Five promising stocks were recently added to the coveted Zacks Rank #1 (Strong Buy) list, signaling potential for growth and outperformance in the market.

SharkNinja, Inc.: A Diverse Innovator

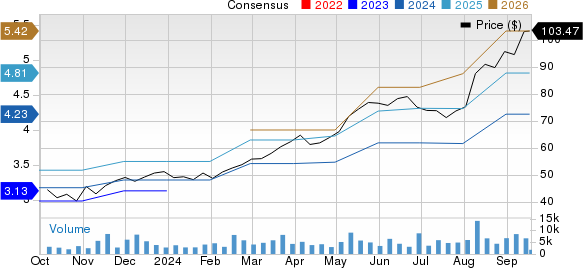

SharkNinja, Inc. (SN), a dynamic product design and technology company, has witnessed a 10.7% surge in the Zacks Consensus Estimate for its earnings this year. This showcases a positive trajectory for its performance and market standing.

Alexander’s Inc.: Maximizing Real Estate Potential

Alexander’s Inc. (ALX), a real estate investment trust, has experienced a notable 6.6% increase in the Zacks Consensus Estimate for its current year earnings. This upward trend reflects the company’s strategic positioning in the market.

Popular Inc.: Banking on Success

Popular Inc. (BPOP), a prominent bank holding company with a stronghold in Puerto Rico, has seen a rise of 6.0% in the Zacks Consensus Estimate for its current year earnings. This growth underscores the company’s resilience and adaptability in a competitive sector.

Arcadis NV: Pioneering Infrastructure Solutions

Arcadis NV (ARCAY), an international consultancy firm specializing in infrastructure and environmental services, has observed a 1.8% increase in the Zacks Consensus Estimate for its current year earnings. This growth reflects the company’s ability to meet evolving market demands and maintain a competitive edge.

J. Sainsbury PLC: Sustaining Retail Excellence

J. Sainsbury PLC (JSAIY), a leading UK food retailer, has recorded a 0.9% growth in the Zacks Consensus Estimate for its current year earnings. This positive momentum indicates the company’s commitment to customer satisfaction and operational efficiency.

These top-ranking stocks signify opportunities for investors seeking potential returns in the market. The Zacks Rank #1 (Strong Buy) designation underscores these companies’ strong fundamentals and growth prospects, making them noteworthy additions to investors’ portfolios.

Zacks Highlights Semiconductor Market’s Bright Future

Amidst the dynamic market landscape, Zacks has identified a standout semiconductor stock poised for significant growth. This stock, though a fraction of the size of industry giant NVIDIA, possesses immense potential for expansion in the rapidly evolving technology sector.

With a robust earnings trajectory and a growing customer base, this semiconductor stock is well-positioned to capitalize on the increasing demand for Artificial Intelligence, Machine Learning, and Internet of Things technologies. The semiconductor market’s projected growth from $452 billion in 2021 to $803 billion by 2028 further underscores the vast potential for this emerging chip technology.

For investors seeking exposure to this promising segment of the market, exploring investment opportunities in the semiconductor industry could prove lucrative in the long term.