The battle for cloud dominance between tech giants Oracle Corp (ORCL) and Salesforce Inc (CRM) is reaching new heights, propelling both stocks skyward on the AI wave to remarkable gains.

But with the two computing behemoths going head-to-head, who is emerging victorious? Let’s break down the figures, recent maneuvers, and key insights for savvy investors.

Oracle’s Strategic Move: Making Waves in Malaysia

Oracle is flexing its muscles in the cloud arena, witnessing a 20% surge in stock value over the past month and a whopping 61% year-to-date climb, fueled by robust growth in its cloud infrastructure services. The latest power play?

A monumental $6.5 billion investment earmarked for setting up a public cloud region in Malaysia—outpacing the $6.2 billion AWS initiative by Amazon.com Inc. Oracle’s aggressive expansion aims to tap into Malaysia’s burgeoning appetite for AI, data, and analytics, marking a significant tech investment in Southeast Asia.

Read Also: Oracle Bets Big: Plans Over $6.5B Cloud Expansion In Malaysia To Fuel AI Innovation

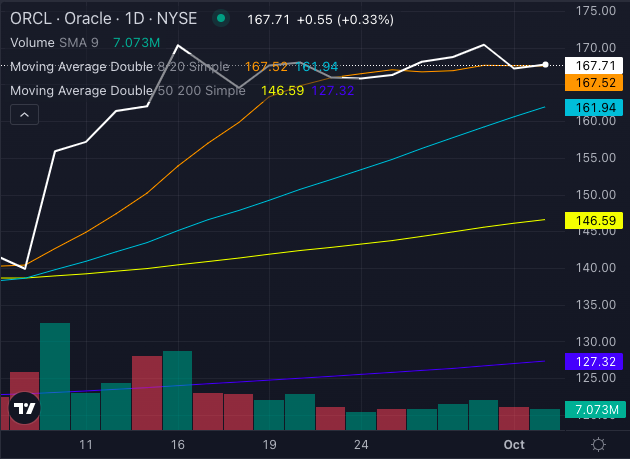

Chart created using Benzinga Pro

Oracle’s stock charts demonstrate strong bullish signals, with the share price at $167.71, comfortably above its eight-day, 20-day, and 50-day moving averages. However, a hint of selling pressure advises caution for those eyeing short-term gains. Nonetheless, with ambitious revenue targets of $104 billion by fiscal year 2029, Oracle is clearly playing the long game.

Salesforce: Embracing GenAI Power

Meanwhile, Salesforce is not resting on its laurels. The stock has surged by 12.67% in the last month, propelled by its latest offering, the AgentForce platform, which analysts have hailed as “on par” with Microsoft Corp’s GenAI.

Piper Sandler has raised Salesforce to an Outperform rating with a price target of $400. AgentForce, tailored for sales, marketing, and service workflows, has the potential to expand Salesforce’s Total Addressable Market (TAM) by a staggering $3.2 trillion.

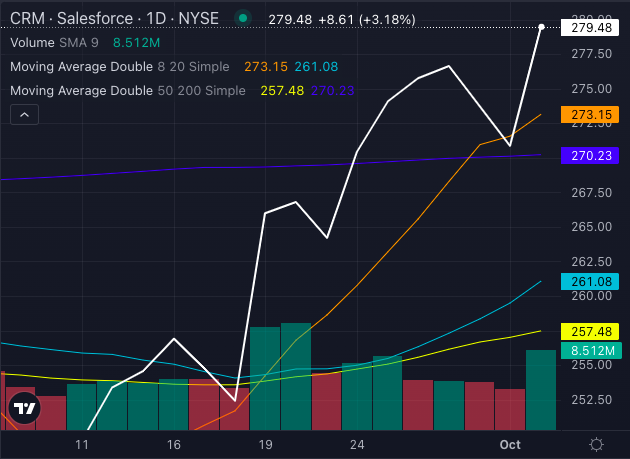

Chart created using Benzinga Pro

Salesforce’s stock charts reveal strong technical signals, trading at $279.48, comfortably above its eight-day, 20-day, and 50-day moving averages, confirming robust buying momentum.

The Verdict?

Both Oracle and Salesforce stand as AI-driven, cloud-focused titans with substantial growth potentials. While Oracle’s bold steps in Asia underscore its global ambitions, Salesforce’s GenAI pursuits position it to dominate the enterprise software realm.

Investors with an eye on cloud computing and AI innovation should carefully evaluate both offerings. Oracle’s expansive international ventures and optimistic long-term trajectory may give it an edge over Salesforce’s innovative short-term victories.

The burning question remains: In the battle for cloud supremacy, who will emerge as the reigning monarch? The unfolding AI boom holds the answer.

Read Next:

Photo: Shutterstock

Market News and Data brought to you by Benzinga APIs