When making decisions on stocks, investors often turn to analyst recommendations. These recommendations, often influenced by media reports, play a role in shaping stock prices. But how reliable are they? Before diving into the reliability of brokerage recommendations and how investors can leverage them to their advantage, let’s peek into what Wall Street giants opine about Energy Fuels (UUUU).

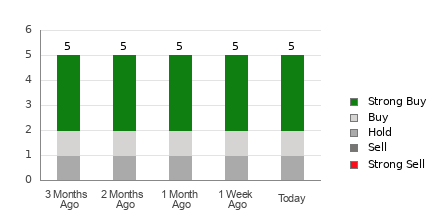

With an average brokerage recommendation (ABR) of 1.60, Energy Fuels sits between a Strong Buy and Buy on the scale of 1 to 5, with actual recommendations from five brokerage firms shaping this score. Of the current recommendations, three are Strong Buy and one is Buy, making up 60% and 20% of all recommendations, respectively.

Evaluating Trends in Brokerage Recommendations for UUUU

The ABR might signal a strong case for investing in Energy Fuels, but solely relying on this information might not be the wisest move. Research indicates that brokerage recommendations have limited success in directing investors towards stocks with substantial price appreciation potential.

Why is that? Analysts working for brokerage firms tend to exhibit a significant positive bias towards the stocks they cover, with a tendency to issue more “Strong Buy” ratings compared to “Strong Sell” recommendations, tilting the scales in favor of the firms’ interests rather than retail investors’ benefits.

Considering this, it’s advisable to complement this data with your personal analysis or a reliable tool with a proven track record in predicting stock price movements.

One such tool is the Zacks Rank, a proprietary stock rating system with a robust audited history that categorizes stocks from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), offering insights into a stock’s potential price performance in the near term. Combining ABR insights with the Zacks Rank could provide a sound basis for investment decisions.

Understanding the Distinction Between Zacks Rank and ABR

While both ABR and Zacks Rank are rated on a scale of 1-5, they serve distinct purposes. ABR derives from broker recommendations and is usually depicted in decimals, whereas the Zacks Rank, based on earnings estimate revisions, is displayed in whole numbers.

Brokerage analysts’ optimistic bias in their ratings stemming from their firms’ interests often misleads investors more than guiding them. In contrast, the Zacks Rank draws strength from earnings estimate revisions, which show a strong correlation with short-term stock price movements.

The Zacks Rank spreads its grades evenly across all stocks with current-year earnings estimates, maintaining balance in its rankings. Additionally, the Zacks Rank reflects real-time data as brokerage analysts continually update their earnings estimates based on a company’s evolving business landscape.

Is Investing in UUUU Lucrative?

Analysts’ consistent views on Energy Fuels have resulted in an unchanged Zacks Consensus Estimate for the company at -$0.11 over the last month. This stability could indicate the stock performing in alignment with the broader market in the short run.

With a Zacks Rank #3 (Hold) for Energy Fuels due to minimal changes in earnings estimates, cautious optimism might be advisable for investors. For a list of today’s Zacks Rank #1 (Strong Buy) stocks, visit here.

Considering the uncertain future, proceeding with vigilance regarding the Buy-equivalent ABR for Energy Fuels could be judicious.

Providing a Reliable Foundation for Investment

While the ABR provides insights into Wall Street analysts’ views, combining this with the Zacks Rank, rooted in earnings estimate revisions, could offer a more holistic perspective for investors. By scrutinizing multiple angles of analysis, investors can make informed decisions amidst the dynamic stock market environment.