TEGNA TGNA shares have declined 9% year to date (YTD), underperforming the broader Zacks Consumer Discretionary Sector’s appreciation of 2.4%. It has also lagged the Zacks Broadcast Radio and Television industry and peers like Netflix NFLX, Fox FOXA and Nexstar Media Group NXST.

Over the same time frame, shares of Netflix, Fox and Nexstar Media have gained 41%, 31.1% and 2.4%, respectively, while the industry has appreciated 49.1%.

TGNA shares underperformance can be attributed to lower top-line growth due to reduced subscription revenues as well as a temporary disruption of service with a distribution partner. Sluggish Advertising and Marketing Services (AMS) revenues also impacted top-line growth. The decline in subscription and AMS revenues also negatively impacted operating income growth.

However, political revenues saw growth in the first-half of 2024. TEGNA expects strong political ad spending and the Summer Olympics to boost its top-line growth (9-12% range) for the third quarter. This is significant considering the fact that subscription and advertising revenue growth remains under pressure due to a sluggish macroeconomic environment and reduced national ad spending.

TGNA continues to successfully manage its expense goals, which is positive for investors. It expects third-quarter operating expenses to remain flat or decline slightly on a year-over-year basis.

So, the question for investors is – will higher political revenues and stringent cost control be enough to help TEGNA shares rebound? Let’s analyze.

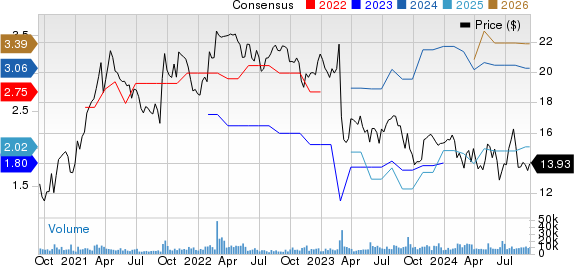

TEGNA Inc. Price and Consensus

TEGNA Inc. price-consensus-chart | TEGNA Inc. Quote

Is Premion’s Strong Growth Enough to Aid TGNA’s Top Line?

TGNA has integrated Octillion with Premion, its industry – leading CTV/OTT advertising platform. Octillion is a futuristic demand side platform that is helping Premion expand its capabilities by combining technology and advertising solutions.

Premion has expanded TGNA’s reach to 210 markets to run streaming CTV advertising campaigns this year. Its local revenues grew double-digit in the second-quarter offset by weakness in national Premion revenues.

However, TEGNA believes that strong political advertising revenue will boost Premion’s top-line growth in 2024. The addition of Octillion will further boost growth in future years.

TEGNA recently signed a New Broadcast Rights Agreement with Dallas Mavericks and will deliver additional broadcasting experience to more than 10 million people in Texas. TGNA’s reach is 39% of all television households in the country and is the largest independent station group owner of the top four network affiliates, namely NBC, CBS, ABC and FOX, in the top 25 areas.

TGNA has also entered into agreements with NBC for the broadcast rights of the Paris Olympics, Washington Commanders, Indiana Fever and Seattle Kraken.

Although contractual rate increases have benefited TGNA’s top-line growth, subscriber decline has been negatively impacting subscription revenues. TEGNA expects to renew 20% of its traditional subscribers at the end of this year and another 45% in 2025.

Earnings Estimate Revision Shows Downward Trend for TGNA

The Zacks Consensus Estimate for both the third quarter of 2024 and the full year of 2024 earnings has shown a declining trend over the past 30 days.

The Zacks Consensus Estimate for third-quarter 2024 earnings is currently pegged at 83 cents, down 7.8% over the past 30 days. The consensus mark for third-quarter 2024 revenues is pegged at $792.44 million, indicating year-over-year growth of 11.1%.

For 2024, the Zacks Consensus Estimate for revenues is pegged at $3.12 billion, indicating year-over-year growth of 7.33%. The consensus mark for earnings is pegged at $3.07 per share, down 2% over the past 30 days.

TEGNA – To Buy, Hold or Sell?

TEGNA shares are currently undervalued, as suggested by a Value Score of A.

However, given the near-term challenges related to subscription and AMS revenues, we expect prospects to remain muted.

TGNA currently has a Zacks Rank #3 (Hold), which implies that investors may want to wait for a more favorable entry point.

You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Zacks Names #1 Semiconductor Stock

It’s only 1/9,000th the size of NVIDIA which skyrocketed more than +800% since we recommended it. NVIDIA is still strong, but our new top chip stock has much more room to boom.

With strong earnings growth and an expanding customer base, it’s positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>

Netflix, Inc. (NFLX) : Free Stock Analysis Report

Nexstar Media Group, Inc (NXST) : Free Stock Analysis Report

Fox Corporation (FOXA) : Free Stock Analysis Report

TEGNA Inc. (TGNA) : Free Stock Analysis Report