Financial giants have recently taken a bold bullish stance on Deere. A deep dive into the options history for Deere (DE) exposed 8 noteworthy trades.

Upon closer examination, it was revealed that 37% of traders exhibited bullish sentiment, while an equal 37% displayed bearish tendencies. Notably, 5 puts valued at $790,985 and 3 calls valued at $161,944 were identified among the trades.

Anticipated Price Movements

Analysis of Volume and Open Interest on these contracts indicates a targeted price range between $300.0 and $420.0 for Deere over the past 3 months.

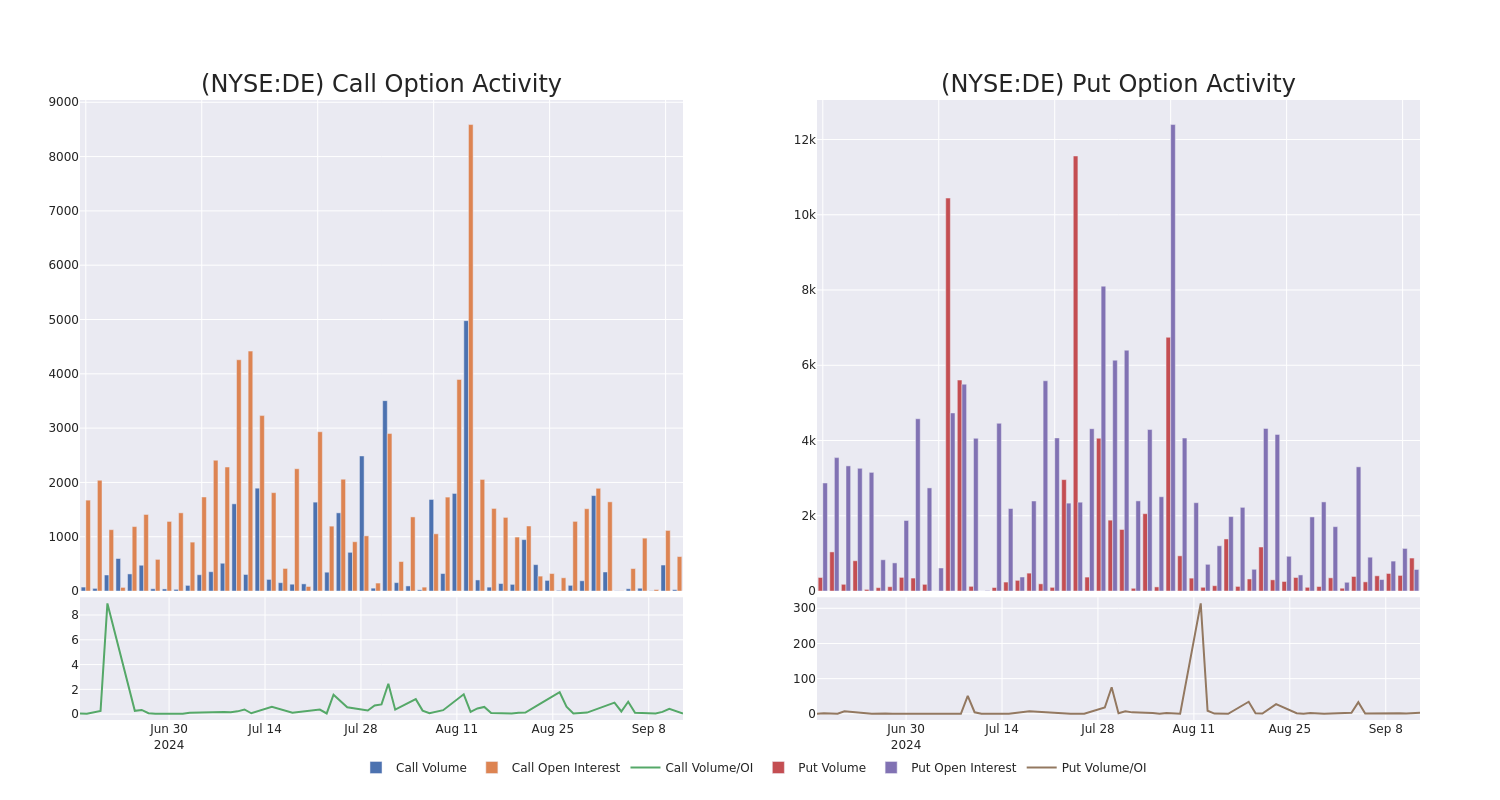

Evolution of Volume & Open Interest

Currently, the average open interest for Deere options stands at 241.6, with a total volume reaching 903.00. Detailed graphical representation outlines the trajectory of call and put option volume and open interest for substantial trades in Deere, focusing on the strike price spectrum from $300.0 to $420.0, over the previous 30 days.

Snapshot of Deere’s 30-Day Option Volume & Interest

Largest Options Identified:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DE | PUT | TRADE | NEUTRAL | 12/18/26 | $19.85 | $16.6 | $18.2 | $300.00 | $364.0K | 265 | 200 |

| DE | PUT | TRADE | BULLISH | 01/16/26 | $12.45 | $11.95 | $11.95 | $300.00 | $212.7K | 308 | 250 |

| DE | PUT | TRADE | BEARISH | 06/20/25 | $6.45 | $4.5 | $6.45 | $300.00 | $93.5K | 308 | 150 |

| DE | CALL | SWEEP | NEUTRAL | 06/18/26 | $48.35 | $43.75 | $43.75 | $420.00 | $87.9K | 13 | 0 |

| DE | PUT | TRADE | BULLISH | 01/16/26 | $12.4 | $11.95 | $11.95 | $300.00 | $83.6K | 308 | 71 |

Insights on Deere

Deere, a global leader in agricultural machinery manufacturing, boasts an array of recognizable equipment, all donning the distinctive green and yellow hues. The company’s operations span four key segments: production and precision agriculture, small agriculture and turf, construction and forestry, and John Deere Capital. With a vast dealership network encompassing over 2,000 locations in North America and 3,700 worldwide, Deere is well-positioned to cater to its market. John Deere Capital further facilitates sales through retail financing to customers and wholesale financing to dealers.

Following a meticulous review of Deere’s options trading activities, a comprehensive analysis of the company’s current market standing and performance comes under scrutiny.

Deere’s Present Market Position

- Trading at a volume of 374,320, DE’s price has surged by 1.38%, now standing at $392.33.

- Indications from RSI readings suggest the stock may be nearing an overbought position.

- The anticipated earnings release is slated for 68 days from now.

Analyst Opinions on Deere

Over the past month, 5 industry analysts have provided ratings on Deere, with an average target price of $410.2.

- An analyst from Evercore ISI Group maintains an In-Line rating on Deere, holding firm on a $378 target price.

- Reinforcing their stance, an analyst from B of A Securities upholds a Neutral rating on Deere with a $410 target price.

- A reaffirmed Neutral stance is adopted by an analyst from Citigroup, retaining a target price of $395.

- Expressing reservations, an analyst from Truist Securities downgrades their rating to Buy, setting a new price target of $443.

- Meanwhile, an analyst at Morgan Stanley adheres to an Overweight rating on Deere, with a current price target of $425.

Trading options introduces heightened risks alongside the potential for amplified gains. Seasoned traders navigate these risks through continuous learning, strategic adjustments, leveraging diverse indicators, and staying abreast of market dynamics. Stay informed about the latest Deere options trades with