A Glimpse into the Oversold Materials Stock Arena

When it comes to the world of stocks, momentum indicators like the Relative Strength Index (RSI) can be a guiding light. An RSI below 30 typically signifies an oversold asset, beckoning astute traders with a keen eye for opportunities. The materials sector, known for its robust nature, currently houses some enticing prospects for those looking to delve into undervalued companies.

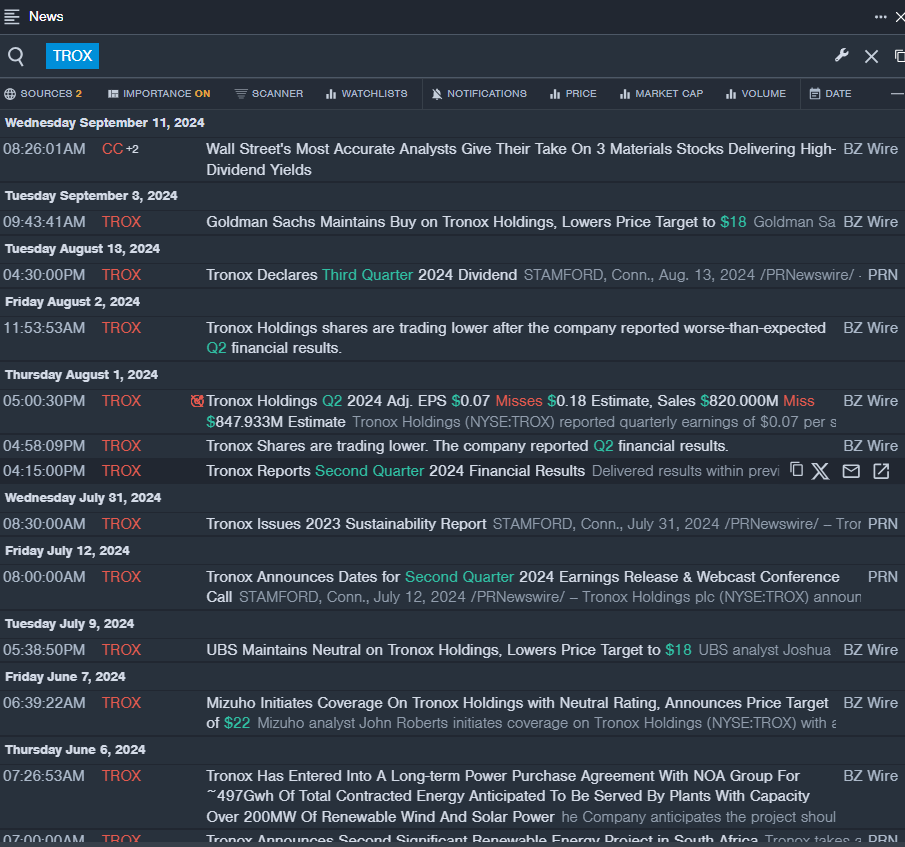

Tronox Holdings PLC: Weathering the Storm

Tronox Holdings PLC recently weathered a storm with less-than-stellar second-quarter financial results, causing a dip in its stock price by about 7% over the last five days. With an RSI value of 27.54 and a 52-week low of $10.08, Tronox is signaling a potential uptick. Despite the setbacks, the sun might soon shine on this struggling stock, offering a ray of hope for investors.

Clearwater Paper Corp: Navigating through Losses

Clearwater Paper Corp, after reporting quarterly losses of $1.55 per share, saw its stock tumble approximately 11% over the past month. However, armed with an RSI value of 28.09 and a 52-week low of $27.69, the company is navigating through the storm with resilience. As the paperboard market demand is primed for a rebound, Clearwater Paper Corp might just emerge stronger amid the challenges it faces.

Ascent Industries Co: Treading the Path of Recovery

In the face of quarterly losses of 2 cents per share, Ascent Industries Co is treading the path of recovery with fortitude. The recent quarterly sales of $50.189 million are a testament to the company’s unwavering commitment to growth. With an RSI value of 29.92 and a 52-week low of $7.27, Ascent Industries Co is poised for a potential turnaround. The journey may be challenging, but the destination promises to be rewarding for those who stand by this company.