Investors often turn to broker recommendations to navigate the complex landscape of stock trading. The opinions of these Wall Street analysts can sway market sentiment and impact stock prices significantly. But are these recommendations really the golden ticket to profitable trades?

Before delving into the nuances of brokerage advice and how it can shape your investment strategy, let’s dissect the current sentiment surrounding AZZ (AZZ).

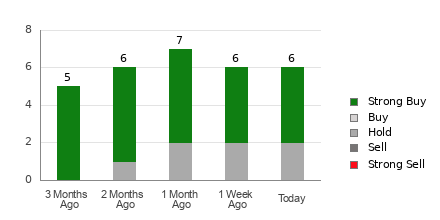

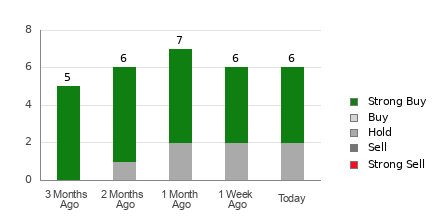

AZZ currently boasts an Average Brokerage Recommendation (ABR) of 1.67, falling between Strong Buy and Buy on a scale of 1 to 5. This metric is derived from the consensus opinions of six brokerage firms. Notably, 66.7% of these recommendations are Strong Buy ratings, painting a favorable picture for the stock’s future.

Examining Brokerage Trends for AZZ

The ABR points towards a bullish stance on AZZ, yet relying solely on this metric may not be prudent. Research indicates that broker recommendations often carry a bias towards upbeat ratings, influenced by the firms’ vested interests in the stocks they cover.

For every “Strong Sell” rating, brokerage analysts tend to assign five “Strong Buy” ratings, hinting at a potentially skewed perspective. Thus, it is advisable to utilize brokerage insights as a validation tool rather than a sole decision-making factor.

Enter Zacks Rank – a proprietary stock rating tool with a strong track record of predicting price movements. While ABR reflects broker sentiments, the Zacks Rank leverages earnings estimate revisions to gauge a stock’s potential. Aligning ABR data with Zacks Rank findings could lead to more informed investment choices.

Unpacking the Differences: ABR vs. Zacks Rank

Though both ABR and Zacks Rank operate on a 1-5 scale, their methodologies diverge significantly. ABR leans on brokerage recommendations, often swayed by positive biases, while Zacks Rank derives insights from earnings estimate revisions, offering a more objective evaluation.

Historically, brokerage analysts tend to be overly optimistic in their ratings, potentially misleading investors. Conversely, Zacks Rank’s reliance on earnings trends has shown a strong correlation with stock price movements, enhancing forecast accuracy.

One key advantage of Zacks Rank is its prompt reflection of changing business trends through earnings estimate revisions. This ensures timeliness in predicting stock performance, a vital edge over potentially outdated ABR data.

Pondering AZZ Investment Potential

Glancing at AZZ’s earnings estimate revisions, the Zacks Consensus Estimate for the current year stands steady at $4.94 over the past month. Analysts’ stable outlook on the company’s earnings could translate to aligned stock performance in the near term.

Based on the consensus estimate stability and other related factors, AZZ currently holds a Zacks Rank #3 (Hold) designation. This underscores the importance of cautious optimism when interpreting the Buy-equivalent ABR for the stock.

As you contemplate investment decisions, it’s vital to weigh the various insights offered by brokerage recommendations and data-driven tools like Zacks Rank. Navigating the nuanced realm of stock trading demands a blend of analytical rigor and strategic foresight.