Alibaba, the behemoth of Chinese e-commerce, is stepping into uncharted territory by opening its revered platforms, Taobao and Tmall, to Tencent’s WeChat Pay. This maneuver, effective as of September 12, marks a seismic shift in China’s tech landscape, as companies dismantle siloed systems in compliance with recent regulations encouraging cross-pollination among domestic tech titans.

After successful trials with a select user base, the full integration of WeChat Pay is anticipated to sweep through the platforms imminently. A fusion that promises to redefine the rules of the game and tilt the scales of competition.

A New Avenue for BABA’s Prosperity

Traditionally tethered to Alipay as its sole payment conduit, Alibaba’s foray into the world of WeChat Pay heralds a revolution in user interaction. By diversifying payment options, Alibaba elevates the shopping experience for its vast customer base.

Moreover, this collaboration furnishes Alibaba with a strategic edge, broadening its horizons by tapping into Tencent’s colossal network, spanning a staggering 1.37 billion users. It’s a savvy play by Alibaba to fortify Taobao and Tmall against the encroaching shadows of emerging adversaries like JD.com and Pinduoduo.

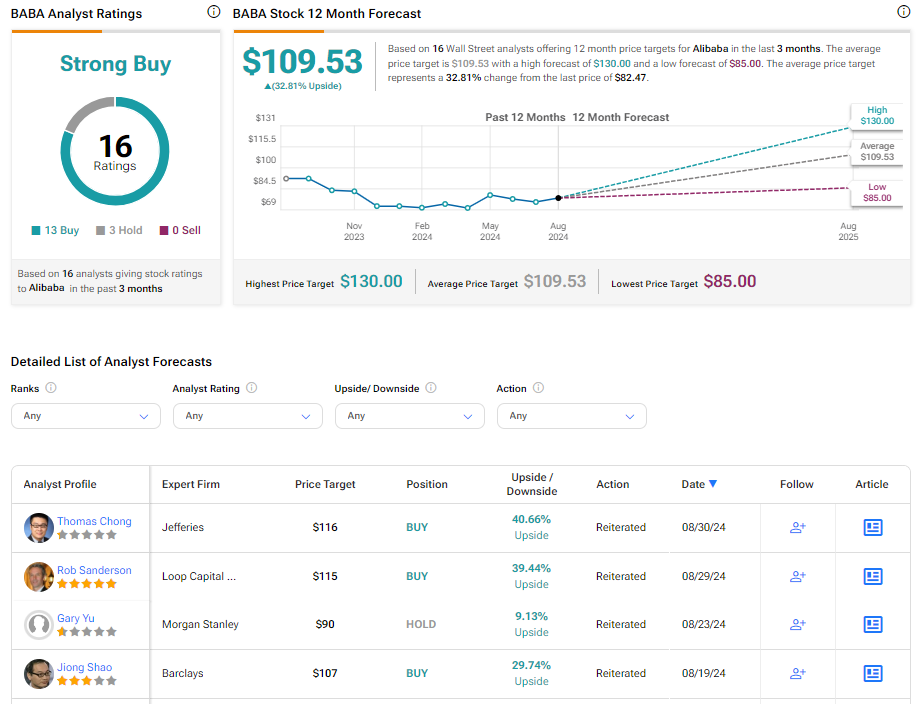

Charting Alibaba’s Investment Potential

When contemplating Alibaba’s investment allure, the sentiment on Wall Street is unequivocally positive. Backed by a Strong Buy consensus from 13 Bulls and three Moderates, analysts maintain high hopes for BABA’s trajectory. The average price target of $109.53 forecasts a substantial 32.81% upward surge from the current standing. Over the last half-year, Alibaba has seen shares ascend by a robust 16.9%, painting a picture of resilience and growth.