Fission Uranium FCUUF has completed the hearing before the Supreme Court of

British Columbia regarding the approval of the final order for its acquisition by Paladin Energy Limited.

The hearing began before the Court on Sept. 13, 2024, and ended on Sept. 26. Its decision on the final

order is expected in the coming weeks.

Fission’s acquisition by Paladin Energy, however, remains opposed by CGN Mining Company Limited (“CGN”),

which holds an 11.26% stake in Fission. CGN is a subsidiary of China General Nuclear Power Corp.

Fission’s shareholders voted in favor of the acquisition at the special meeting held on Sept. 9, 2024. The

closure of the acquisition currently remains subject to receipt of the final order and clearance under

the Investment Canada Act, as well as other customary conditions.

Anticipating the Fission Uranium-Paladin Energy Merger

Fission Uranium sealed the deal with the Australian miner, Paladin Energy, in June 2024. Under the

agreement, Paladin Energy would acquire FCUUF’s outstanding shares for an implied total equity value of

C$1.14 billion ($0.846 billion).

If the acquisition comes to fruition, a company with a pro forma market capitalization of $3.5 billion will

be born. This entity will stand tall among the largest pure-play global uranium companies, possessing a

combined mineral resource of 544 million pounds of uranium and ore reserves of 157 million. It will boast

a robust portfolio of exploration, development, and production assets, as well as significantly increased

exposure to international capital markets.

Shareholders of Fission Uranium are poised to receive 0.1076 fully paid shares of Paladin Energy for each

FCUUF share held. Post-transaction, existing shareholders of Paladin Energy and Fission Uranium will

command approximately 76% and 24%, respectively, of the amalgamated entity.

Paladin Energy has initiated the process for the listing of its shares on the Toronto Stock Exchange in

tandem with finalizing the transaction. Consequently, Fission Uranium shareholders will find themselves in

possession of TSX-listed Paladin Energy shares.

Strengthening Paladin’s Uranium Fortunes with the FCUUF Buyout

Paladin Energy is an autonomous uranium producer holding a 75% stake in the renowned Langer Heinrich Mine,

a long-life asset situated in Namibia. The company also owns a collection of uranium exploration and

development assets across Canada and Australia. Through the Langer Heinrich Mine, it supplies uranium to

prominent nuclear utilities worldwide, boasting a 17-year estimated mine life and an annual capacity of 6

million pounds of uranium.

The addition of Fission Uranium to its portfolio will bestow upon Paladin Energy full ownership of the

Patterson Lake South uranium property. This proposed high-grade uranium mine and mill sited in Canada’s

Athabasca Basin region is expected to operate for a decade with an annual output of 9.1 million pounds of

uranium as per the feasibility study.

This strategic maneuver positions Paladin Energy to capitalize on the mushrooming demand for uranium,

driven by various factors such as escalating need for electricity generation and the global movement

toward decarbonizing electrical grids, among other catalysts.

The global uranium market has transitioned from an inventory-driven to a production-driven phase over

recent years. Historic underinvestment in uranium mining operations has precipitated a structural gap

between global production and uranium requisites. Projections indicate a shortfall of over 66 million

pounds of uranium between production and demand in 2024 and 2025, swelling to over 400 million pounds by

2034. The buoyant demand and tight supply dynamics are anticipated to prop up uranium prices.

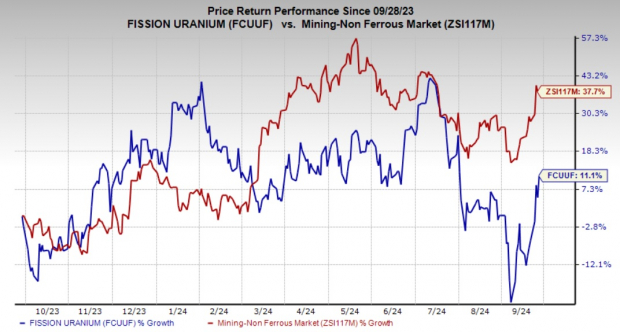

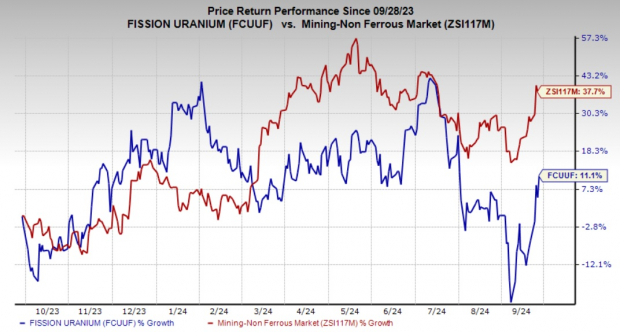

Assessing Fission Uranium’s Stock Journey

Fission Uranium shares have observed an 11.1% uptick over the past year, lagging behind the industry’s

growth rate of 37.7%.

Image Source: Zacks Investment Research

Delving into FCCUF’s Zacks Rank & Market Options

Fission Uranium presently holds a Zacks Rank #3 (Hold).

Superior alternatives in the basic materials sphere include Carpenter Technology Corporation

CRS,

Eldorado Gold Corporation EGO, and IAMGOLD Corporation

IAG. Each of

these entities flaunts a Zacks Rank #1 (Strong Buy) at the moment.

Carpenter Technology’s fiscal 2025 earnings are estimated at $6.06 per share. Earnings projections have

surged by 17% in the past two months with an average earnings surprise of 15.9% over the trailing four

quarters. CRS shares have appreciated by 129% within a year.

Eldorado Gold’s 2024 earnings are projected at $1.32 per share. The earnings outlook has climbed by 16%

over the past 60 days with an average earnings surprise of 430%. EGO shares have surged by 106% over a

year.

IAMGOLD is expected to earn 39 cents per share in 2024, with earnings forecasts improving by 44% in the past

two months. The company has recorded an average earnings surprise of 200% over the last four quarters,

while IAG shares have gained 160% over a year.