Apple (NASDAQ: AAPL) may no longer shine as brightly in the investor landscape as it did during the iPhone’s inception, but that doesn’t diminish the incredible investment potential it carries. The luster may have dulled, but beneath the surface lies a gem waiting to be discovered. Here are three compelling reasons why Apple stock remains a sound investment choice in today’s market.

Revolutionizing with AI-Enabled Innovation

Apple’s recent launch of the iPhone 16, boasting AI capabilities, may not have triggered the anticipated frenzy among investors. However, the incorporation of an A18 processor chip for on-device AI tasks heralds a new era for the tech giant. While competitors like Google Gemini and Microsoft’s Copilot vie for the AI throne, Apple’s robust brand loyalty sets it apart.

The impending release of Apple Intelligence promises to transform iPhones and iPads into cutting-edge AI devices, catering to the growing demand for generative AI-capable smartphones. With an estimated surge in such devices over the next decade, Apple is poised to secure a significant market share, bolstered by its user-friendly technology and unparalleled brand allegiance.

Pivoting Towards Lucrative Services

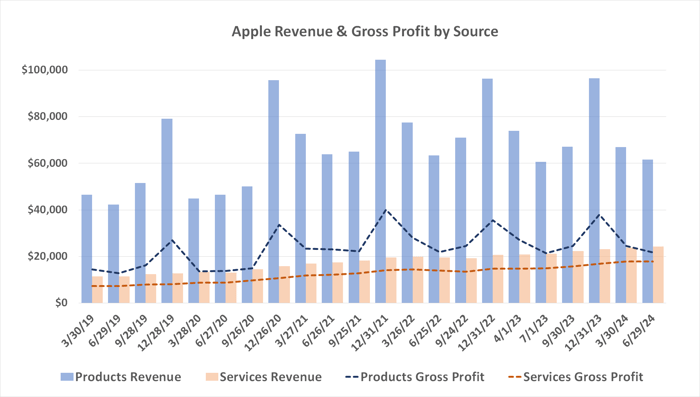

While the iPhone continues to dominate Apple’s revenue streams, the focus is gradually shifting towards high-margin services. Digital offerings like apps, streaming services, and music subscriptions have emerged as key revenue drivers, constituting a substantial portion of Apple’s top line.

The diversification into services signifies a strategic evolution for Apple, wherein devices lay the foundation for an expanding ecosystem of lucrative digital services. With services accounting for nearly 40% of Apple’s gross income, the company is strategically leveraging its existing user base to drive sustained profitability.

Insight into Apple’s Stock Performance

An Unusual Downturn for Apple Stock

Despite expectations for a surge following a recent high-profile publicity event introducing the new iPhone 16 and other innovative technologies within the iOS ecosystem, Apple’s stock trajectory has bafflingly taken a downturn. Historically, Apple’s September events have acted as a catalyst, propelling stock prices upward. However, this year, anticipation peaked in June with a glimpse of the company’s AI aspirations, leaving little room for the stock to climb further post-event. As a result, the stock has been steadily declining, defying the typical pattern of a post-event rally.

Yet, this downward trend may not persist for long. Even as Apple entered the AI realm later than its competitors and recent stock retractions, Wall Street analysts remain optimistic. The majority of analysts maintain a bullish stance, endorsing the stock as a strong buy with a consensus target price of $247.22 – slightly exceeding the current share price. This might mark the beginning of a reversal in Apple’s recent stock downtrend.

Potential for Investment in Apple

Considering the recent dynamics of Apple’s stock performance, the question arises – is now a favorable time to invest in Apple? As the company’s AI initiatives gain traction as growth drivers, the uptrend in the stock price could be imminent. As Wall Street progressively revises its average price targets, investors might uncover an opportune moment to capitalize on Apple’s potential.

It’s intriguing to note that a leading financial advisory service, Motley Fool Stock Advisor, did not feature Apple in its list of top 10 stock picks for potential growth. Drawing parallels, when Nvidia appeared on a similar list in 2005, an investment of $1,000 back then would have grown to an astonishing $716,375. Such instances underscore the transformative power of strategic stock selection and long-term investment approaches.

The Stock Advisor service, known for guiding investors with a comprehensive strategy for portfolio-building, provides regular updates and ongoing support. Since its inception in 2002, the service has significantly outperformed the S&P 500, illustrating the potential for substantial returns in the long run.