For investors flush with cash, a wave of optimism has washed over Icahn Enterprises IEP.

And what about the small fries in the trading pond? Well, this news is worth their fishing net.

Today we bear witness to a remarkable surge in noteworthy options trading activity concerning Icahn

Enterprises, as reported by our diligent trackers at Benzinga.

Whether these moves are masterminded by institutional giants or deep-pocketed individuals remains a mystery.

However, such monumental shifts within Icahn Enterprises often foretell insider whispers being turned into

action.

So, what exactly has caught the eye of these high rollers?

Today, Benzinga’s options scanner has flagged 8 rare options trades linked to Icahn Enterprises.

This is no ordinary occurrence.

The prevailing sentiment among these prominent traders is evenly split, with 37% advocating bullish positions

and an equal 37% leaning towards bearish outcomes.

Of the unique options contracts unearthed, 4 belong to the put category, totaling $234,757, while the remaining

4 are calls, amounting to $387,650 in value.

Predicted Stock Movements

Analyzing the recent flurry of trades suggests the heavy hitters are setting their sights on a price range

spanning $10.0 to $12.5 for Icahn Enterprises in the near future.

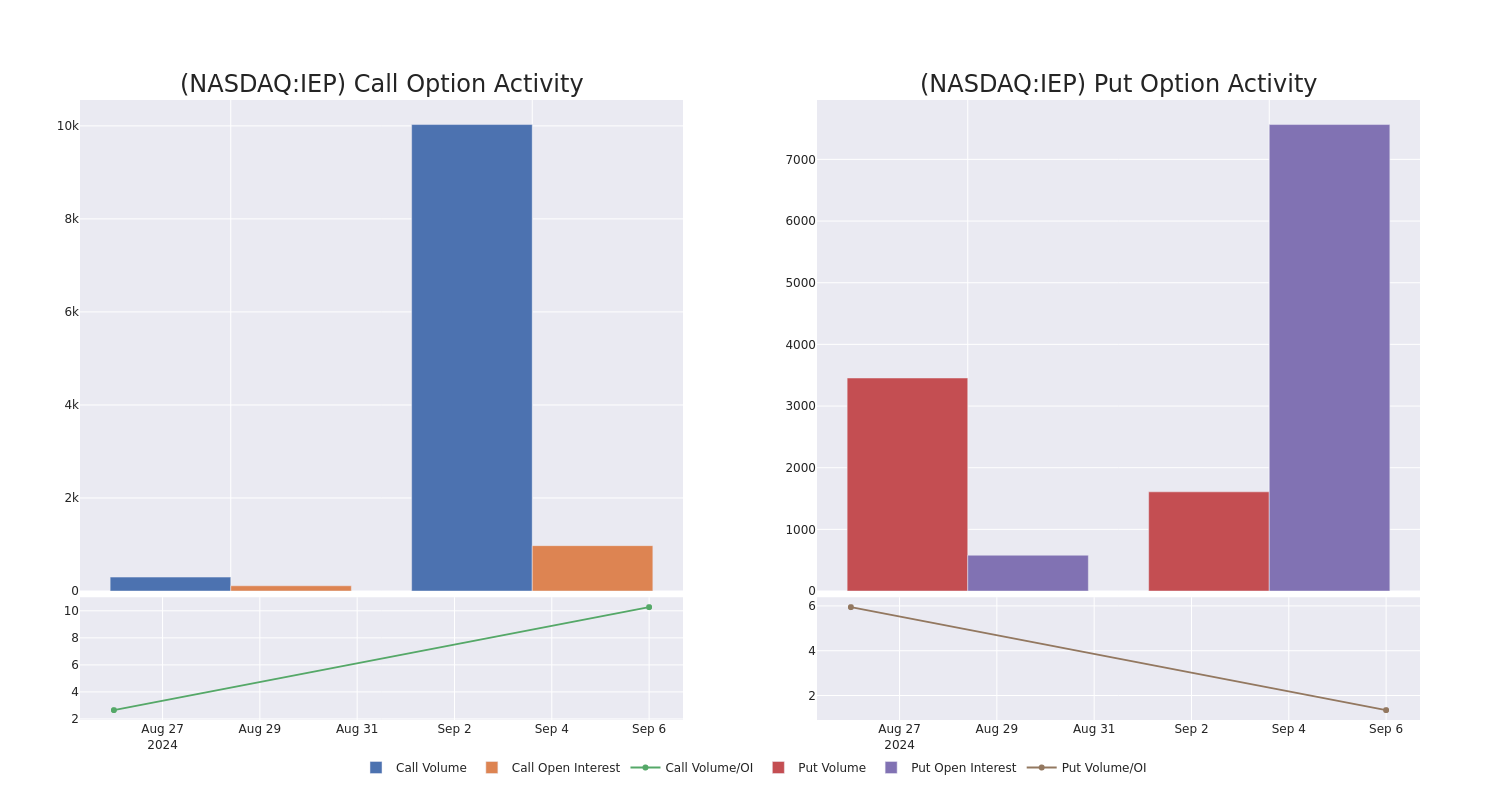

Exploring Volume & Open Interest Trends

Diving into the realm of volume and open interest unveils a trove of insights pertinent to stock due

diligence.

This data serves as a barometer to gauge interest and liquidity levels in related options tied to Icahn

Enterprises at various strike prices.

Below, we chronicle the trajectory of call and put volume, alongside open interest figures, encapsulating all

whale activity surrounding Icahn Enterprises within the $10.0 to $12.5 strike price range over the past 30

days.

Summary of Icahn Enterprises Call and Put Volume: 30-Day Overview

Standout Options Trades Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| IEP | CALL | TRADE | NEUTRAL | 09/20/24 | $0.6 | $0.25 | $0.4 | $11.50 | $160.0K | 45 | 4.7K |

| IEP | CALL | TRADE | BEARISH | 09/13/24 | $0.65 | $0.35 | $0.35 | $11.00 | $140.0K | 96 | 4.9K |

| IEP | PUT | SWEEP | BULLISH | 09/20/24 | $2.25 | $2.05 | $2.06 | $12.50 | $104.5K | 1.9K | 80 |

| IEP | CALL | TRADE | NEUTRAL | 01/16/26 | $3.4 | $1.5 | $2.5 | $12.50 | $62.5K | 623 | 250 |

| IEP | PUT | SWEEP | BEARISH | 01/17/25 | $3.2 | $3.0 | $3.2 | $12.50 | $51.2K | 3.4K | 159 |

About Icahn Enterprises

Icahn Enterprises LP is a beacon of diverse business services in the United States. Its operations span

through various domains like Investment, Automotive, Energy, Food Packaging, Real Estate, Pharma, and Home

Fashion. Foremost among these, the Energy sector rakes in the lion’s share of the company’s revenues.

Predominantly, revenue flows from the heartland of the United States.

Having dissected the options landscape surrounding Icahn Enterprises, the focus now shifts to examine the

company firsthand, delving deep into its current market posture and standing.

Icahn Enterprises’s Current Standing

- With a substantial trading volume of 1,995,181, IEP’s price registers a slight dip of -1.17% to $11.02.

- Signs from RSI indicators suggest a potential oversold status for the underlying stock.

- The next earnings report is slated for release within 56 days.

Options present a higher-risk avenue compared to standard stock trades, albeit offering lucrative profitability

prospects. Seasoned options players mitigate this risk through constant learning, judicious trade scaling,

monitoring multiple indicators, and keeping a hawk-eyed watch over market developments.

To receive real-time updates on the latest options maneuvers involving Icahn Enterprises, make sure to tune in

to Benzinga Pro for instant alerts.