The Trade Desk’s shares have been on a tear lately, surging by 5.8% in the last month. This remarkable performance has far surpassed the Computer & Technology sector as well as the Internet Services industry, which have both experienced declines during the same period.

The company’s robust growth can be attributed to its expanding customer base and impressive top-line results. Revenues soared by 27% in the first half of 2024 compared to the previous year, primarily fueled by increased spending from both new and existing clients.

The Trade Desk’s self-service cloud-based platform offers cutting-edge automation in ad buying, enabling its clients to navigate through a rapidly evolving media landscape. With a growing global presence, a focus on omnichannel ad inventory, and a strong foothold in programmatic advertising, The Trade Desk has positioned itself as a leader in the industry.

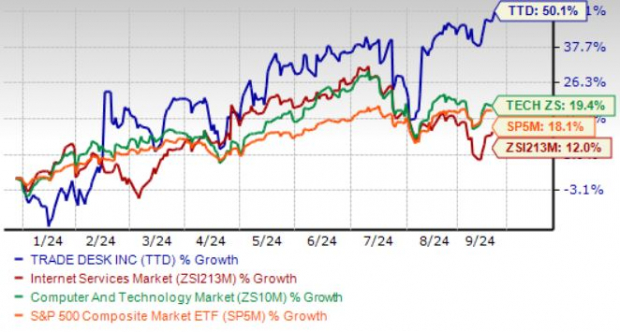

These strategic moves have propelled The Trade Desk’s stock to new heights, hitting a 52-week high of $109.5 on Sept. 18 and closing at $108.02, marking a remarkable 50.1% year-to-date increase.

The Trade Desk Outperforms Sector Year-to-Date

The technical indicators are currently showing a bullish trend for The Trade Desk, with shares trading above both the 50-day and 200-day moving averages, indicating strong upward momentum.

The Trade Desk’s Strong Position in the Market

The Trade Desk’s initiatives such as UID2, OpenPass, and Kokai have capitalized on the surging demand for its advertising services. Notable partnerships with industry giants like Roku, DIRECTV, and LG Ad Solutions have further solidified its market presence.

With a growing emphasis on Connected TV (CTV) and retail media, The Trade Desk is well-positioned to capitalize on these high-growth channels. The company’s robust performance in international markets, particularly in the CTV segment, bodes well for its future prospects.

Expanding Partner Base Boosts TTD’s Growth

The Trade Desk’s collaboration with major players in the industry such as Netflix, Disney, Amazon, and Walmart has been instrumental in driving its growth trajectory. These partnerships enhance the company’s visibility and expand its reach in the market.

Positive Estimates Point to Continued Growth

Analysts expect The Trade Desk to maintain its growth trajectory with third-quarter revenues projected to reach $618 million, reflecting a significant 25% year-over-year increase. The company’s strong performance is also reflected in the upward revision of its 2024 revenue estimates.

Valuation Concerns and Conclusion

Despite its strong performance, The Trade Desk’s stock is currently trading at a premium valuation, which is a cause for concern. The Value Score of F indicates that the stock may be overvalued compared to industry peers.

While The Trade Desk retains a Zacks Rank #3 (Hold) at the moment, investors are advised to closely monitor the stock for a more opportune entry point. However, the company’s robust growth potential and expanding market presence make it an attractive long-term investment option.

Stay Informed with Zacks Investment Research

For the latest recommendations and insights from Zacks Investment Research, be sure to visit their website for detailed analyses and valuable stock information.