Investors gravitate towards dividend stocks for various compelling reasons. Companies that offer dividends provide a steady income stream, which can be reinvested to build long-term wealth. Moreover, dividend-paying companies tend to exhibit greater stability and financial health, serving as a shield against economic downturns.

Considering these factors, we delve into two high-yield dividend stocks that hold significant upside potential and merit attention in the current investment landscape.

An Expanding Real Estate Dynasty

Realty Income (NYSE: O) operates as a real estate investment trust (REIT) and boasts a robust portfolio of over 15,540 properties primarily situated in the U.S. and the United Kingdom. A gem among investors, Realty Income stands out for its resilience to economic downturns, with 90% of its rent providers demonstrating buoyancy and immunity against e-commerce pressures, fostering long-term client relationships.

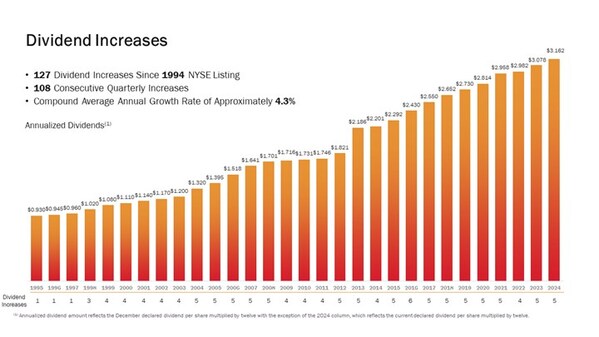

The company’s commitment to dividends is unwavering, exemplified by its record of 108 consecutive quarters with an increased payout and a commendable 4.3% compound annual growth rate (CAGR) in dividends since 1994. The current 5% dividend yield is particularly enticing for income-driven investors, backed by a history of consistent dividend hikes. Realty Income is not just about dividends; it harbors growth prospects, such as venturing into new verticals like data center development in the U.S.

Moreover, the company eyes expansion opportunities in Europe beyond its core U.K. stronghold. With a substantial global addressable market for net lease properties and a pipeline of quality acquisition targets, Realty Income is a top contender for investors seeking stable income, growth avenues, and recession-resilient assets.

Navigating EV Challenges as Ford’s Pro Aspect Soars

Ford Motor Company (NYSE: F) is a tantalizing dividend stock due to its attractive valuation, sporting a modest 10.8 price-to-earnings ratio (P/E) and alluring 5.5% dividend yield. The company stands out on two fronts: its burgeoning Ford Pro commercial division and its model e electric vehicle (EV) segment.

Ford Pro has metamorphosed into a high-margin growth engine, surpassing its traditional gasoline-powered vehicle segment in earnings and exhibiting superior revenue growth momentum. This division’s commendable EBIT margin and revenue uptick underscore its pricing prowess and positive trajectory within Ford’s business landscape.

While Ford Pro ascends, the model e division, responsible for EVs, faces challenges. Estimated losses of up to $5.5 billion by 2024 have prompted Ford to scale back up to $12 billion in EV investments. However, the company anticipates financial improvements as EV scale increases and battery costs decline, potentially tipping the EV division towards profitability and augmenting Ford’s bottom line substantially.

Capturing Potential Investment Opportunities

Both Realty Income and Ford Motor Company present a tantalizing dividend yield exceeding 5%, coupled with promising growth avenues for long-term investors. Realty Income’s expansion prospects in the U.S. and Europe, combined with Ford’s potential for enhanced profitability by streamlining its EV division and leveraging its thriving Ford Pro business, offer enthralling investment opportunities.

Contemplating an Investment in Ford Motor Company

Before delving into Ford Motor Company’s stock, scrutinize the insights from the Motley Fool Stock Advisor analyst team. While Ford Motor Company did not make it to their list of top 10 stocks, other selections could potentially yield substantial returns in the foreseeable future.

Ever wondered about the transformative power of timely investments? Consider the impact of Nvidia’s inclusion on this list back in 2005. A $1,000 investment at the time of recommendation would have mushroomed into an astonishing $743,952. The Stock Advisor service continues to outshine the S&P 500 returns, underscoring its prowess in guiding investors towards lucrative opportunities.

*Stock Advisor returns as of September 23, 2024