Challenges Amidst Growth

Amazon, a pioneering force in the e-commerce and cloud computing arenas, witnessed a notable deceleration in revenue growth during Q2 2024. With figures up by only 10% to $148 billion, the tech giant encountered a slump compared to the remarkable 40%+ growth rates experienced in the preceding years.

Positive Outlook Amid Shifting Tides

Despite the slowdown, a prominent investor, renowned as Kody’s Dividends, expresses unwavering faith in Amazon’s continued prosperity. Citing the company’s robust performance across all segments in the second quarter, Kody accentuates Amazon’s commitment to customer value and convenience as key drivers for growth.

Emphasizing the plethora of growth opportunities on the horizon, Kody points to Amazon’s expanding e-commerce reach and the leading role played by Amazon Web Services (AWS) in the cloud computing realm.

An Attractive Buying Opportunity

Kody perceives Amazon as a compelling investment prospect, particularly given the perceived undervaluation of shares, estimated to be around 40% below their fair value based on Price-to-Operating Cash Flow metrics. Should Amazon maintain its growth trajectory, Kody predicts a remarkable 114% upside potential for the company by the end of 2026, positioning AMZN shares as a Strong Buy in the current market climate.

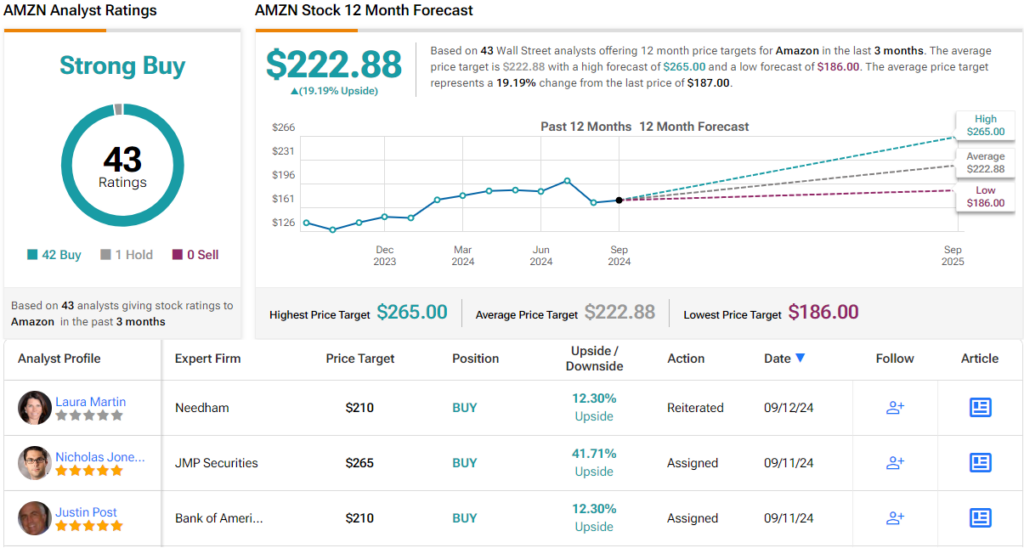

Consensus and Forecast

Market analysts align with Kody’s optimistic stance, with TipRanks data painting a bright picture for Amazon stock, designating it as a Strong Buy. The consensus target price of $222.88 suggests a promising return potential of 19% for investors willing to ride the Amazon wave.

To delve into undervalued stocks and explore compelling investment opportunities, TipRanks’ Best Stocks to Buy tool presents a valuable resource encompassing a wealth of equity insights.

Disclaimer: The opinions shared in this article solely belong to the highlighted investor. This content is intended for informational purposes and underscores the importance of conducting independent analysis before engaging in any investment pursuits.