China Stimulus Sparks Equities in 2024

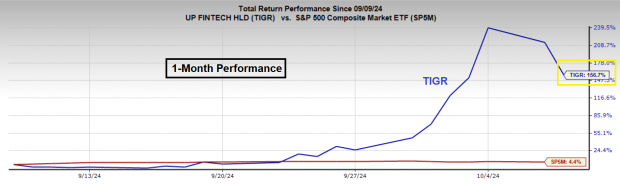

On the night of September 23rd, the Chinese government announced a sweeping stimulus package that was above expectations. The Chinese stimulus package included monetary stimulus, which slashed mortgage rates to help rejuvenate China’s real estate market, which has been ailing years. A combination of depression-like sentiment, bargain-basement equity valuations, and heavy short interest sent Chinese stocks flying higher in their biggest rally in years. Chinese ADRs like JD.com (JD) and Futu Holdings (FUTU) are up more than 50% in the past month, while UP Fintech Holding (TIGR) soared a staggering 240% before retreating Tuesday!

Image Source: Zacks Investment Research

Chinese Stocks Suffer Worst Day Since Financial Crisis

Chinese stocks finally took a well-deserved breather after a multi-week face-ripping rally. The iShares China ETF (FXI) (a proxy for large-cap Chinese stocks) had soared from $25 to $37 over the past few weeks and gained ground in 11 of 13 sessions before retreating ~9% Tuesday. Several news sources quickly pointed out that the one-day drubbing in Chinese stocks was the worst since the heart of the Global Financial Crisis when former banking juggernaut Lehman Brothers went bust.

China: Should Investors Buy the Dip?

Though the one-day drop in Chinese stocks is painful for those who chased the bull move, such action is standard in the context of the mega short squeeze that has occurred. A 10% pullback in the depths of a bear market is entirely different from a 10% pullback after a significant short squeeze. For instance, FXI is giving back roughly 1/3 of its move higher. To give investors an idea of its strength, the stock is retreating to its short term 10-day moving average for the first time. The current level is a perfect place for investors who missed the initial bull move but didn’t chase strength and are likely to jump in at these levels.

Image Source: TradingView

Buybacks are a Bullish Catalyst

Alibaba (BABA), China’s leading e-commerce company, is worth watching as a proxy for investors. Like Apple (AAPL) years ago, BABA is driving its stock higher through buybacks. In fact, the company bought back its own shares nearly every day in September and buybacks totaled more than $4 billion in Q3. BABA paused buybacks as Chinese equities started squeezing, but I anticipate that the company will use the dip to resume buybacks, thus cutting the supply of shares and driving them higher.

Chinese Equities Remain Cheap

Despite the epic short squeeze in Chinese stocks, valuations remain historically cheap. For example, BABA’s price-to-sales ratio of ~2x is a fifth of what it was in 2020.

Image Source: Zacks Investment Research

Bottom Line

Chinese stocks cratered on Tuesday. However, the fundamentals and technical suggest that the pullback is likely a buying opportunity rather than a top.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +23.7% per year. So be sure to give these hand picked 7 your immediate attention.

Apple Inc. (AAPL) : Free Stock Analysis Report

iShares China Large-Cap ETF (FXI): ETF Research Reports

JD.com, Inc. (JD) : Free Stock Analysis Report

Alibaba Group Holding Limited (BABA) : Free Stock Analysis Report

Futu Holdings Limited Sponsored ADR (FUTU) : Free Stock Analysis Report