Intel Corporation (INTC) shareholders traversed a tumultuous landscape this year, grappling with losses amidst a beleaguered foundry business. Despite this, a strategic spin-off, a promising alliance with Amazon.com, Inc. (AMZN), and the allure of a potential QUALCOMM Incorporated (QCOM) acquisition heralded a bullish surge in Intel’s stock values in the preceding week. But can this rally be classified as a lasting resurgence, or is it merely a fleeting uptick in the stock’s trajectory? The conundrum persists.

Intel Stock Emerges from the Ashes

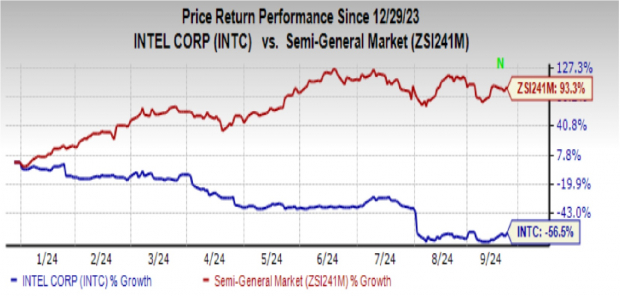

The past twelve months have proven to be a crucible for Intel, with share prices plummeting by a daunting 57%, a stark contradiction to the Semiconductor – General industry’s meteoric 93.3% ascent. The company’s progression has been stalled by exorbitant technological advancements, instigating cash woes that prompted dividend suspensions and layoffs.

Intel’s unfortunate failure to capitalize on the rampant artificial intelligence (AI) wave has indeed taken its toll on the stock. Yet, a triad of fortuitous events steered Intel towards a remarkable rebound last week, propelling share prices to soar upwards by more than 11% – the most robust weekly performance since November.

Factors Fueling Intel’s Stock Surge

Per a Wall Street Journal expose, Qualcomm’s flirtation with Intel for a potential acquisition forecasts mutual benefits for the companies. While Intel specializes in personal computers (PC) and server chips, Qualcomm’s forte lies in mobile products. A synergistic merger could enable both entities to leverage each other’s competencies, thereby enhancing market penetration.

Furthermore, Intel’s possession of manufacturing facilities holds promise for Qualcomm – averting outsourcing costs and concurrently augmenting profit margins.

In a bid to reclaim lost ground and counter NVIDIA Corporation’s price hikes, Intel unveiled a new collaboration with Amazon. Amazon Web Service (AWS) is set to incorporate Intel’s bespoke chip designs. This strategic allegiance intends to claw back market territory from NVIDIA, which has emerged as a global AI powerhouse.

Crowning this series of developments is Intel’s decision to morph its foundry business into a standalone entity. This move instills optimism among Intel investors fretting over ceding chip designs to industry adversaries. The bifurcation provides a lifeline to the struggling foundry sector, plagued by lackluster performance juxtaposed with Intel’s design division’s success.

The bifurcation is poised to enhance Intel’s return on invested capital. Significantly, Intel envisages substantial investments in the foundry segment to catalyze domestic chipmakers’ reliance on U.S. manufacturers vis-a-vis foreign entities like Taiwan Semiconductor Manufacturing Company Limited (TSMC).

Assessing Intel’s Recent Triumphs: Sage Investment?

Intel’s CEO, Patrick Gelsinger, anchors hopes on these strategic alliances and the foundry business segregation to drive bottom-line growth and uplift share prices. Esteemed analysts have bolstered INTC’s average short-term price target by a notable 36.1% from its latest closure at $21.14. The loftiest price target lingers at $66, promising a 212.2% upsurge.

Alas, Arm Holdings plc has wreaked havoc on Intel’s server and networking domain, with Advanced Micro Devices, Inc. (AMD) exploiting this vulnerability to forge ahead in high-performance processing hardware manufacture.

Intel’s current rich valuation hardly commensurates with its challenges – the INTC stock trades at a steep 81.3X forward earnings, eclipsing the industry’s 47.7X forward earnings multiple.

Prudence beckons to prospective investors eyeing Intel’s stock – tread carefully on this precarious path. However, extant INTC shareholders are advised to maintain their position, envisaging substantial growth once Intel metamorphoses into the American counterpart of TSMC, with the recent ventures attaining fruition.

For now, Intel’s stock bears a Zacks Rank #3 (Hold). To explore further options, refer to today’s premier Zacks Rank #1 (Strong Buy) stocks.

The Evolution of Tech Stocks: An Investor’s Guide

Dive into the World of Tech Giants

The tech sector has long been a hotbed of innovation and dynamism, attracting both seasoned investors and eager newcomers. As the digital landscape continues to evolve at breakneck speed, tech stocks have become an enticing yet volatile realm for those looking to grow their portfolios. Among the juggernauts shaping the sector are the stalwarts like Amazon.com, Inc. (AMZN), Intel Corporation (INTC), QUALCOMM Incorporated (QCOM), Advanced Micro Devices, Inc. (AMD), NVIDIA Corporation (NVDA), ARM Holdings PLC Sponsored ADR (ARM), and Taiwan Semiconductor Manufacturing Company Ltd. (TSM).

Unveiling the Gems in the Tech Industry

These companies represent the vanguard of technological advancement, pioneering groundbreaking products and services that have transformed the global landscape. From e-commerce behemoths to semiconductor giants, each entity plays a crucial role in shaping the digital future. Despite the inherent risks associated with the tech sector, astute investors have flocked to these stocks in pursuit of substantial returns.

Challenges and Opportunities in the Tech Sphere

While the tech sector offers immense potential for growth and innovation, it is not without its challenges. Rapid technological obsolescence, regulatory hurdles, and intense competition are just a few of the obstacles these companies must navigate. However, for those willing to weather the storm, the rewards can be substantial. As the global economy becomes increasingly digitized, tech stocks are poised to play an even more integral role in shaping our world.

Exploring the rich tapestry of tech stocks can provide investors with a glimpse into the future, offering a tantalizing blend of risk and reward. As the industry continues to push boundaries and redefine what is possible, those who dare to invest in these cutting-edge companies may reap the benefits of their foresight and acumen.