Exploring PepsiCo’s Performance Expectations

As the Q3 earnings season looms closer, the spotlight shines on PepsiCo (PEP), a stalwart in the consumer staples sector, set to unveil its financial report on Tuesday, October 8th, before the market unveils its daily drama.

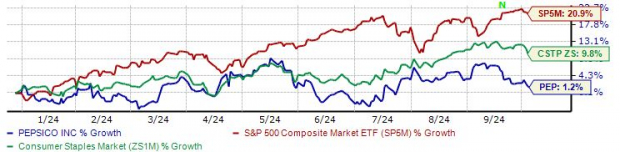

Throughout 2024, PEP shares have wavered, mustering a mere 1.2% uptick and largely following a sideways trajectory. It’s a bittersweet reality considering the dwindling interest in Consumer Staples stocks, as investors flock to the more tantalizing technology space during this risk-on phase.

A visual journey comparing the year-to-date performance of PEP shares against the Zacks Consumer Staples sector and the formidable S&P 500 sheds light on the picture.

Image Source: Zacks Investment Research

Analysts have recalibrated their earnings outlook downward leading up to this disclosure date. The Zacks Consensus EPS estimate sits at $2.30, marking a 2% drop since mid-July but still projecting a 2.2% rise compared to the previous year.

Image Source: Zacks Investment Research

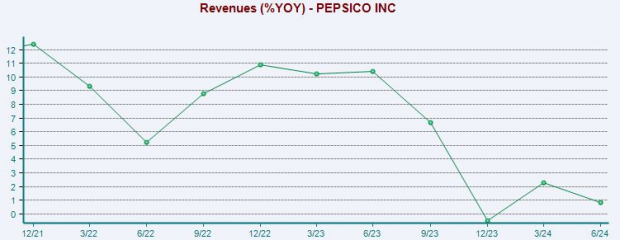

Revenue predictions share a similar narrative, with the anticipated $23.9 billion reflecting a modest 1% decline over time, yet signaling a 1.9% increase from the year prior. Interestingly, PepsiCo’s revenue growth pace shows a noticeable deceleration.

It’s crucial to clarify that the chart showcasing the year-over-year percentage change portrays the evolution accurately.

Image Source: Zacks Investment Research

On a historical valuation basis, PEP shares come at a discount, with the current 19.6X forward 12-month earnings multiple comfortably below the five-year median of 23.6X and the zenith of 27.8X. This downtrend in valuation mirrors the dwindling growth prophesied by investors.

Should Investors Quench Their Thirst for PEP Shares?

The narrative surrounding PepsiCo’s impending earnings announcement paints a cautious portrait. Analysts have fine-tuned their projections downward. Though PEP shares have been relatively lackluster, a positive revelation could invigorate a sense of purpose.

It’s a game of patience and discernment as we wait for the earnings unveiling. As a defensive stock, PEP shares might not plunge drastically even if results fall short of expectations.