Riding the Waves of Turmoil

Tesla, Inc.’s core electric-vehicle manufacturing business has weathered the industry’s downturn by diversifying its portfolio. Despite facing challenges, the company, under the leadership of Elon Musk, has garnered praise from Morgan Stanley’s analyst.

Reiterated Confidence: Adam Jonas of Morgan Stanley reaffirmed Tesla as the top pick in the U.S. auto sector, lauding the company’s strategy of expanding into new ventures. He emphasized, “The company continues to take steps to mitigate downside risks to the core auto business while investing in other domains such as stationary energy, compute infrastructure, and robotics, indicating a shift towards embodied AI.”

Jonas maintains an Overweight rating on Tesla’s stock and set a price target of $310 per share.

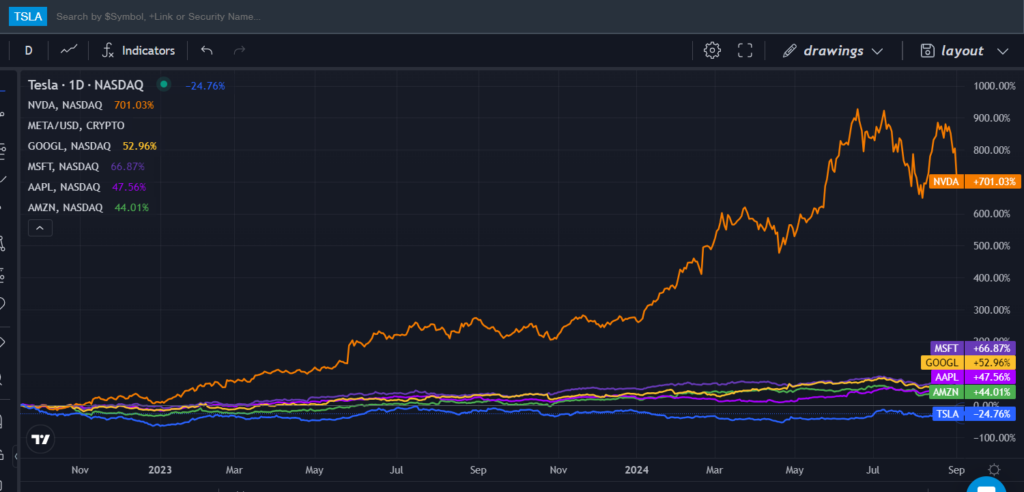

Urgency of Cost Management: Tesla’s shares have dipped over 50% from their peak and lagged behind other tech giants for three consecutive years, Jonas pointed out.

Source: Benzinga Pro

The downtrend in Tesla’s performance is attributed to a substantial decline in consensus estimates over the past year. Jonas emphasized the critical need for stringent cost management to enhance the company’s financial outlook, stating, “Demonstrating cost control is vital for investors to recognize the augmentation of Tesla’s business model in the realm of AI.”

Understanding Margin Challenges: Projections suggest Tesla’s 2024 GAAP operating profit to hit $5.6 billion. However, subtracting the estimated $2.3 billion zero-emission vehicle credits and Tesla Energy profits, leaves the core auto operating profit at $2.2 billion, as per Morgan Stanley’s assessment.

With a significant portion of revenue derived from dealer margins and recurring streams like connectivity and software services, Tesla’s auto business encountered challenges in 2024, inferred Jonas. Notably, a substantial part of Tesla’s operating expenses pertains to non-auto ventures, including AI infrastructure.

Looming Robotaxi Day Anticipation: Jonas expressed caution regarding expectations from the upcoming Robotaxi Day on Oct. 10, set to transpire at Warner Brothers studios. The event is anticipated to showcase advancements in Full Self-Driving (FSD) capabilities, with a likely demonstration of a fully autonomous ‘cyber-cab’ in controlled environments.

Jonas highlighted that while Tesla possesses a permit for autonomous vehicle testing ‘with a driver’ from the California Department of Motor Vehicles, the company currently lacks a permit for testing or deploying autonomous vehicles without a human driver onboard.

In premarket trading, Tesla’s stock experienced a 0.84% decline to $228.24, based on Benzinga Pro data.

Explore more of Benzinga’s Future Of Mobility coverage by visiting their website.