In times of market turbulence, investors often seek solace in dividend-yielding stocks. These stocks, with robust free cash flows, provide shareholders with significant dividend payouts.

Investors can delve into the latest insights from top analysts on their preferred stocks by exploring stock ratings. Analysts’ accuracy is key in guiding investors through this volatile landscape.

Here’s a breakdown of the top-rated high-dividend stocks in the consumer staples sector:

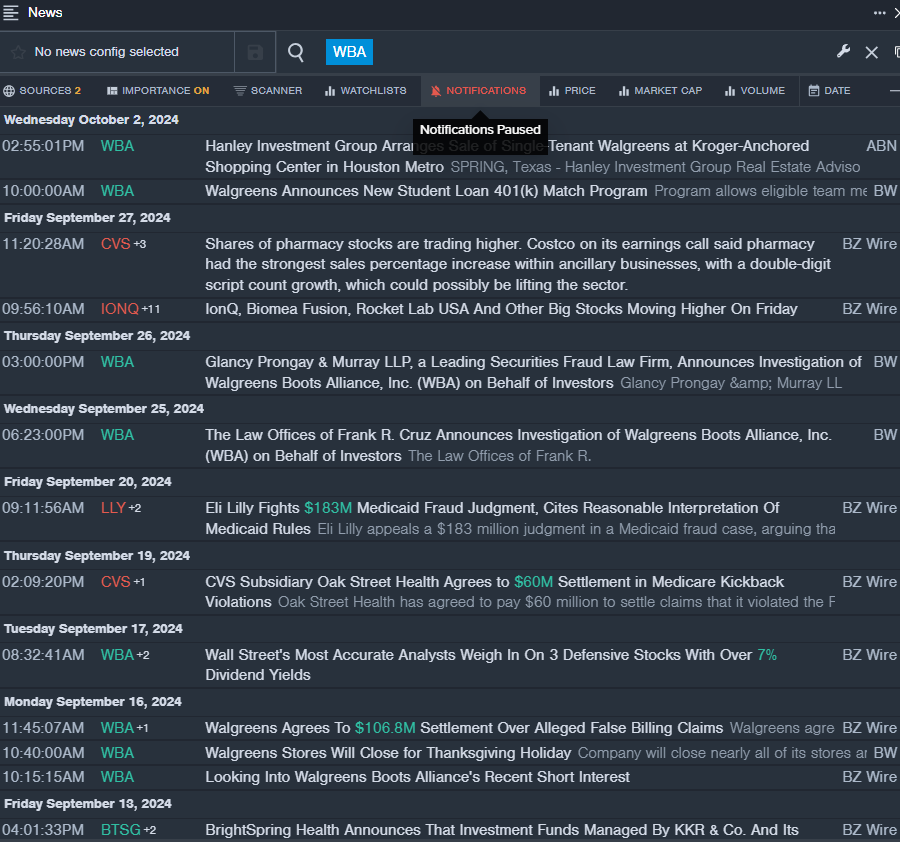

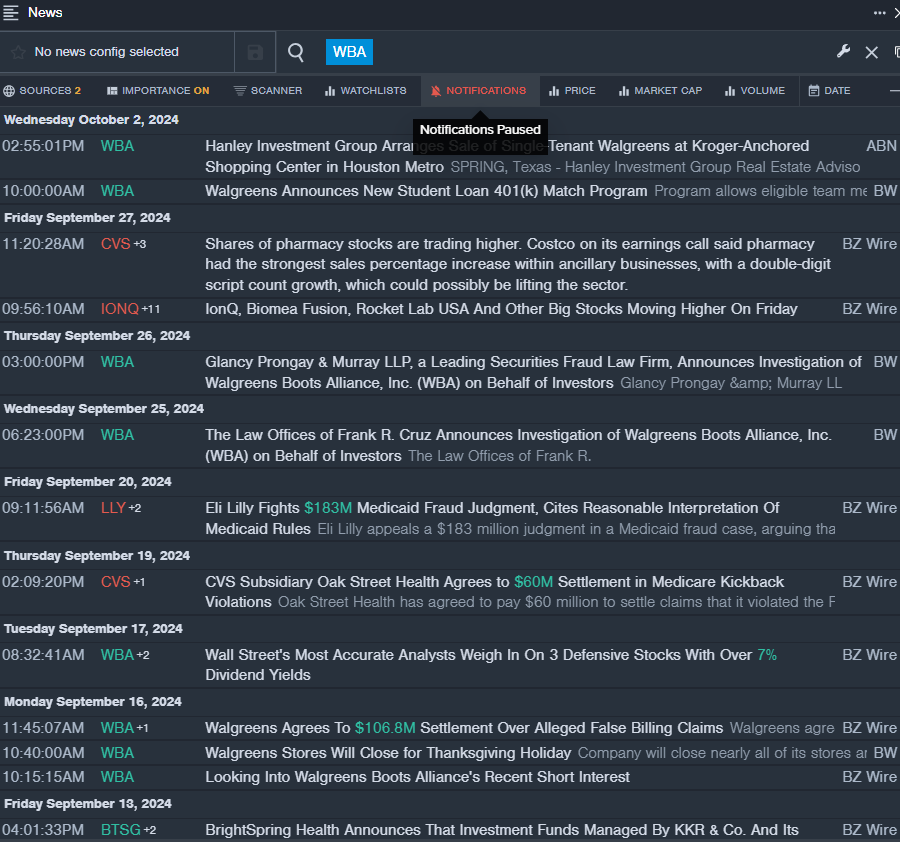

Walgreens Boots Alliance, Inc. WBA

- Dividend Yield: 11.49%

- UBS analyst Kevin Caliendo, with a commendable 75% accuracy rate, maintained a Neutral rating on July 3 and revised the price target down from $17 to $12. On the same day, RBC Capital analyst Ben Hendrix, boasting a 73% accuracy rate, retained a Sector Perform rating and lowered the price target from $22 to $13.

- Noteworthy Event: On September 13, Walgreens Boots Alliance settled a case by agreeing to a $106.8 million payment due to allegations of false claims submission to government healthcare programs.

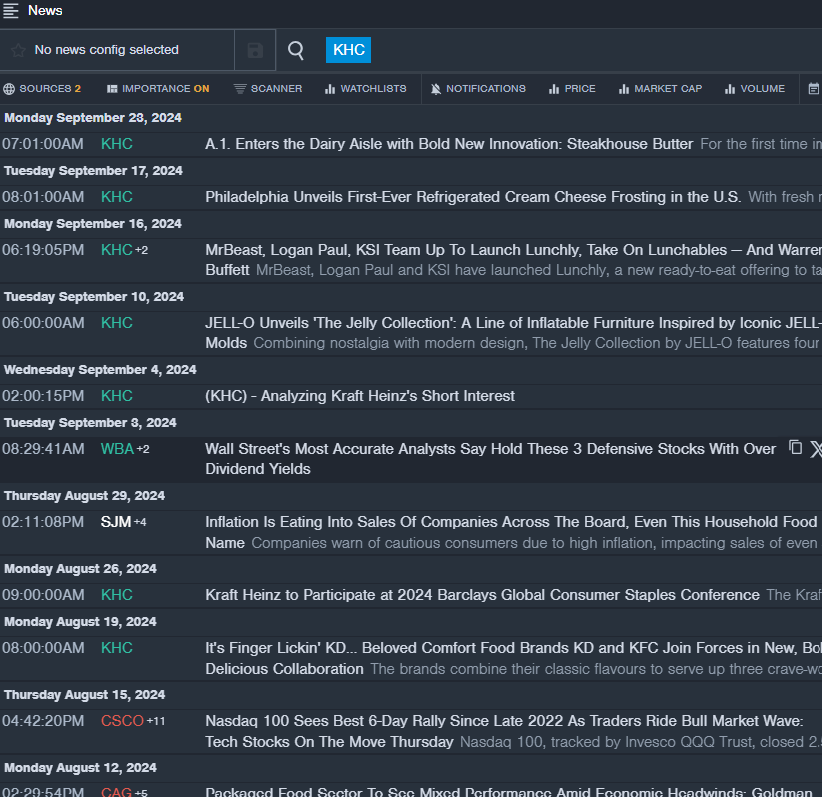

The Kraft Heinz Company KHC

- Dividend Yield: 4.66%

- Wells Fargo analyst Chris Carey, holding a 63% accuracy rate, maintained an Equal-Weight rating on August 1 and raised the price target from $34 to $35. On July 10, another reputed analyst, B of A Securities‘ Bryan Spillane, with a 64% accuracy rate, upheld a Buy rating and adjusted the price target from $42 to $38.

- Key Update: On July 31, Kraft Heinz reported second-quarter adjusted EPS results that exceeded expectations.

Philip Morris International Inc. PM

- Dividend Yield: 4.52%

- Goldman Sachs analyst Bonnie Herzog, boasting a 71% accuracy rate, maintained a Buy rating and increased the price target from $126 to $140 on September 26. On September 9, Barclays analyst Gaurav Jain, with a 66% accuracy rate, retained an Overweight rating and raised the price target from $130 to $145.

- Upcoming: Philip Morris International is set to unveil its fiscal third-quarter results on October 22.

More Insights Await:

Market News and Data brought to you by Benzinga APIs