Apple recently revealed its latest innovation, the AI-powered iPhone 16 series, signaling a significant leap forward in technological advancement. Alongside, the tech giant also introduced the Apple Watch Series 10, AirPods 4, and AirPods Pro 2, further solidifying its foothold in the consumer electronics market.

The iPhone 16 and iPhone 16 Plus, equipped with the groundbreaking A18 chip, promise enhanced performance, efficiency, and impressive battery life. Noteworthy features include the Camera Control function with a 48MP Fusion camera and a 2 times Telephoto option, providing users with unparalleled photography capabilities.

On the other hand, the premium models, iPhone 16 Pro and iPhone 16 Pro Max, boasting the A18 Pro chip, offer advanced specifications like a new 48MP Fusion camera with a quad-pixel sensor for 4K120 fps video recording in Dolby Vision, setting a new benchmark in smartphone videography.

The introduction of Apple Intelligence, unveiled at Apple’s annual developers’ event, promises to revolutionize the user experience across various Apple devices. This cutting-edge personal intelligence system seamlessly integrated into iOS 18.1, iPadOS 18.1, and macOS Sequoia 15.1 is destined to redefine user interaction dynamics. The much-anticipated Apple Intelligence is set to be accessible starting next month.

Transformative Potential of Apple Intelligence

Powered by GenAI models, Apple Intelligence is meticulously designed to elevate user experience by incorporating advanced language and image processing capabilities alongside personalized context. This technological marvel, underpinned by Apple silicon, not only streamlines daily tasks but strictly adheres to Apple’s stringent privacy standards.

Apple is set to roll out Apple Intelligence first in U.S. English with plans for swift expansion into other English-speaking regions by December, followed by additional language support in the coming year for Chinese, French, Japanese, and Spanish users.

The integration of Apple Intelligence into Siri enhances the voice assistant’s naturalness, contextual awareness, and task-handling capabilities. This intricate system now offers seamless voice and text communication, while maintaining context across multiple user requests.

Moreover, Apple’s innovative writing tool enables users to rewrite, proofread, and summarize text effortlessly across various platforms, empowering users with unbridled creativity. The Photo features enhancement, including the innovative Movie feature and Clean Up tool, further exemplify Apple’s commitment to pushing the boundaries of innovation.

By leveraging ChatGPT, Apple brings a wealth of expertise directly to users through iOS 18, iPadOS 18, and macOS Sequoia, enhancing user proficiency and interaction within these platforms.

Strategic Implications for AAPL Stock

In a fiercely competitive AI landscape dominated by tech conglomerates like Alphabet, Microsoft, and Amazon, Apple’s foray into AI with Apple Intelligence is poised to bolster its competitive stance significantly. Though Apple’s cornerstone remains its iconic iPhone, the Services arm is emerging as a potent driver of growth, with Services revenues surging to $24.21 billion, contributing significantly to Apple’s overall sales.

Looking ahead, Apple anticipates robust growth in the upcoming quarter, maintaining optimistic projections for both overall revenue growth and double-digit expansion in the Services segment, reaffirming its strategic diversification beyond hardware dominance.

Valuation Analysis and Investor Strategy

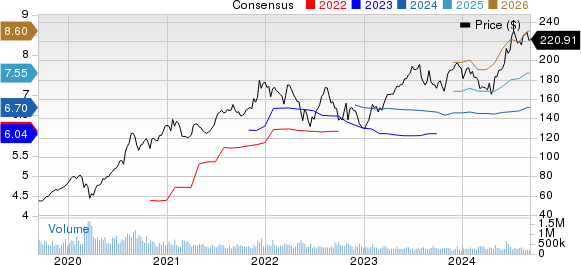

Despite the market enthusiasm surrounding Apple’s AI advancements, the AAPL stock presents a mixed picture with a Value Score of D, indicating a potentially stretched valuation. With a forward 12-month P/E ratio of 29.43X, Apple trades at a premium compared to industry peers and historical medians, signaling caution among investors regarding the stock’s current valuation levels.

Furthermore, Apple shares have slightly underperformed the Computer & Technology sector, posting a 23.1% return year-to-date, marginally trailing sectoral performance.

While Apple’s AI innovations and Services growth trajectory offer promise, the company’s challenges in the Chinese market remain a pressing concern. Nevertheless, with a Zacks Rank #3 (Hold) recommendation, investors are advised to exercise prudence and wait for a more opportune entry point to maximize potential returns.

Conclusion: Navigating the Apple Investment Landscape

Apple’s unveiling of the AI-powered iPhone 16 series and the revolutionary Apple Intelligence signify a strategic shift towards AI integration and Services expansion, underscoring the company’s commitment to innovation and user-centric design. While transformative technologies like the AI-powered features hold promise for future growth, uncertainties surrounding valuation and market headwinds necessitate a cautious approach for investors eyeing AAPL stock.

By analyzing Apple’s strategic direction, technological milestones, and market positioning, investors can navigate the evolving landscape of Apple investments, leveraging insights to make informed decisions in line with their risk appetite and growth objectives.