The Current State of GOOG Stock

Alphabet (GOOG) (GOOGL) has faced a turbulent year, boasting a modest YTD gain of just over 12%. Despite being part of the “Magnificent 7” pack, Google parent company Alphabet is trailing behind the S&P 500 Index. Recent legal hurdles, including accusations of monopolizing the online search market, have clouded the company’s immediate prospects.

Investor Sentiments

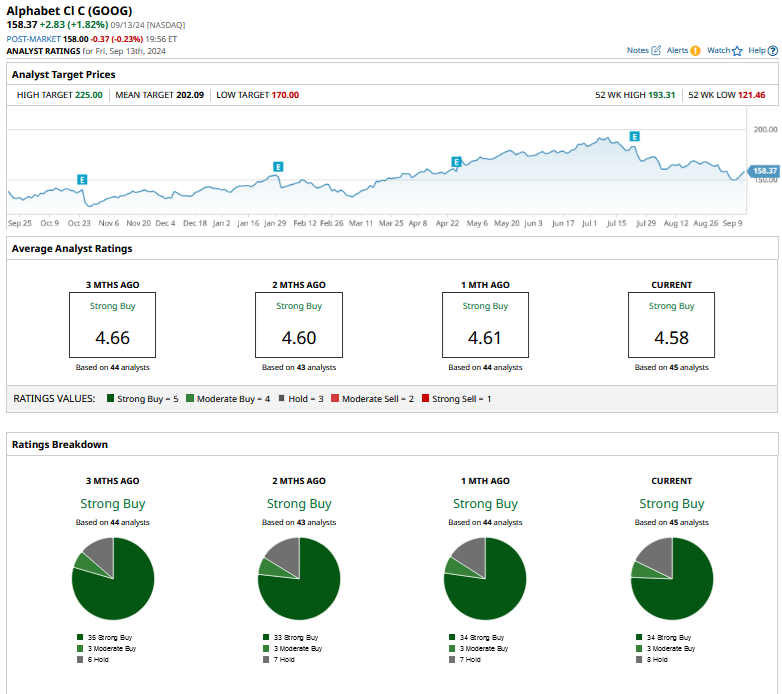

Despite maintaining a consensus “Strong Buy” rating from analysts, Alphabet’s stock has shown signs of a mixed bag. While many analysts still back the tech giant, significant downgrades over the past few months, coupled with a decrease in target prices, have cast a shadow of doubt over its performance.

Challenges on the Horizon

Alphabet is not without its challenges. The company faces heightened regulatory risks, potential litigations totaling billions of dollars, and the looming threat of antitrust actions. Moreover, increased competition in the advertising space from tech giants like Amazon and emerging players such as Uber, Disney, and Netflix further add to Alphabet’s woes.

Additionally, advancements in Artificial Intelligence (AI) pose a strategic threat to Google’s dominant position in the search market. While Alphabet has intensified its AI efforts, the competition remains fierce.

Considering an Investment in Alphabet

Despite the hurdles, Alphabet stock presents an intriguing opportunity. With a forward P/E multiple of 20.4x, Alphabet is currently trading at a discount compared to its industry peers. This lower valuation, combined with underappreciated assets like YouTube, Waymo, and its Cloud segment, provides a compelling case for long-term investors.

While regulatory uncertainties persist, the market appears to have priced in these risks. Embracing the volatility and considering Alphabet stock as a buying opportunity for the medium to long term could potentially yield significant returns, especially given the company’s diverse revenue streams and growth prospects in key segments.