Small Caps Buzzing With Anticipation

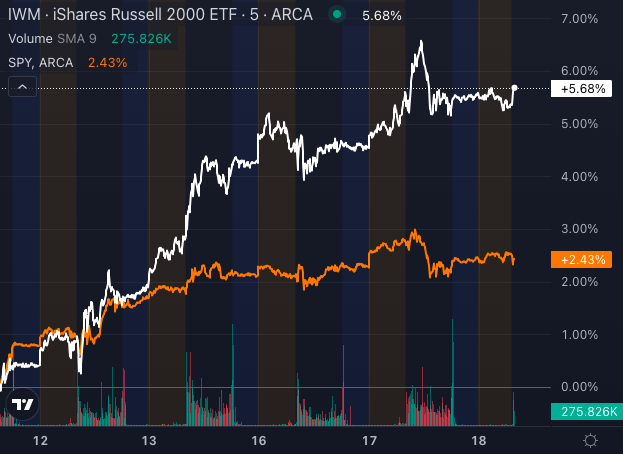

As the Federal Reserve’s interest rate cut looms on the horizon, small-cap stocks are ablaze with excitement, seizing the spotlight. The Russell 2000 Index has ignited a stunning performance, surging over 5% in the past week, a feat that eclipsed its larger counterparts in the S&P 500 Index, which managed a modest 2.5% gain.

Evidently, the iShares Russell 2000 ETF (IWM) has outshined the SPDR S&P 500 ETF (SPY) in this fervent race. Notable small-cap performers fueling this surge include IGM Biosciences Inc, Intuitive Machines Inc, and Applied Therapeutics Inc, boasting impressive gains of 59.33%, 38.62%, and 44.90%, respectively, over the past five days.

Small Caps Preparing for Cost Reduction

Investors are wagering on an imminent ease by the Fed, believing that small caps—particularly those tethered to floating rates and encumbered by debt—stand to gain significantly. The allure lies in the fact that small-cap entities predominantly rely on floating-rate debt, resulting in lowered borrowing costs when interest rates plummet. This tailwind could boost cash reserves for companies with precarious balance sheets, inviting investors to anticipate handsome returns in these smaller stocks.

But a caveat beckons before boarding the small-cap bandwagon.

Market Dynamics at Play: Earnings and Economic Outlook

While the allure of reduced borrowing costs is tantalizing, market chatter surrounding lackluster earnings and an uncertain U.S. economic landscape threatens to temper small-cap exuberance. The success of small caps hinges on the vibrancy of the economy fulfilling its end of the bargain.

For investors eyeing a slice of the action, exchange-traded funds like IWM and the Vanguard Small-Cap ETF (VB) offer diversified exposure to small-cap stocks. These funds mirroring small-cap indexes serve as prudent avenues to reap potential gains without the risk of cherry-picking individual stocks.

Yet, the lingering question remains: How enduring is this rally?

Resilient Bullish Trend in Small Cap ETF

The IWM—a barometer for small-cap stocks—is tracing an unwavering bullish trajectory, with its share price at $219.23 perched above the five, 20, 50, and 200-day simple moving averages (SMAs).

The eight-day SMA at $213.80, the 20-day SMA at $215.07, and the 50-day SMA at $214.41 collectively signal a bullish upswing, underscoring the ETF’s robust upward momentum. Despite a mild selling pressure currently experienced by IWM, hinting at potential short-term volatility, its elevated position vis-à-vis the 200-day SMA of $203.57 fortifies an upbeat technical outlook, implying sustained vigor in the small-cap sector.

Should the Fed opt for a hefty half-point cut, small caps could steal the limelight. Even a modest 25-basis-point cut might sustain the rally—for now. Keeping a lookout on the SPDR S&P 600 Small Cap ETF (SLY) could provide broader exposure to small-cap entities poised to benefit from reduced rates.

Embrace the opportunity to thrive in a volatile market at the Benzinga SmallCAP Conference on October 9-10, 2024, at the Chicago Marriott Downtown Magnificent Mile. Gain exclusive access to CEO presentations, investor meetings, and insights from financial stalwarts. Whether you’re a trader, entrepreneur, or investor, this event promises unmatched prospects to enrich your portfolio and network with industry luminaries.

Image credits: Midjourney’s artificial intelligence.

Market News and Data brought to you by Benzinga APIs