Investors often ponder where the next gold rush might be in the vast landscape of financial opportunities. The infrastructure sector, a cornerstone of economic growth, emerges as a beacon of potential prosperity. While historic icons like the Suez Canal and the Intercontinental Railroad spearheaded past financial heydays, modern-day equivalents in road and bridge construction, cargo hauling, and energy transformation shine bright with colossal fiscal prospects.

Revolutionizing Infrastructure Investment

Amidst heightened speculation, companies poised to capitalize on massive infrastructure developments are gaining attention as attractive investment options. As financial architects unveil special reports and forecasts to guide investors through this meandering landscape, words like “opportunity” and “potential” reverberate as echoing promises of prosperity.

Exploring the Lucrative Possibilities

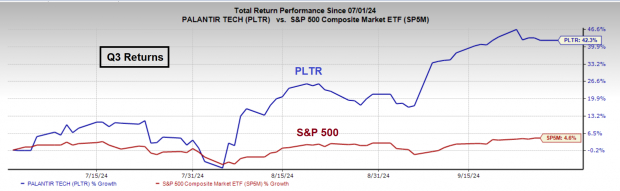

From tech giants like Microsoft Corporation (MSFT) to energy titans like Constellation Energy Corporation (CEG) and cutting-edge innovators like NVIDIA Corporation (NVDA), a diverse array of companies stands on the cusp of reaping rewards from the infrastructure boom. Oracle Corporation (ORCL) and Palantir Technologies Inc. (PLTR) also make the cut as enterprises well-positioned to leverage the burgeoning investment wave. Rocket Lab USA, Inc. (RKLB) and Intuitive Machines, Inc. (LUNR) further showcase the panorama of possibilities ripe for exploration.

Charting a Course for Financial Prosperity

With a historical backdrop of industries that underpin economic revolutions through groundbreaking projects, the present infrastructure surge hints at a similar transformative potential. As investors navigate the tumultuous waters of financial markets, key players in the infrastructure sector beckon as lighthouses guiding ships to the shores of profitability.

Unlocking the Gates of Wealth

Amidst the cacophony of financial advice and market analyses, the infrastructure sector stands as a fertile ground for those with the audacity to seize the opportunities it presents. As whispers of market trends and investment ideas echo through the realms of finance, astute investors align their sails with the winds blowing from the sector, setting course for the promise of financial fortune.