Amidst the tempest of market volatility, a beacon shines for investors seeking shelter, as the consumer discretionary sector unveils a trove of undervalued gems waiting to be discovered.

Market dynamics, like the Relative Strength Index (RSI), unfurl a nuanced tapestry of patterns, offering traders insight into the ebb and flow of stock movements. When the RSI dips below 30, a stock is deemed oversold, heralding a potential turnaround in fortunes.

Here lies a compendium of three stalwarts in the consumer space, poised for a resurgence, their RSIs hovering close to or below the auspicious 30 threshold.

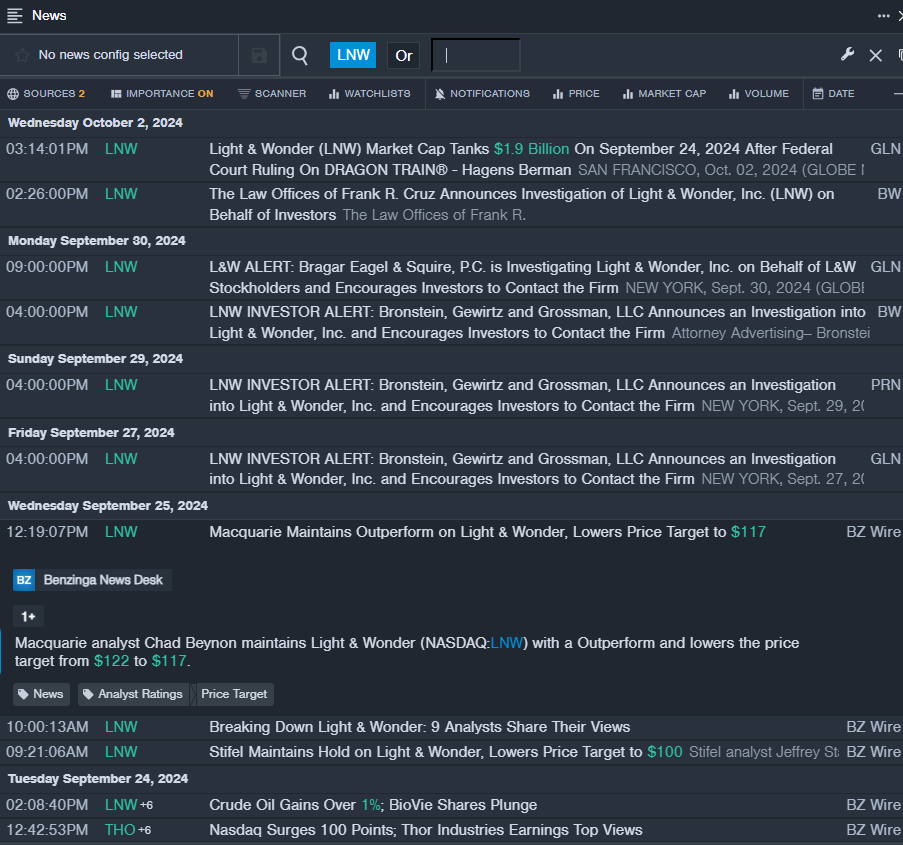

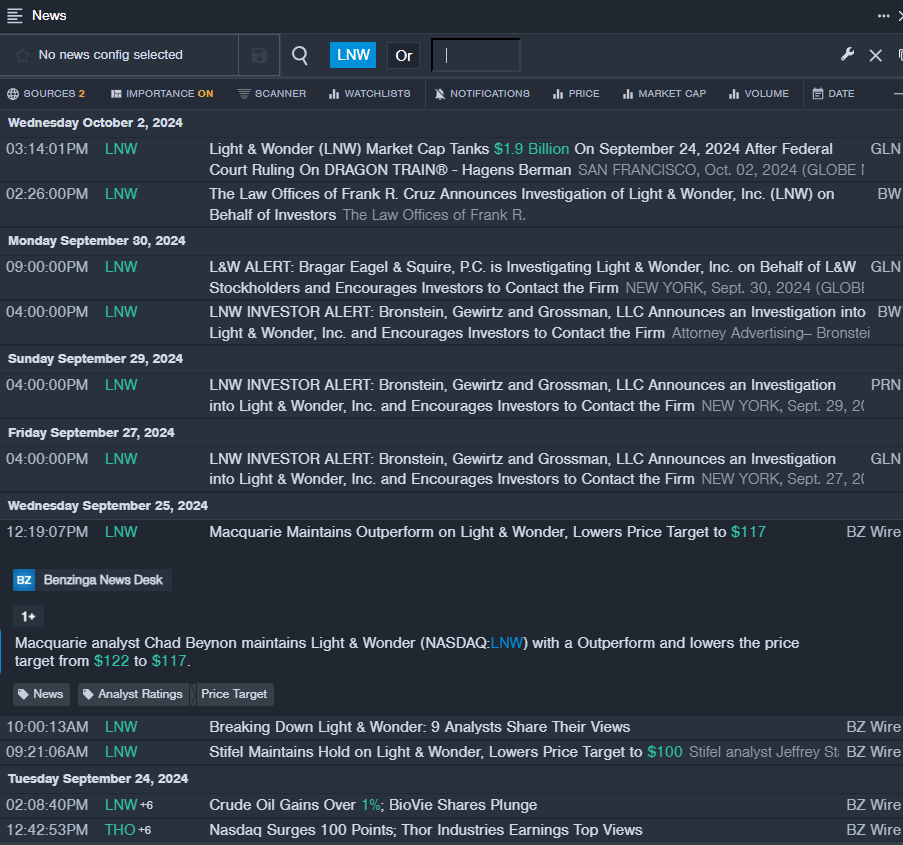

Light & Wonder Inc LNW

- Embarking on September 25th, the Macquarie analyst Chad Beynon, unwavering in his assessment, upheld Light & Wonder, albeit with a revised price target of $117, down from $122. The stock witnessed a descent of nearly 19% in the past lunar cycle, nestling near its 52-week nadir at $67.71.

- RSI Value: 26.57

- LNW Price Action: Light & Wonder shares wavered marginally, receding 0.2% to conclude at $87.74 by midweek.

- Meticulous in its curation of real-time insights, Benzinga Pro evoked the latest tidings on LNW, a testament to its unwavering commitment to clarity.

Makemytrip Ltd MMYT

- Traversing through August 27th, the B of A Securities analyst Sachin Salgaonkar, a shepherd of many, maintained a Buy rating on MakeMyTrip, elevating the price target to $112 from the prior $100. With the stock dipping approximately 18% in the recent quintet of trading days, it seeks solace near $36.81, its lowest echelon in a year.

- RSI Value: 29.31

- MMYT Price Action: Activating a 5.2% descent, Makemytrip closed shop at $86.91, marking a grim denouement for the week.

- Guided by the illuminative charts of Benzinga Pro, the trend winds of MMYT were deciphered, heralding a potential metamorphosis in stock fortunes.

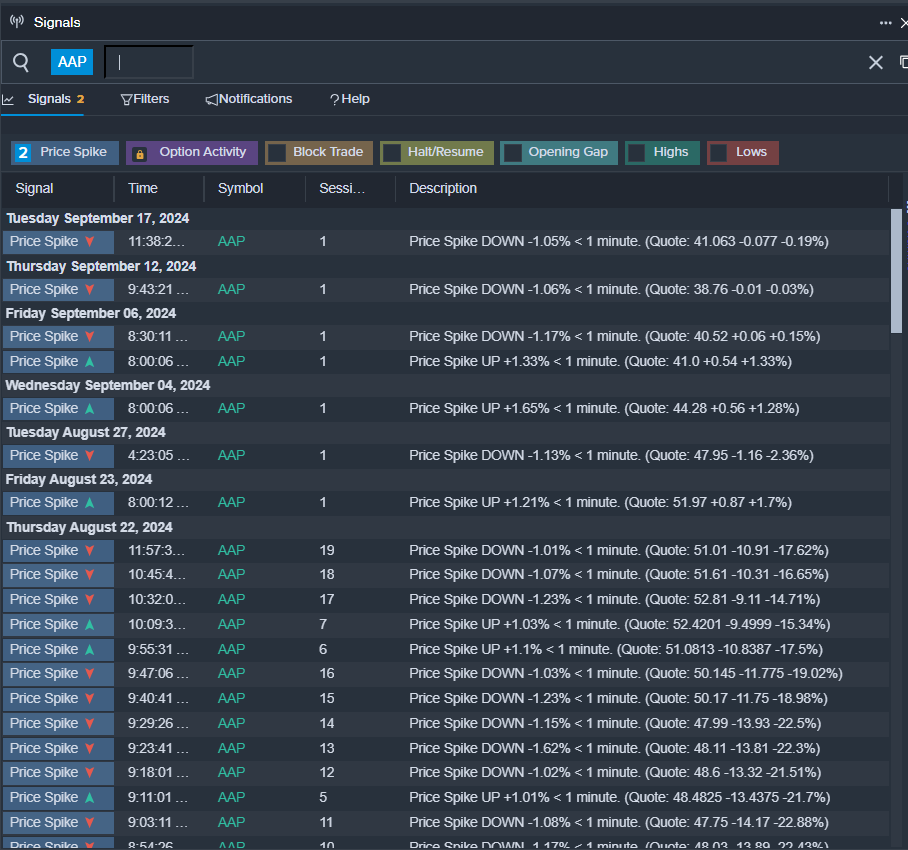

Advance Auto Parts, Inc. AAP

- Steering through September 12th, the Mizuho analyst David Bellinger, a sentinel of objectivity, retained a Neutral stance on Advance Auto Parts, dialing down the target price to $38 from the former $45. Witnessing a somber slide of 15% in the past monthly cycle, the stock found itself languishing near $37.08, battling the whims of fate.

- RSI Value: 27.47

- AAP Price Action: With a faltering gait, Advance Auto Parts endured a 1.6% dip, closing the day’s proceedings at $37.17, beckoning the shadows of uncertainty.

- In a prophetic nod, Benzinga Pro’s perceptive signals hinted at a potential renaissance in the realm of AAP shares, a harbinger of changing tides in the fickle sea of stocks.

Read Next:

Market News and Data brought to you by Benzinga APIs