Prevailing Market Trends of Bank Stocks

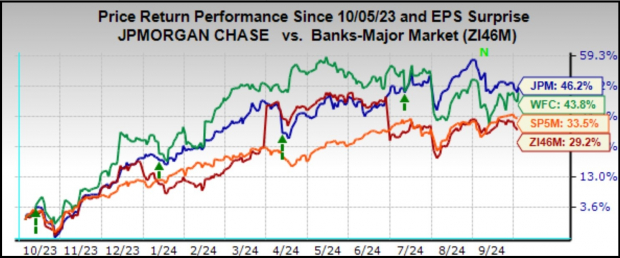

Throughout the financial sphere, JPMorgan shares have regrettably shed about 7% of their value since reaching a 52-week high at the culmination of August. In juxtaposition, Wells Fargo, which, in tandem with JPMorgan, launches the Q3 earning season for the Finance sector, shows a less daunting descent, having only lost half of the former’s plummet within the same period. Interestingly, despite this downturn, both JPMorgan and Wells Fargo have shone as standout performers over the preceding year.

An Economic Conundrum

So what has precipitated the recent underperformance of JPMorgan and Wells Fargo stocks? The catalyst appears to be a potent combination of resurgent concerns regarding economic expansion and the repercussions of dwindling interest rates on net interest incomes in the foreseeable future. This economic growth unease is proving to be a significant headache for banks such as JPMorgan and Wells Fargo, as it not only impacts the demand for credit but also the robustness of the extant loan portfolio.

Forecasting Brighter Days Ahead

Notwithstanding the challenges, there is a ray of hope on the horizon. Industry data hints at a meager +1% loan growth in Q3, albeit the commencement of the Federal Reserve’s easing cycle may not yield immediate effects in this realm. The impending outlook for loan demand seems promising for 2025, especially if the economy manages to sidestep the feared recessionary slump.

Cautious Optimism in Credit Quality

The travails in the commercial real estate market are well-established and already provisioned for at major banks. Beyond these concerns, bankruptcy rates in the U.S. have spiraled post the pandemic lows of early 2022, yet the growth rate has plateaued in recent months. With bankruptcies currently lingering at 30% below pre-pandemic levels, the deceleration in bankruptcy growth might signal improved financial health among households. Nevertheless, a rosy credit quality outlook hinges on the Federal Reserve’s easing measures steering the economy clear of recession.

Diving into Investment Banking Projections

On the investment banking frontier, revenues are expected to observe moderate growth in the low-to-mid teens percentage range. While debt and equity capital market activities are anticipated to post year-over-year upsurges, a persistent weakness in M&A activities tempers the gains. The M&A outlook is poised to brighten post-election, with a clearer political and regulatory landscape.

Peering into Earnings Projections

JPMorgan is foreseen to declare earnings of $4.04 per share (dipping by 6.7% year-over-year) on revenues of $41.01 billion (rising by 2.9% YoY). Conversely, Wells Fargo is expected to report an EPS of $1.27 (falling by 8.6% YoY) on revenues amounting to $20.38 billion (down by 2.3% YoY).

Valuation Insights and Market Comparisons

Despite the recent outperformance by big bank stocks, they remain attractively priced across most conventional valuation metrics. For instance, the Zacks Major Banks industry’s 10-year history on a forward 12-month P/E basis reveals a present multiple of 9.1X. This figure, although not as compelling as the 7.1X recorded in October 2022, remains competitively priced compared to the industry’s historical highs and lows.

Market Sentiment and Investment Appeal

At a juncture where the S&P 500 index hovers around a record zenith, the discounted valuations within the Finance sector present an enticing investment opportunity. Particularly inviting for investors envisioning a soft economic deceleration, the Finance sector holds the promise of favorable outcomes in terms of credit losses and loan demands.

Expounding on the Broader Earnings Landscape

The broader economic landscape anticipates total Q3 earnings for the S&P 500 index to ascend by 3.3% year-over-year on revenues marked by a 4.5% uptick. While the earnings panorama doesn’t dazzle, it doesn’t dismay either. Noteworthy, however, is the recent adverse trend in earnings revisions for the impending Q3, contrasting earlier positive revision patterns in the corporate profitability spectrum.