Investors often rely on Wall Street analysts’ recommendations before diving into an investment. While these analysts’ endorsements can sway a stock’s price, do they truly hold weight?

Before delving into the robustness of brokerage suggestions and how they can be leveraged, let’s explore what the financial titans on Wall Street opine about Newmont Corporation (NEM).

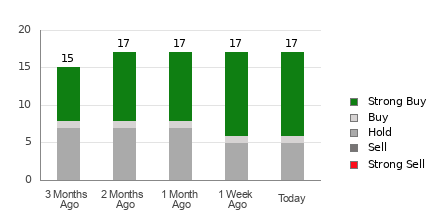

Newmont currently boasts an average brokerage recommendation (ABR) of 1.65, lying between Strong Buy and Buy on a scale of 1 to 5, aggregated from 17 brokerage houses. Out of these 17, 11 signal Strong Buy and one indicates a Buy, constituting 64.7% and 5.9% of all recommendations, respectively.

Unraveling Trends in Brokerage Recommendations for NEM

The ABR might beckon towards investing in Newmont, yet solely relying on this metric could be perilous. Studies reveal that brokerage recommendations only marginally influence investors toward stocks adjudged for price gains.

Curious as to why? Well, sensing stock at heart, brokerage analysts often adorn reviewed stocks with an overly optimistic outlook. Research exposed that for every “Strong Sell” appraisal, there are a whopping five “Strong Buy” endorsements.

This skewed inclination from institutions might not always align with retail investors’ interests, offering blurry insights into a stock’s future trajectory. Hence, it is gleaned that this intel should be used judiciously either to affirm personal assessments or pair with a tried-and-tested tool for price prognostication.

A distinctive tool, Zacks Rank, segregates stocks into five bands, stretching from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), based on audited performance. Overlaying the ABR with Zacks Rank could channel investment choices effectively.

Navigating Between Zacks Rank and ABR

Although both ABR and Zacks Rank share a numeric gamut of 1-5, they resonate distinctively.

ABR hails from brokerage comments, cladded with decimals, contrary to Zacks Rank, a numeric metric spanning 1 to 5, propelled by earnings forecasts. The latter inclines stock price movements to short-term earnings variance, a thesis backed by empirical probes.

Conversely, Zacks Rank garners proportionate grades across stocks tethered to brokerage earnings outlooks for the ongoing year, fostering an equilibrium among the five ranks it delegates.

While ABR might stall date-wise, Zacks Rank, galvanized by swift earnings alterations, mirrors analysts’ estimates promptly, unfurling pertinent stock projections.

Deciphering Newmont’s Investment Potential

Weighing Newmont’s trajectory, the Zacks Consensus Estimate clings at $2.82 for this fiscal, unruffled over a month. This stability coddling into earnings outlooks could align the stock with the broader market in the imminent term.

Marking this consensus placidity, alongside other earnings triggers, Newmont clasps a Zacks Rank #3 (Hold). Foraging for Strong Buys? Skim through today’s Zacks Rank #1 (Strong Buy) picks for a bountiful selection.

Dwelling in the Buy-hued realm of ABR for Newmont warrants a sliver of vigilance.