The Federal Reserve’s Influence on the Market

The Federal Reserve, under the guidance of Chairman Jerome Powell, plays a significant role in shaping market dynamics. The Fed’s rate decisions impact liquidity, which in turn affects equity markets. Recent confirmation of an impending rate cut raises questions about its potential impact on stocks.

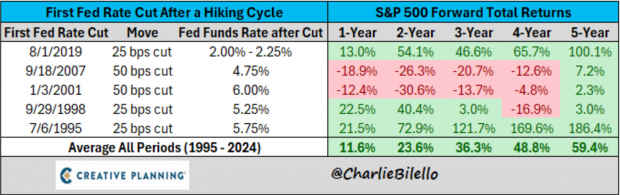

Interpreting Rate Cut Magnitudes

Historical data shows that initial rate cuts post-hiking cycles generally favor equities. However, a deeper rate cut of 50 basis points might signal market distress. Past instances indicate that when the Fed opted for a half-point cut at the onset of a cutting cycle, the market saw declines a year later.

Technology Stocks and the 200-Day Moving Average

While certain value stocks have shown resilience, tech giants like Nvidia and Microsoft have been driving market performance. A crucial indicator for market technicians is the Nasdaq 100 ETF’s adherence to its 200-day moving average. Sustained performance above this line suggests bullish sentiment, while a dip below signals potential bearishness.

Market Cycle Projections

Analysis by InvesTech Research indicates that considering historical trends, the current bull market, which began in late 2022, could extend until 2026. This perspective offers a positive outlook for U.S. equities in the coming years.

Volatility Index and Market Bottoms

The Volatility Index (VIX) serves as a key barometer of market uncertainty. Historically, VIX spikes above $60 have coincided with generational market bottoms, leading to substantial gains in stocks over the subsequent year.

September Trends in Stock Markets

September often witnesses market pullbacks, following a historical pattern. Despite these fluctuations, recent years have seen September weakness giving way to stronger market performance by year-end, offering reassurance to investors amidst short-term volatility.

The Art of Investment: Navigating Market Volatility

Investors should approach the market with adaptability and a willingness to embrace change. While current indicators suggest a prolonged bull market, prudent investors remain vigilant and anticipate various potential outcomes.

5 Opportunities with Potential for Growth

Highlighted by experts for doubling your investment by more than 100% in 2024, these carefully chosen stocks have a history of remarkable success. Previous suggestions have surged by impressive margins including +143.0%, +175.9%, +498.3%, and +673.0%.

Most notably, these stocks are often overlooked by mainstream financial analysts, offering early investors a unique chance to enter at an advantageous position.

Discover Exciting Investment Prospects

Are you interested in staying updated on the latest investment advice from Zacks Investment Research? Download the free report on 5 potential stocks that are poised for significant growth.

AT&T Inc. (T) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Altria Group, Inc. (MO) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Oracle Corporation (ORCL) : Free Stock Analysis Report

Invesco QQQ (QQQ): ETF Research Reports

For more insights, read the full article on Zacks.com by clicking here.