Uncertainty looms in September on the heels of a confusing August for investors.

The tech sector witnessed Bitcoin and Ether prices stagnating this week due to dwindling investor enthusiasm. Meanwhile, Broadcom’s (NASDAQ: AVGO) recent quarterly update added to the cautious atmosphere among market participants.

Tesla (NASDAQ: TSLA) came under the spotlight with its enticing announcement of imminent full self-driving technology deployment in specific markets, while Intel (NASDAQ: INTC) faces potential acquisition interest in its struggling design business.

Stay abreast of the latest tech industry happenings with the Investing News Network’s comprehensive coverage.

1. A Bumpy Start for Tech in September

The US markets kicked off the week with substantial percentage drops, reminiscent of the August 5 turmoil. The Nasdaq Composite (INDEXNASDAQ: .IXIC) saw a 2.85 percent decline on Tuesday (September 3), with the S&P 500 (INDEXSP: .INX) shedding 1.83 percent, and the Russell 2000 (INDEXRUSSELL: RUT) losing 2.77 percent.

These declines were triggered by fresh US manufacturing data for August. The S&P Global US Manufacturing PMI dipped to 47.9 in August from 49.6 in July, marking the second consecutive month below the 50-point threshold. Similarly, the ISM Manufacturing PMI rose to 47.2 percent in August from 46.8 percent in July.

In Canada, the S&P Global Canada Manufacturing PMI data weighed on the S&P/TSX Composite Index (INDEXTSI: OSPTX), indicating reduced output and demand alongside a slight employment cut in the country.

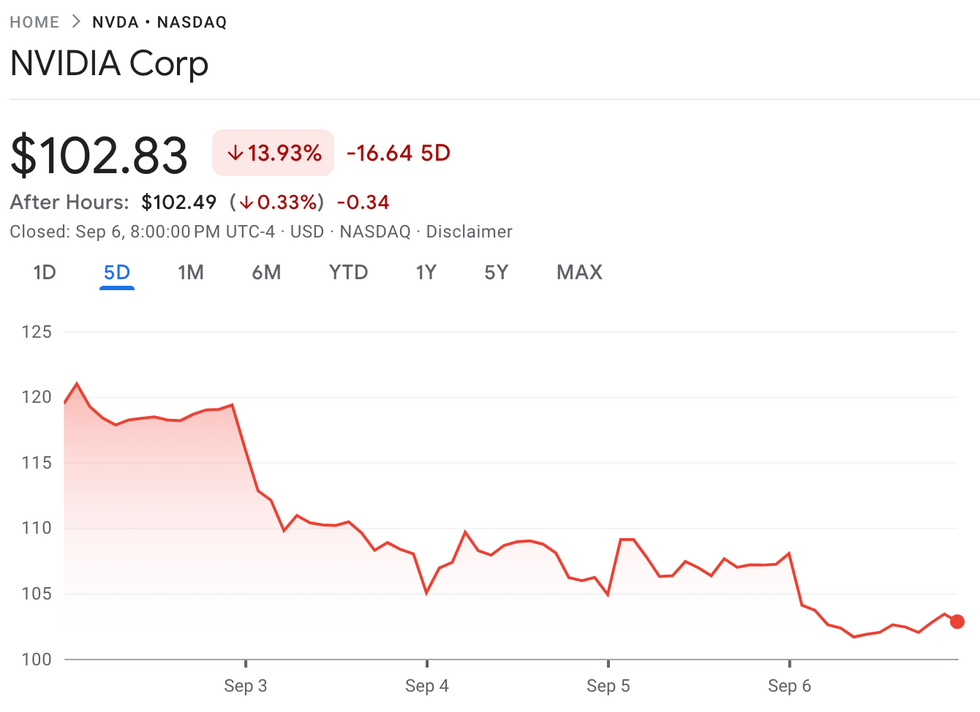

On Wednesday (September 4), the Bank of Canada slashed interest rates for the third time during the summer, while the US Department of Labor’s JOLTS report revealed a three-and-a-half-year low in job openings for July, down 1.1 million from the previous year. Major indices maintained relative stability, although the Nasdaq Composite faced a dip at the opening bell prompted by a selloff that wiped out almost 9.5 percent of NVIDIA’s (NASDAQ: NVDA) market value in a single day.

This rapid decline followed a report by Bloomberg indicating that the US Department of Justice had served NVIDIA with a subpoena as part of an expanding antitrust investigation—a claim that NVIDIA promptly refuted.

2. Heading into the Future

The Tape Tells a Story of Economic Data, Crypto Troubles, and Broadcom’s Quarter

1. Economic Data in the US and Canada

Economic data readings out of the US and Canada on Thursday proved to be a mixed bag. The US services sector showed resilience with non-manufacturing PMI increasing to 54.5 in August. However, the ADP National Employment report revealed a cooling labor market with only 99,000 jobs added in the private sector, falling short of the predicted 145,000. This figure marked the lowest hiring rate in three years.

Across the border, Canada saw the S&P Global Canada Services PMI at 47.8 for August, a slight improvement from July’s 47.3. Yet, this number indicates a continued, albeit slower, contraction in the sector.

Looking ahead to Friday’s non-farm payrolls report, anticipation ran high. However, the report showed only 142,000 new jobs added instead of the expected 160,000. This news, coupled with a 0.1 percent drop in the unemployment rate from July, caused a momentary downturn in the markets. Amid concerns about the economy’s strength and impending interest rate changes, the VIX edged above 22.

In Canada, Statistics Canada’s labor force survey indicated a modest gain of 22,000 jobs in the previous month, but the jobless rate ticked up to 6.6 percent from 6.4 percent.

2. Crypto Market Facing Troubles in September

September proved challenging for the crypto market, which has been struggling since the August 5 rout due to factors including investor sentiment, regulatory ambiguity, and macroeconomic conditions. Over the past seven days, Bitcoin and Ether witnessed declines of 4.2 percent and 6.5 percent, respectively.

Bitcoin, in particular, showed sharp corrections at the beginning of each month in Q3 but has now stalled due to lackluster demand from retail investors and subdued ETF sentiment. Since reaching US$65,000 on August 25, Bitcoin has been in a downward trend, with reduced miner profitability and increased mining difficulty adding pressure on its price movements.

Similarly, Ether struggled, partly due to declining activity on the Ethereum mainnet and the failure of Ether ETFs to meet expectations.

Recent plunges saw Bitcoin dropping to US$56,160 and Ether falling 4.35 percent in just an hour. Despite brief surges, both cryptocurrencies faced downward pressure during the week, pushing Bitcoin to US$53,304 and Ether to US$2,192 at one point, as observed on CoinGecko.

The downward trend in Bitcoin and Ether prices reflects a cautious market sentiment. Investors’ fears of a possible US recession are prompting them to reduce their exposure to volatile assets like cryptocurrencies, leading to a prevailing “sell-on-rise” attitude.

3. Broadcom’s Disappointing Quarterly Results

Broadcom’s third fiscal quarter results, released on Thursday, showed a 47 percent year-on-year revenue increase to US$13.07 billion. While this figure was slightly above the expected US$13.03 billion, the results still fell short of market expectations.