Whales with a substantial heap of cash are swimming in a notably bearish direction when it comes to Comcast’s stock.

Delving into the options history of Comcast, we unearthed a total of 10 trades. Upon scrutinizing the specifics of each trade, a stark reality unveils itself—10% of investors initiated trades with bullish aspirations, whereas a whopping 70% took a bearish stance.

Among these trades, there are 2 puts, amounting to $63,354, and 8 calls worth $606,337 in total.

Exploring Projections and Sentiments

Our investigation into the Volume and Open Interest in these contracts reveals a target price range that the significant players have been fixated on, spanning from $35.0 to $47.5 for Comcast during the last quarter.

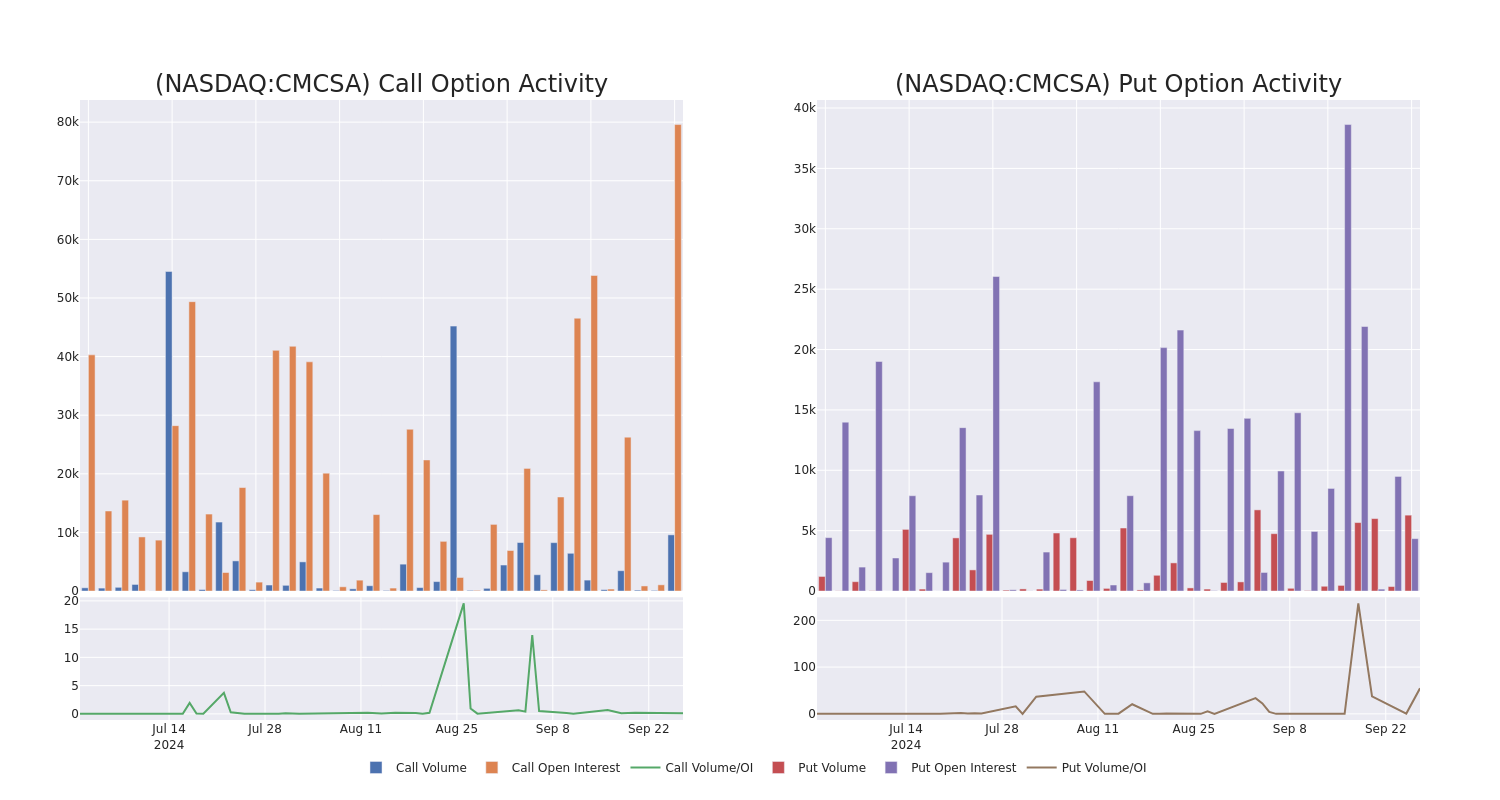

Deciphering Volume & Open Interest Trends

A critical examination of volume and open interest provides imperative insights into stock research. This information serves as a cornerstone in evaluating liquidity and interest levels for Comcast’s options at specific strike prices. Here, we offer you a snapshot of the trends in volume and open interest for calls and puts across significant trades linked to Comcast, within the strike price spectrum of $35.0 to $47.5, over the past month.

Deep Dive into Comcast’s Call and Put Volume

Identification of Key Options Trades

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CMCSA | CALL | SWEEP | BEARISH | 09/19/25 | $8.35 | $8.25 | $8.25 | $35.00 | $171.6K | 4 | 223 |

| CMCSA | CALL | SWEEP | NEUTRAL | 10/18/24 | $2.0 | $1.91 | $1.98 | $40.00 | $103.5K | 7.2K | 2.8K |

| CMCSA | CALL | SWEEP | BEARISH | 01/17/25 | $1.96 | $1.92 | $1.94 | $42.50 | $101.4K | 28.3K | 2.8K |

| CMCSA | CALL | TRADE | BEARISH | 04/17/25 | $1.24 | $1.14 | $1.16 | $47.50 | $58.0K | 1.0K | 1.0K |

| CMCSA | CALL | TRADE | BEARISH | 04/17/25 | $1.24 | $1.15 | $1.16 | $47.50 | $58.0K | 1.0K | 501 |

Insight into Comcast’s Corporate Profile

Comcast is akin to a three-tiered cake. The core cable division boasts networks capable of offering television, internet access, and phone services to 63 million US domains, nearly consuming half the realm. Approximately half of these territories subscribe to at least one Comcast service. Comcast acquired NBCUniversal from General Electric in 2011. NBCU holds sway over several cable networks like CNBC, MSNBC, and USA, the NBC network, the Peacock streaming platform, several local NBC affiliates, Universal Studios, and a bevy of theme parks. Sky, snagged in 2018, is a mammoth television provider in the UK, heavily investing in exclusive content to solidify its stance. Sky also reigns as a significant pay-TV provider in Italy, casting its shadow across Germany and Austria.

Assessment of Comcast’s Present Position

- Currently witnessing a trading volume of 6,485,734, CMCSA’s price has scaled by 2.0%, settling at $41.84.

- RSI readings hint that the stock might be teetering towards an overbought territory.

- Eagerly anticipated earnings reveal lies just 34 days away.

Can you turn $1000 into $1270 in just 20 days?

An options trading veteran spanning two decades unveils his one-line chart process that pinpoints buy and sell signals effectively. Emulate his trades that have averaged a 27% profit every 20 days. Discover it here for access.

Options trading unfolds a realm of higher risks coupled with alluring rewards. Discerning traders adeptly navigate these perils through continuous education, strategic adaptability, vigilant monitoring of multiple indicators, and a hawk-eyed observance of market oscillations. Stay abreast with the latest Comcast options maneuvers through real-time alerts courtesy of Benzinga Pro.

Market News and Data brought to you by Benzinga APIs