Apple (NASDAQ: AAPL) shareholders are holding onto a successful iPhone 16 launch. Otherwise, the stock could be in trouble. Right now, Apple’s stock trades at a premium price point despite its weak growth prospects, but the iPhone 16 could change all of that.

However, Apple investors received concerning news about the iPhone 16, and it could spell disaster for the stock.

iPhone 16 preorders are reportedly underwhelming

TF International Securities analyst Ming-Chi Kuo monitors several key Apple suppliers to gauge iPhone preorders. The iPhone 16 was announced last week, making this the first weekend of preorder data available, which is crucial in determining overall demand. The last few years have seen fairly weak iPhone demand, with sales barely moving from year to year. Unfortunately, for investors, that trend is starting to move in the wrong direction.

According to Ming-Chi Kuo and his sources, iPhone preorders are down about 13% year over year. This is terrible news for Apple investors, as they needed a successful iPhone 16 launch to justify the stock’s current price.

So it is time to panic-sell? Not necessarily.

There are a few factors at play. First, this is information from suppliers and could have errors. If this information came directly from Apple, then it would be a different story. Second, part of the draw of the new iPhone 16 is that it can run Apple Intelligence, Apple’s take on generative AI. However, some of these features aren’t expected to be available until October, after the iPhone 16 is available to the public.

So, there is still hope that the iPhone 16 will be a successful launch, and I’d caution investors to wait until this year’s holiday season is complete before judging its success or failure.

But one thing isn’t up for debate: Apple needs the iPhone 16 to be a success.

Apple’s growth has been off for nearly two years

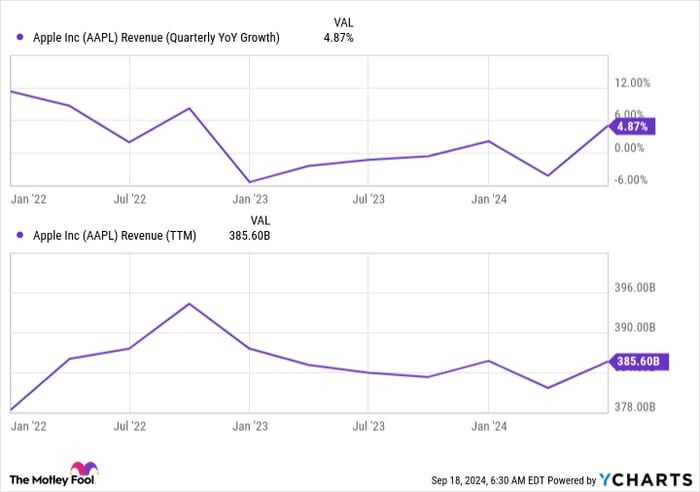

Apple is one of those stocks that is trading on its historically strong performance, not its current results. Since 2022, Apple has failed to post any meaningful revenue growth.

AAPL Revenue (Quarterly YoY Growth) data by YCharts

Basically, Apple’s revenue is still below the peaks it reached in 2022, yet the stock price has significantly climbed since that point. This is partially due to improving profit margins and share buybacks boosting earnings, but the price investors must pay for Apple’s stock has also climbed.

AAPL PE Ratio (Forward) data by YCharts

While investors used to be able to purchase the stock for somewhere in the mid-to high-20s times forward earnings, that’s no longer the case. At more than 32 times forward earnings, Apple stocks trade for a substantial premium over the broader market’s 23.7 times forward earnings (measured by the S&P 500).

When a stock has that much premium over the broader market, it needs to grow earnings rapidly, which requires strong revenue growth.

While Apple Intelligence and the iPhone 16 were supposed to supply that to Apple, preliminary signs are pointing toward that not working out. Once investors get more official data, this could ignite a larger sell-off in the stock. Until then, Apple is still a very expensive stock that is trading on the promise of future success. There are other stocks out there that are far cheaper and have a clearer path to success than Apple, and investors should consider moving capital into them instead of Apple.

Should you invest $1,000 in Apple right now?

Before you buy stock in Apple, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Apple wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $722,320!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

Keithen Drury has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple. The Motley Fool has a disclosure policy.