Reading the Market Signals

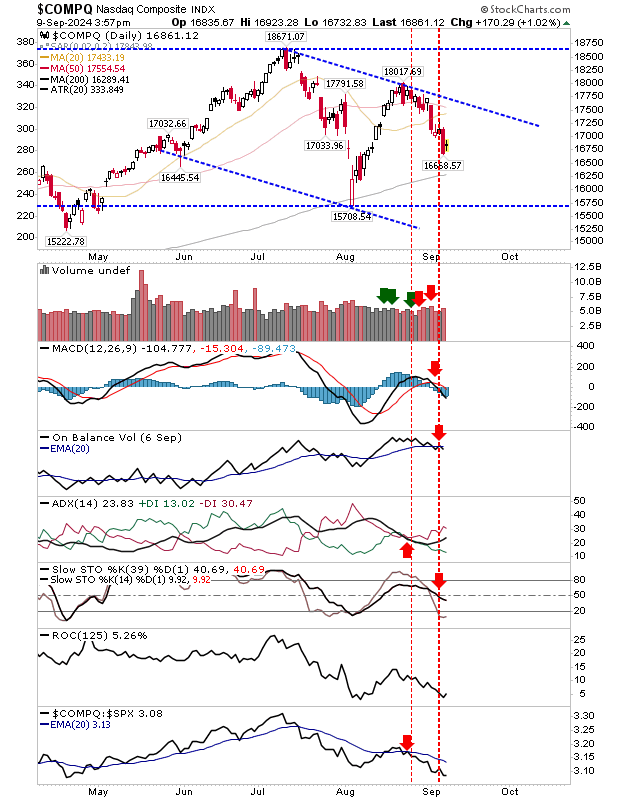

As Nasdaq traders engaged in some soul-searching over the weekend, their regretful sellers likely fueled yesterday’s buying frenzy. The presence of bullish haramis in the indexes hints at potential reversal opportunities, yet the resistance posed by moving averages looms as a formidable obstacle.

Charting the Territory

Nasdaq concluded with a bullish harami cross, a signal typically associated with a bullish reversal. The index now treads near its 200-day Moving Average (MA), an area that could spell trouble if breached, especially considering the recent unsuccessful test.

Seeking Support

Preferably, Nasdaq should avoid touching the 200-day MA and find support around Friday’s lows in the 16,650s. Such a bounce could set the stage for a new series of higher lows, igniting fresh momentum in the market.

Stability at a Price

Meanwhile, the X trades tenaciously around the $207.50 support level, bolstered by the May swing highs. However, doubts linger about the strength of this level, especially given its hesitant behavior during the August test of the 200-day MA. Yesterday’s buying activity lacked significant volume, leaving the technical outlook unchanged. A breach below $207 could trigger a descent towards the 200-day MA.

Market Dynamics in Focus

The Y opened the session with a gap up and extended its gains throughout the trading day, showcasing its resilience. Despite lagging behind the August swing low and the 200-day MA, the Y enjoys the support of bullish Stochastics and stands out as a relative performance leader. Short-term risk compared to reward may not be as favorable, but a move towards challenging levels around 5,650s could renew investor interest.

The Path Ahead

Bullish haramis, while promising as reversal signals, often require upward gaps to truly come to fruition. Protection of yesterday’s lows is imperative to validate this pattern. As the market gears up for the day’s trading, keeping an eye on pre-market indicators could provide valuable insights for navigating Nasdaq’s current landscape.