Chipotle Mexican Grill (NYSE: CMG) has recently faced a storm of negative press, from the departure of its esteemed CEO to a significant 20% downturn in its stock price. However, for steadfast long-term investors, there are compelling reasons to maintain a positive outlook on Chipotle’s shares.

Chipotle’s Stock Behavior

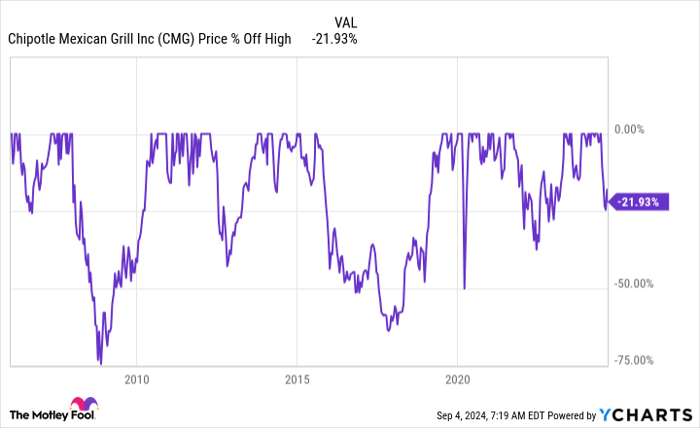

Growth stocks, like Chipotle, often follow a pattern of sharp ascents, retracements, and subsequent recoveries. Thus, the current drop in Chipotle’s share price, as history shows, is not an anomaly but rather a characteristic feature of its market performance.

Despite multiple pullbacks exceeding 20%, and even some at 50% and 75%, Chipotle’s stock remains around 20% below its peak, signifying a gradual upward trajectory punctuated by intermittent declines – a natural ebb and flow.

Operational Strength of Chipotle

Chipotle not only has ample room for expansion with its 3,500 restaurants compared to Taco Bell’s 8,500 outlets but is also thriving presently. In the second quarter of 2024, its same-store sales jumped by a substantial 11.1%, surpassing industry standards. Total sales surged by 18.2% to $3 billion, a robust figure for the restaurant sector.

Organizational Stability Post-CEO Exit

While the departure of CEO Brian Niccol to Starbucks sparked concerns, Chipotle remains solid due to the strong leadership team and operational efficiency in place. The transition to interim CEO Scott Boatwright, a seasoned insider, and the continued support of experienced staff ensure that Chipotle remains on a steady course.

Investor Guidance from Motley Fool

Growth stocks like Chipotle often endure volatility on their path to sustained growth. Chipotle’s stable operations and positive performance metrics do not warrant a panicked response from investors at present.

*Stock Advisor returns as of September 3, 2024