Oracle recently announced plans to inject a whopping $6.5 billion into a Malaysian public cloud region, a move signaling a pivotal step in the fierce AI and cloud computing arena. This bold strategic decision not only stands as one of the largest foreign capital injections into Malaysia’s tech realm but also positions Oracle at the helm of the burgeoning Southeast Asian market while bolstering its global AI capabilities.

The Gateway to Malaysia: Oracle’s ASEAN AI Strategy Unfolds

This aggressive investment by Oracle arrives at a crucial juncture as the tech giant aggressively expands its cloud infrastructure and AI offerings, showcasing a relentless pursuit to gain a significant slice of the AI-powered cloud services pie.

The strategic selection of Malaysia leverages the nation’s burgeoning tech talent pool and its strategic positioning within the ASEAN region. This strategic move propels Oracle into a rapidly expanding market while elevating its global AI prowess. The newly established hub is set to complement Oracle’s existing global cloud regions and innovation outposts, constructing a robust ecosystem for AI development and deployment.

For shareholders eyeing the Oracle stock, this massive investment hits the bull’s eye on several fronts. First and foremost, it underscores Oracle’s steadfast commitment to AI and its readiness to allocate substantial resources to stay nimble in this swiftly evolving field.

Oracle’s cutting-edge AI capabilities are becoming a linchpin in the progressively AI-centric tech domain. The company has already built a solid reputation in handling generative AI workloads, securing prominent clients like Reka and Elon Musk’s xAI. This advantageous standing positions Oracle favorably in the competitive landscape of cloud infrastructure and services, where global expenditures surged to $78.2 billion in the second quarter of 2024, with a significant chunk aimed at AI-related investments.

To fortify its AI ecosystem, Oracle has rolled out new AI features within its Fusion Cloud Applications Suite, introducing over 50 novel AI agents and a slew of AI capabilities to offer guidance, recommendations, and actionable insights across finance, supply chain, HR, sales, marketing, and service domains. Additionally, the company has introduced generative development (GenDev) for enterprises, providing avant-garde technologies for accelerated application development.

Oracle’s Gen2 Cloud infrastructure, tailored to support AI and machine learning workloads, could serve as a substantial competitive edge. The company has also integrated AI-powered functionalities into Oracle Fusion Data Intelligence to aid organizations in extracting maximum value from their data assets.

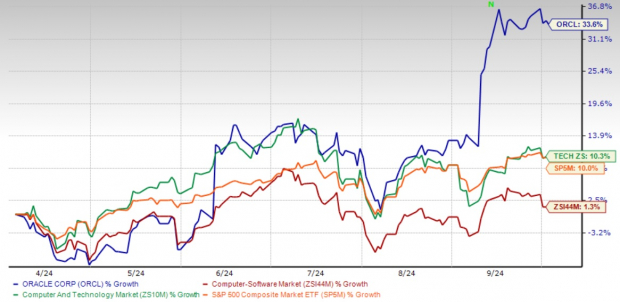

These strategic maneuvers are mirrored in Oracle’s optimistic cloud business forecasts, with an anticipated total cloud revenue growth of 23-25% at constant currency for the fiscal second quarter of 2025. The company envisions its cloud infrastructure services surpassing the growth witnessed in fiscal 2024 by a whopping 50% in the forthcoming year.

As Oracle presses on with innovations and expansion of its AI and cloud offerings, investors should vigilantly monitor the firm’s execution of these ambitious schemes and their consequential impact on both market share and financial performance amidst the cutthroat cloud and AI sectors.

The Final Frontier: Weighing in on Oracle’s Valuation and Market Competition

The AI and cloud computing arena stands as a fierce battleground, with tech behemoths such as Alphabet-owned Google, Microsoft, and Amazon continuously raising the stakes through relentless innovation and investments in these spaces. Oracle must ensure that its massive capital outlay translates into tangible technological breakthroughs and market share gains to justify the spend to its shareholders.

It is crucial to ponder whether Oracle’s current stock valuation accurately mirrors the company’s long-term growth prospects and ability to navigate the fierce competitive milieu.

ORCL is presently trading at a premium with a price/book of 41.03X as opposed to the Zacks Computer-Software industry’s 8.99X, portraying an extended valuation.

The Tapestry Unraveled: Assessing Oracle’s Path Ahead

Oracle’s monumental $6.5 billion investment in a Malaysia AI hub emerges as a distinctive strategic move that could sculpt the company’s trajectory in the spheres of AI and cloud computing. For investors, this move presents a mix of opportunities and risks. Savvy investors might opt to wait and watch how this sizable investment unfolds and influences Oracle’s financial performance in the coming quarters. They might track promising signs like fresh product launches, partnerships in the Southeast Asian market, or enhancements in cloud services market share before diving in.

Strategic Move: Oracle’s Investment in Malaysia’s AI Hub

Research Chief Reveals “Single Best Pick to Double”

Amidst the bustling financial markets, where every ticker symbol seems to whisper the promise of enormous profits, there lies a whisper of an insider’s secret. A secret so tantalizing that five of Zacks’ brightest minds have each marked their territory among thousands of stocks. These experts, perched on the frontiers of financial intellect, have handpicked their most prized equities – those set to ascend by no less than 100% in the coming months. Amidst these five coveted signals, the Director of Research at Zacks, Sheraz Mian, extends his hand to unveil the most explosive prospect of them all.

This enigmatic entity is no less than Oracle Corporation. This tech titan, with a sharp focus on capturing the attention of discerning millennial and Gen Z audiences, witnessed nearly $1 billion in revenue last quarter alone. An opportune retreat in its market value now beckons prospective shareholders to seize the helm. While acknowledging that not all their elite picks are impeccable, this particular gem in the Zacks constellation holds the potential to surpass previous stunners like Nano-X Imaging, which catapulted by a staggering 129.6% in just over 9 months.

To read this article on Zacks.com click here.