Google is contemplating the adoption of nuclear power to power its data centers, a move detailed in a recent Bloomberg report. The technology behemoth is actively engaging with utilities in the United States and worldwide to evaluate the potential of this energy source.

Google’s Energy Shift to Nuclear Power for Data Centers

This strategic pivot echoes the surging interest from tech enterprises in nuclear energy. This interest stems from the unprecedented demand for electricity, sparked by the artificial intelligence surge. The burgeoning interest in AI has led tech firms to ramp up investments in data centers, critical infrastructures comprising storage systems and servers that necessitate substantial power to handle, manage, and disseminate data.

For Google, securing a dependable, steadfast energy supply is paramount for fostering sustained growth, particularly as the company broadens its AI capacities. Notably, in its pursuit to fortify resilience against potential risks, Google appears to be leaning towards diversifying its energy sources, with nuclear energy emerging as a viable contender.

Google’s Global Quest for Nuclear Power

Amanda Peterson Corio, Google’s global head of data center energy, disclosed to Bloomberg that in heavily regulated U.S. energy markets, where direct power procurement by the company is not feasible, Google is engaged in collaborations with utility partners and generators to explore innovative technologies, with nuclear power being a prime candidate.

Corio also hinted at the possibility of embracing nuclear energy in countries like Japan. Concurrently, other tech giants such as Microsoft and Amazon have already adopted nuclear power as a dependable, eco-friendly energy source to cater to the skyrocketing demands of their data centers, a move aimed at reducing reliance on fossil fuels.

Evaluating Google’s Investment Prospects

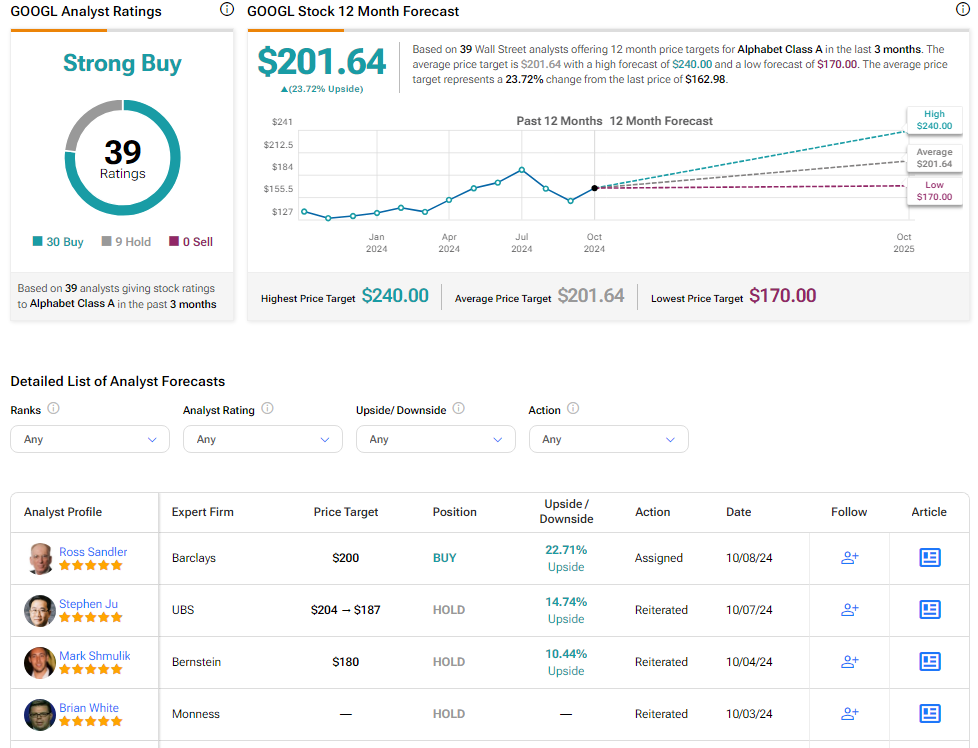

Market analysts maintain an optimistic outlook on GOOGL stock, endorsing a Strong Buy consensus rating based on 30 Buy ratings and nine Holds. Over the past year, GOOGL stock has demonstrated a noteworthy growth, surpassing 15%, and the average price target of $201.64 foresees a potential upside of 23.7% from current levels.

Explore more analyst ratings for GOOGL here