Bullish Whales Make Waves in PDD Holdings

Deep-pocketed investors have donned their bullish hats on a carnival ride within the grounds of PDD Holdings.

Trading Insights on PDD Holdings

Diving into the ocean of options history for PDD Holdings (PDD) reveals a mosaic of 104 trades.

An analysis of these trades discloses a split: 49% of investors unveiling a buoyant demeanor, while 39% adopting a more bearish stance.

The sea contains 21 puts, worth $2,224,901, and 83 calls, tallying up to $9,801,050.

Riding the Waves of Price Movements

The tidal pull of trading activities suggests a compass pointing towards a price band of $100.0 to $230.0 for PDD Holdings in recent months.

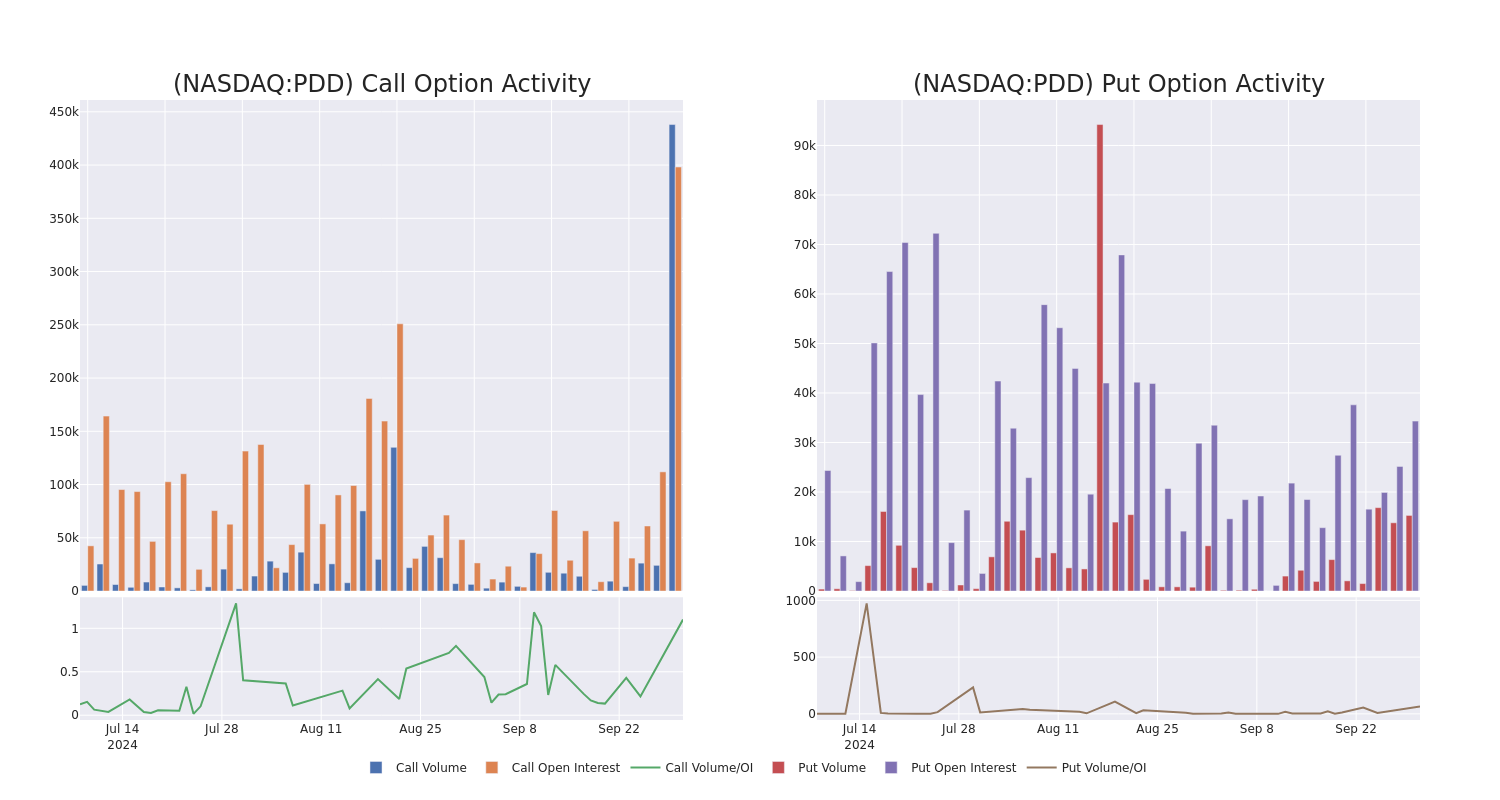

Diving into Volume & Open Interest

Measuring the depth of volume and open interest is akin to peering into a crystal ball for options trading. These metrics serve as lanterns illuminating the path of liquidity and investor intrigue embraced by PDD Holdings’s options across strata of strike prices.

Theatrics of PDD Holdings Option Activity: A Snapshot

Unveiling Major Option Sightings

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PDD | CALL | TRADE | NEUTRAL | 11/01/24 | $9.35 | $8.8 | $9.1 | $155.00 | $910.0K | 696 | 2.0K |

| PDD | CALL | SWEEP | BULLISH | 11/15/24 | $7.5 | $7.4 | $7.5 | $165.00 | $675.0K | 6.8K | 14.8K |

| PDD | CALL | SWEEP | NEUTRAL | 01/16/26 | $22.0 | $21.9 | $21.92 | $200.00 | $320.2K | 2.1K | 1.5K |

| PDD | CALL | TRADE | NEUTRAL | 12/20/24 | $29.8 | $29.6 | $29.7 | $130.00 | $297.0K | 4.8K | 206 |

| PDD | CALL | TRADE | BULLISH | 12/20/24 | $54.7 | $54.35 | $54.7 | $100.00 | $273.5K | 3.0K | 174 |

An Introduction to PDD Holdings

PDD Holdings emerges as a multinational commerce spectacle, orchestrating a portfolio of enterprises. PDD’s mission hinges on ushering in more businesses and people into the digital fold, where local communities and small ventures can reap the fruits of enhanced productivity and novel horizons.

Current Winds in PDD Holdings

- With a trading volume cresting at 16,894,034, PDD’s price drifts down -0.16% to $152.38.

- The RSI signals hoist a flag, hinting at a potential overbought scenario for the stock.

- The upcoming earnings report unfurls its sails 53 days hence.

Steering the Ship Amid Unusual Options Activity

Charting a course through the oceanic layers of options unveils potential hidden treasures before they surface. Ride the crest of the waves with the smart money positioning itself. Delve deeper into the action.

Options, akin to a thrilling leap across a chasm, harbor higher profits but also higher perils. Seasoned traders navigate this terrain by gleaning wisdom daily, executing timely maneuvers, heeding multiple signals, and keeping a vigilant watch on the tides of the markets.

Market News and Data brought to you by Benzinga APIs