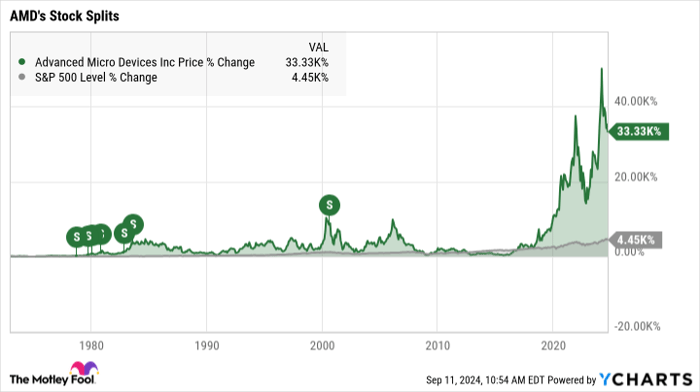

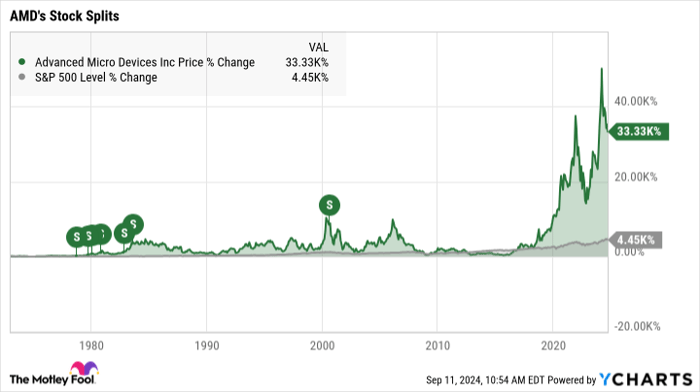

Advanced Micro Devices has solidified its position as a key player in the artificial intelligence sector, challenging Nvidia in the high-performance graphics processing units market for gamers and designers, while also gaining ground on Intel in various niches. AMD’s stock has skyrocketed by a remarkable 3,410% over the past decade, outperforming the S&P 500, which only saw a 231% gain, and leaving Intel investors with a 29% loss. Despite not offering reinvested dividends, AMD’s growth trajectory has been nothing short of astonishing.

Tracing AMD’s Stock-Split Evolution

Speculation surrounding a potential stock split arose as AMD’s stock price climbed to $141 per share. Over the years, AMD has undergone several stock splits, although none have occurred recently. The company’s historical stock-split ratios are as follows:

|

Split Date |

Split Ratio |

|---|---|

|

October 1978 |

3-for-2 |

|

October 1979 |

3-for-2 |

|

October 1980 |

2-for-1 |

|

October 1982 |

3-for-2 |

|

August 1983 |

2-for-1 |

|

August 2000 |

2-for-1 |

Data source: AMD.

These incremental splits have cumulatively led to a 27-for-1 multiplier over 22 years. A share purchased at AMD’s IPO in 1972 for approximately $11.37 would now amount to 27 shares worth a total of $3,807.

AMD’s last stock split dates back to the era of transistor radios and VHS players, underscoring the company’s enduring legacy in the technology sector.

Is Investing in Advanced Micro Devices Worth It?

Prior to investing in Advanced Micro Devices, it’s critical to weigh your options.

The team at Motley Fool Stock Advisor recently identified the top 10 stocks with high potential for investment, with Advanced Micro Devices not making the cut. These selected stocks are projected to yield substantial returns in the future.

If you had invested $1,000 in Nvidia when it entered the list on April 15, 2005, you would now be sitting on $716,375!

Stock Advisor provides investors a clear roadmap to success, offering portfolio-building strategies, regular analyst updates, and two new stock picks monthly. Since 2002, the service has significantly outperformed the S&P 500, highlighting its consistent track record.

*Stock Advisor returns as of September 9, 2024

Anders Bylund acknowledges Intel and Nvidia positions. The Motley Fool endorses and has positions in Advanced Micro Devices and Nvidia, recommends Intel, and suggests short November 2024 $24 calls on Intel. The Motley Fool adheres to a strict disclosure policy.