Market Rally for AI Heavyweights

AI giants NVIDIA Corp. and Advanced Micro Devices, Inc. experienced a surge in their market value midweek. NVIDIA stock soared over 8%, while AMD made gains of nearly 5%.

A recent report from Reuters reveals deliberations within the U.S. government regarding the possibility of allowing NVIDIA to export its advanced graphics processors to Saudi Arabia. This potential shift in policy could significantly benefit NVDA and similar companies amid recent sluggish momentum.

Positive Developments for Tech Tycoons

Boosting optimism, there are reports of OpenAI, the parent company of ChatGPT, considering a substantial $6.5 billion equity financing raise, attracting interest from industry giants like Nvidia, Microsoft Corp, and Apple Inc. This news indicates a potential growth catalyst for NVIDIA stock as large language models gain popularity.

While some industry leaders thrive, challenges emerge for firms focusing on areas beyond AI. Companies such as Asana Inc., utilizing AI and big data, grapple with past hiring and spending issues during the COVID-19 pandemic, prompting market adjustments that could jeopardize inflated valuations.

ETF Opportunities in AI and Big Data

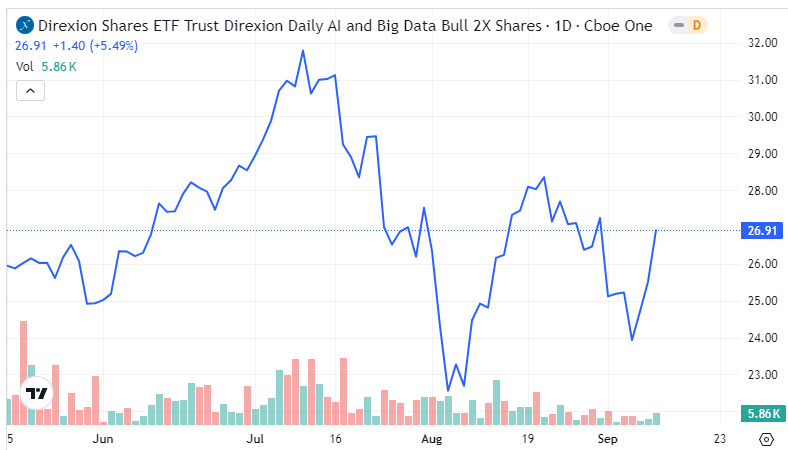

Despite these uncertainties, Direxion offers traders a gateway to capitalize on the digitalization trend through its leveraged ETFs. The Direxion Daily AI and Big Data Bull 2X Shares (AIBU) cater to enthusiasts of machine intelligence, while the Direxion Daily AI and Big Data Bear 2X Shares (AIBD) appeal to skeptics wary of lofty tech valuations. Both ETFs mirror the performance of the Solactive US AI & Big Data Index, magnified by 200% in their respective directions.

Investors entering AIBU or AIBD should note that these funds are designed for short-term exposure due to the compounding effects of daily volatility, which can erode long-term performance expectations.

Performance Insights: AIBU and AIBD

The AIBU ETF displayed a promising start in the first half of the year but faced increased resistance in the latter half. Despite recent momentum challenges plaguing NVDA stock, AIBU encounters hurdles around the $27 and $29 levels, with bears posing a significant threat.

In contrast, AIBD struggled earlier in 2024 but has shown signs of stabilization in the latter part of the year. While encountering resistance at the $22 support line, the inverse ETF garnered notable volume, indicating growing interest in betting against the prevailing AI narrative.