM), the iconic U.S. automaker, is currently on a winning streak in the stock market, trading at just shy of $50 per share as of Friday’s close. Buzzing near its 52-week peak of $50.50, GM, with a solid market capitalization exceeding $55 billion, is a force to be reckoned with.

At the wheel of the U.S. auto market with a commanding 16.2% share in 2023, GM is steering towards an electrifying future. While known for its ICE vehicles – pickups and SUVs that are both popular and lucrative, GM is revving up its investments in environmentally friendly rides.

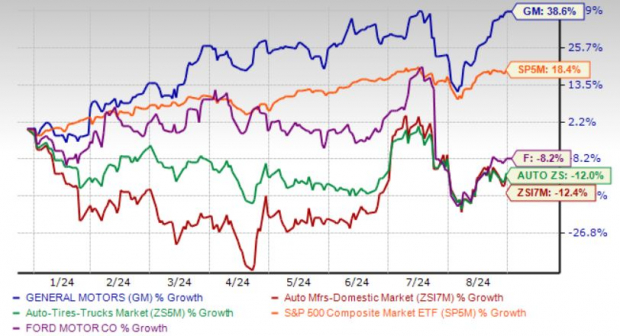

YTD Performance Signals

GM has been a sharp performer this year, soaring over 38%, outflanking its industry, sector, and even the S&P 500. Surpassing its closest competitor Ford (F), GM is not just keeping pace but outpacing the competition on the stock market front.

The Case for GM’s Undervalued Stock

With GM’s consistent profit surprises and a solid track record of exceeding earnings forecasts, the company boasts an average earnings surprise of 18.8%. Market watchers are optimistic about GM’s financial outlook for 2024 and 2025, underpinning its current value on the stock market.

GM’s Bullish Signals

Cost-Cutting Drive: GM’s aggressive cost-cutting endeavors are on track to achieve a substantial $2 billion net reduction by 2024, setting it on a path to leaner operations.

Strong North American Presence: GM’s dominance in the North American market is growing, with marked improvements in market share, sales volumes, and operational efficiency, backing its bullish forecasts for 2024.

Electrification Momentum: Dismissing doubts about its EV strategy, GM is making strides in the electric vehicle market with the launch of innovative models and a dedicated focus on scaling up production and reducing costs. With a diverse EV lineup including buzzworthy models like the Hummer EV, GM is poised for continued growth.

Cruise Autonomy: GM’s autonomous driving subsidiary, Cruise, is gaining traction, poised to resume fully autonomous rides soon. Its strategic alliance with Uber signals robust growth potential in the ride-sharing space.

Solid Financial Footing: Bolstered by a strong cash position and a sizeable share buyback program, GM’s financial health remains robust, reflecting confidence in its future performance.

Buckle Up for GM’s Next Leg Up

Analysts are bullish on GM, with a Zacks average price target projecting a 12% upside potential. If GM steers its EV strategy adeptly while nurturing its traditional ICE business, investors could enjoy substantial returns.

Despite cruising near its yearly high, investing in GM now presents an attractive opportunity, given its solid fundamentals, compelling valuation, and encouraging earnings outlook.

Unveiling Prime Stock Selections

Curating the Cream of the Crop

Announcing the unveiling of 7 top-tier stocks, carefully selected by experts from a pool of 220 Zacks Rank #1 Strong Buys. These distinguished tickers have been identified as “Most Likely for Early Price Pops.”

Since the inception in 1988, the comprehensive list has outperformed the market by over two-fold, yielding an average annual gain of +23.7%. Hence, these meticulously chosen 7 stocks demand your immediate attention.

Exploring Diverse Investment Opportunities

For investors seeking the latest recommendations from Zacks Investment Research, the option is now available to download the 7 Best Stocks for the Next 30 Days, providing valuable insights into potential investment prospects.

Analyzing Prominent Companies

Delving into individual stock assessments, notable entities such as Ford Motor Company (F), General Motors Company (GM), Tesla, Inc. (TSLA), and Uber Technologies, Inc. (UBER) are highlighted for in-depth analysis and evaluation.

To glean further insights into the propitious market trends and investment opportunities, explore the comprehensive view provided by Zacks Investment Research.