When the stock market resembles a tempestuous ocean, fortuitous opportunities may arise for savvy investors to seize potential gems hidden beneath the turbulent waves. The financial sector currently presents a tableau of oversold stocks waiting to be unearthed by discerning eyes.

In the realm of financial investments, the Relative Strength Index (RSI) acts as a weather vane, gauging a stock’s strength during ascents and descents. A stock is deemed oversold when its RSI dips below 30, hinting at a probable upswing. In the intricate dance of market dynamics, these undervalued stocks could be on the cusp of a dramatic turnaround.

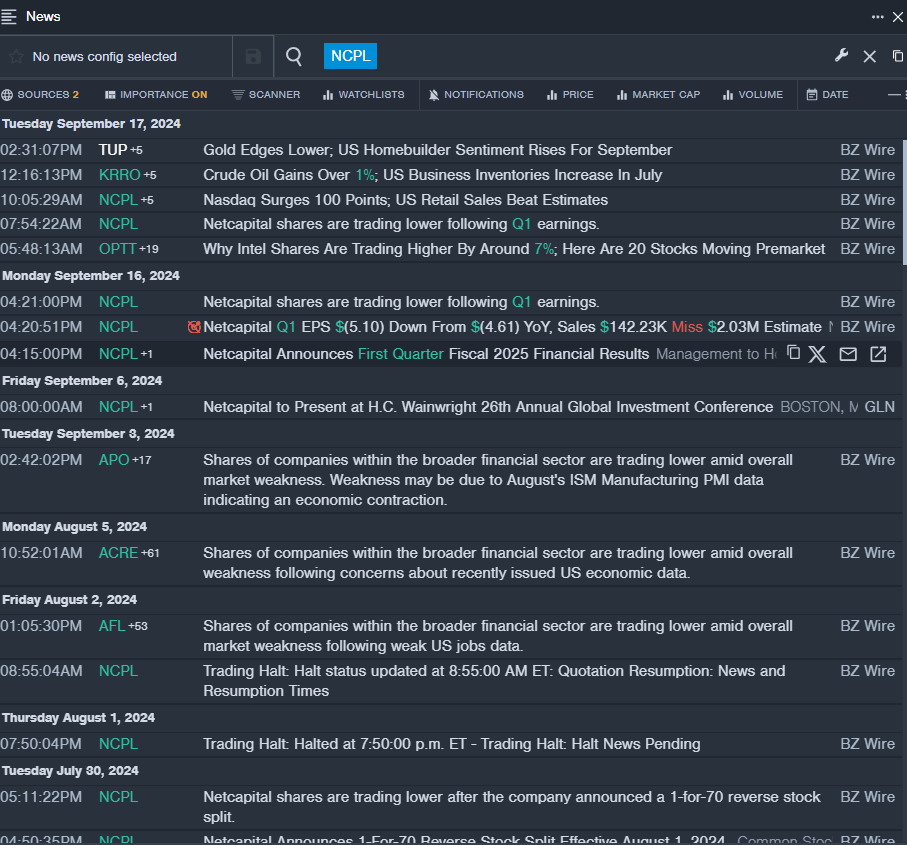

A Bird’s Eye View of Netcapital Inc (NCPL)

- The recent performance of Netcapital Inc resembles a rollercoaster ride, with a 40% decline in stock value over a mere five days. Despite the company’s challenging first quarter, marked by a loss of $5.10 per share, CEO Martin Kay remains optimistic about future prospects. Netcapital Inc’s stock plummeted to a 52-week low of $1.54, reflecting the tumult in the current market landscape.

- RSI Value: 29.24

- NCPL Price Action: Shares of Netcapital witnessed a 5.2% fall, culminating in a closing price of $1.63 on Thursday.

Exploring Reliance Global Group Inc’s (RELI) Trajectory

- A similar narrative unfolds with Reliance Global Group Inc, as the company grapples with an 11% stock devaluation within a short span of five days. Amidst discussions of a pending acquisition with Spetner Associates, Reliance Global Group Inc experienced a reduction in upfront cash payments, signaling a strategic shift. The stock hit a 52-week low of $2.12, offering a snapshot of the company’s recent challenges.

- RSI Value: 27.09

- RELI Price Action: Closing at $2.45, Reliance Global Group Inc witnessed a 5.8% decline in stock value on Thursday.

Navigating the Path of Kaspi.kz AO – ADR (KSPI)

- In the wake of Culper Research’s report on Kaspi.kz AO, the company’s shares nosedived by 21% over five tumultuous days. This substantial downturn was further accentuated by hitting a 52-week low of $85.02. Kaspi.kz AO’s stock faced a daunting challenge, with the RSI value scraping a mere 18.65, signaling potential volatility in the days ahead.

- RSI Value: 18.65

- KSPI Price Action: Concluding the day at $99.81, Kaspi.kz AO experienced a sharp 16.1% decline in its stock value on Thursday.

As these financial stocks teeter on the brink of transformation, only time will reveal whether they emerge as shining stars or fading comets in the vast firmament of market dynamics.