Analyst Downgrades Microsoft as Competitors Catch Up

DA Davidson analyst Gil Luria downgraded the rating on Microsoft Corp to Neutral from Buy while maintaining a price target of $475.

Luria mentioned that competition has essentially caught up with Microsoft on the AI front, reducing the justification for the current premium valuation.

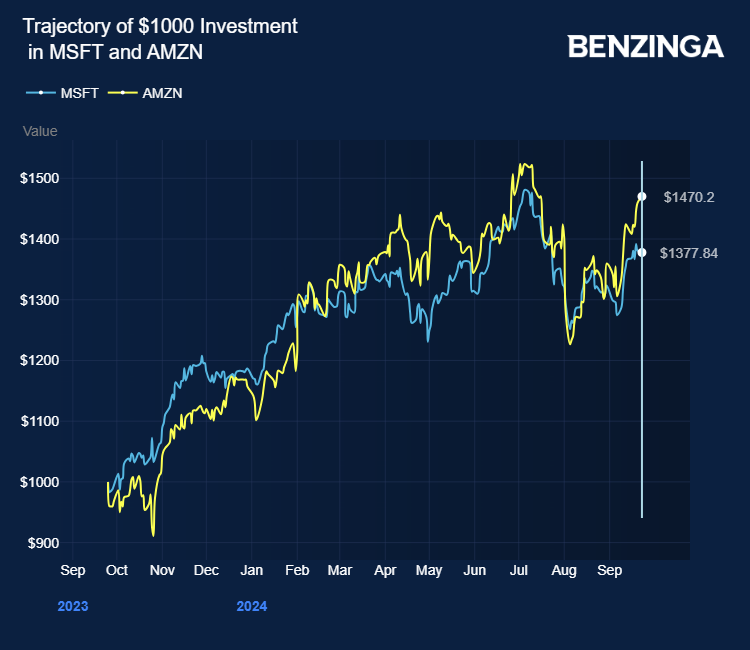

The analyst now ranks Microsoft fourth within the Magnificent Six. The stock has seen a 92% increase since his January 2023 initiation, compared to 49% for the S&P500.

Competition Tightens in the AI Arena

Luria noted that Microsoft has faced a shrinking lead in both the cloud and code generation businesses, making it difficult for the company to maintain its outperformance.

He pointed out that AWS is closing in on Azure’s cloud business, with Google Cloud Platform showing comparable growth rates to Azure in the prior quarter.

Luria’s hyperscaler semiconductor analysis indicates that AWS and GCP are significantly ahead in deploying silicon into their data centers, providing them with a future advantage over Azure.

Challenges in Hardware Development and Margins

Luria highlighted that Microsoft is lagging behind in developing its own semiconductor solutions compared to Amazon and Google, which could pose challenges in the future.

He emphasized that Microsoft’s operating margins are expected to decline due to increased data center capex, a rate higher than Amazon and Google, given Microsoft’s reliance on Nvidia.

The analyst also estimated that Microsoft’s overinvestment annually could lead to a cumulative margin reduction, necessitating significant layoffs to offset the drag.

Forecast and Stock Performance

Luria projected fiscal first-quarter 2025 revenue of $64.2 billion and EPS of $2.96 for Microsoft.

As of the latest check on Monday, MSFT stock was down 0.50% at $433.10.