Market Overview of Oil Giants

At the break of dawn on Monday, behemoths like Chevron Corp (CVX) and Exxon Mobil Corp (XOM) inched up in pre-market trading, striving to mend the bruises from last week’s market nosedive. Predominantly Chevron faced the brunt of the downturn, sparked by economic worries.

Unpacking Economic Indicators

The release of the August employment report fueled existing anxieties. While job additions rose to 142,000 from July’s 89,000, falling short of the expected 161,000, the unemployment rate stayed at 4.2%. Yet, a broader measure incorporating part-time workers and discouraged job seekers escalated to 7.9%, intensifying concerns.

Global Factors Shaking Oil Prices

The tremors from a slowing economy reverberated in oil markets, dragging benchmarks like West Texas Intermediate and Brent Crude down. Additionally, dwindling consumer confidence in China rattled Western brands, magnifying fears of a slump in global hydrocarbon demand.

Geopolitical Intricacies and OPEC+ Dynamics

Moreover, geopolitical complexities, particularly in the Middle East, loom over energy markets in unpredictably volatile ways. It’s worth noting that historically, OPEC+ nations have curtailed production to safeguard plummeting prices.

Analyzing Short-term and Long-term Scenarios

While challenges abound, not all facets of the oil landscape are bleak for investors. Recent Ukrainian drone strikes disrupting Russian oil infrastructure could artificially boost oil prices. Looking ahead, the International Energy Agency forecasts India to drive global oil demand growth till 2030, potentially offsetting the Chinese slowdown.

Direxion’s ETF Offerings

For investors daring to navigate the tumultuous oil sector, Direxion’s suite of leveraged ETFs presents a buffet of choices. Bulls may find solace in the Direxion Daily S&P Oil & Gas Exp. & Prod. Bull 2X Shares (GUSH), offering 2x exposure to the industry’s performance. Conversely, bearish investors can explore the Direxion Daily S&P Oil & Gas Exp. & Prod. Bear 2X Shares (DRIP), aiming to amplify inverse index performance.

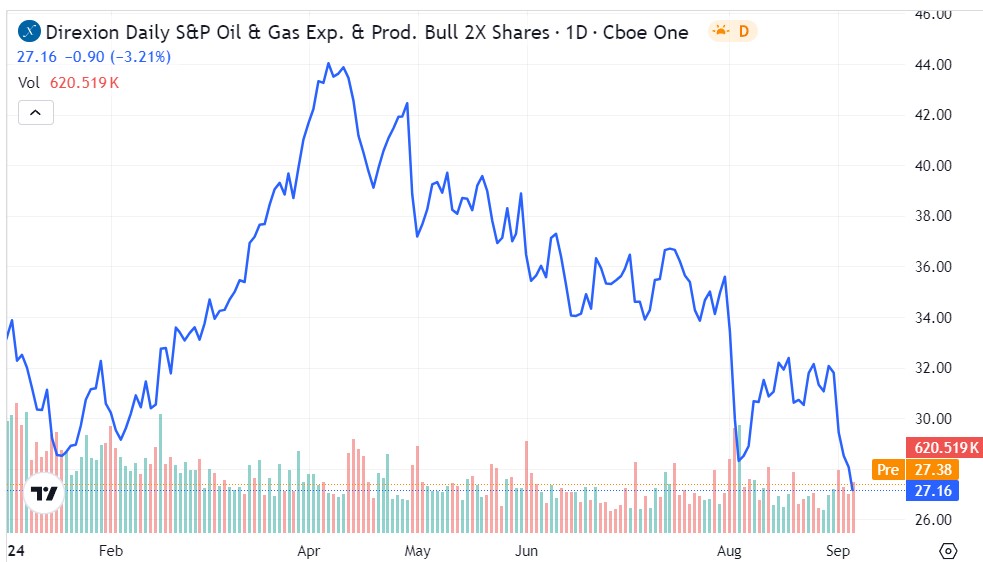

Gauging GUSH Performance

Despite a robust start, GUSH’s year-to-date slide of over 18% reflects ongoing market turbulence. Hovering below key moving averages, GUSH finds support around the $27 mark, hinting at a potential recovery bolstered by underlying fundamentals.

Assessing DRIP’s Trajectory

Conversely, DRIP endured a rocky phase initially but rebounded amidst falling oil prices. Last week saw a notable 15% surge in the bear ETF’s value, yet its future ascent remains uncertain as it faces a resistance zone in the $12-$13 range.

This post contains sponsored content. This content is for informational purposes only and not intended to be investing advice.