Intel investors have reason to rejoice as the chipmaker expands its horizons by incorporating Amazon Web Services to enhance AI supply chains. Through custom microchips and an innovative 18A process node, Intel is set to revolutionize AI applications by offering superior performance and energy efficiency. The forthcoming Xeon 6 chip tailored for Amazon Web Services heralds a new era of efficiency.

Breakthrough with Panther Cove

Intel’s Panther Cove line is emerging as a formidable player, poised to significantly elevate performance and competitiveness. Reports suggest Panther Core’s remarkable advancements in Instructions Per Clock (IPC) figures translating into accelerated task execution. With Intel’s strategic foray into chip foundry upgrades, the long-term gains promise a bright future despite the initial capital investments.

Intel’s Position in the Market

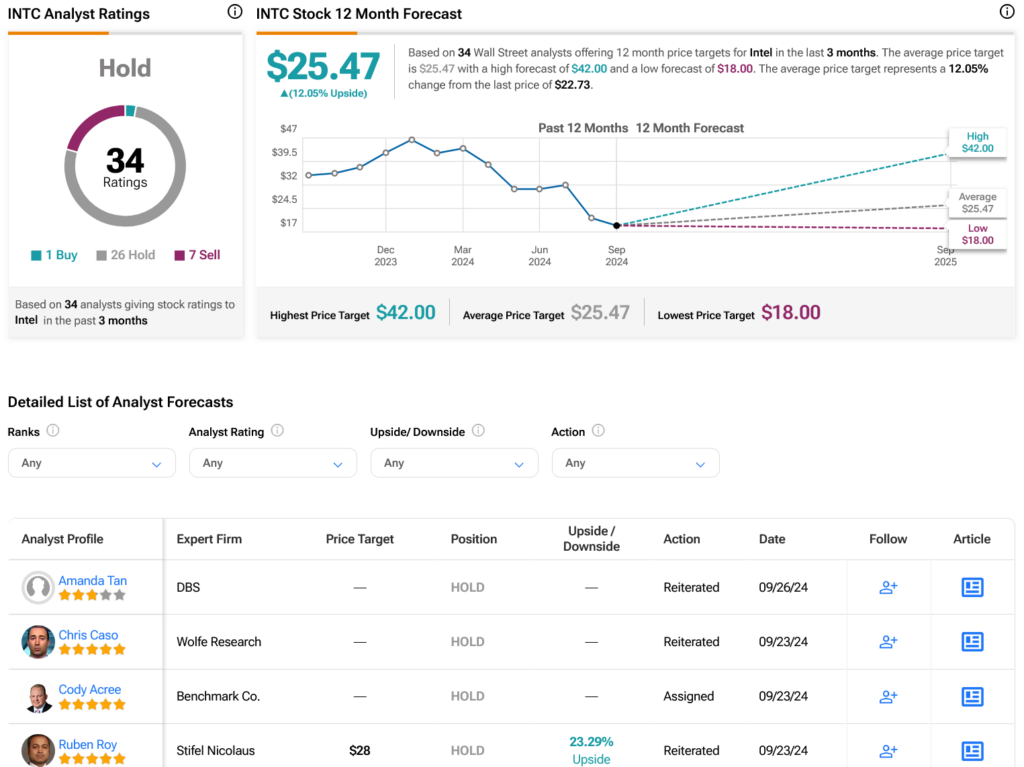

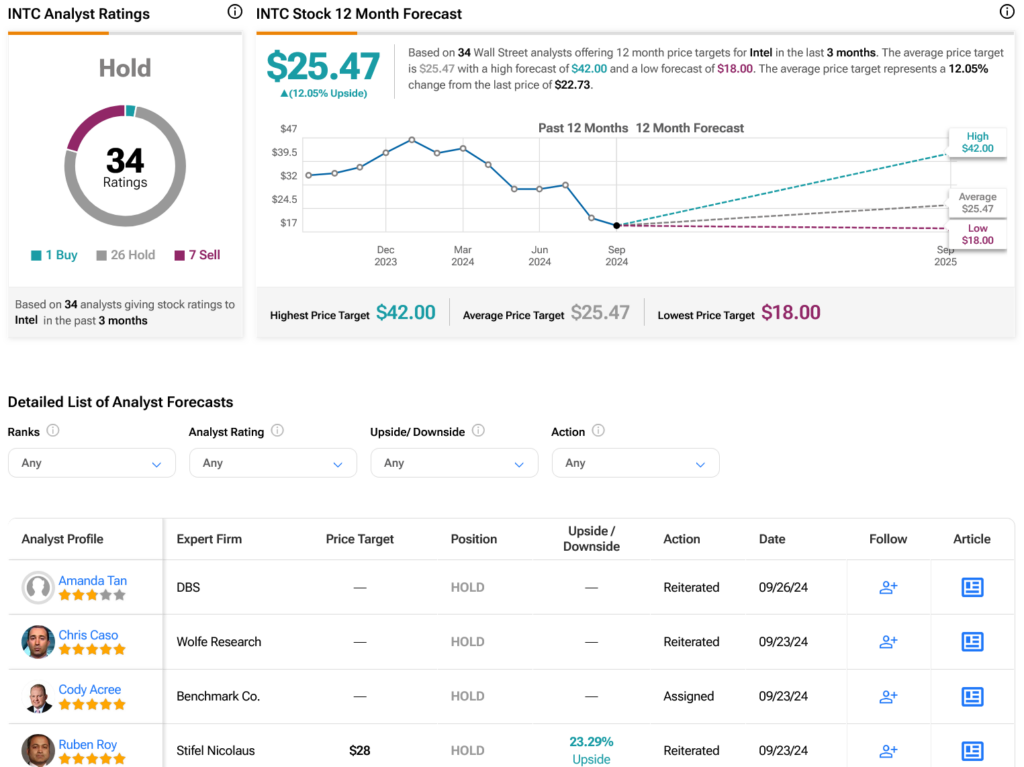

Considering Wall Street sentiments, analysts maintain a Hold consensus rating on INTC stock amidst one Buy, 26 Hold, and seven Sell recommendations over the past quarter. The current average price target of $25.47 per share indicates a promising 12.05% upside potential for investors.

Explore more analyst ratings on INTC here.