When it comes to investing, the recommendations of Wall Street analysts hold significant weight. These so-called experts can often sway investors’ decisions on whether to buy, sell, or hold a stock. But just how reliable are their opinions?

Before we dive into the approach to evaluating brokerage recommendations and leveraging them to your advantage, let’s first examine what the Wall Street heavyweights are saying about Accenture (ACN).

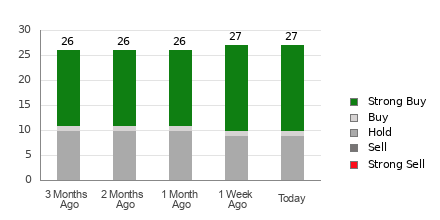

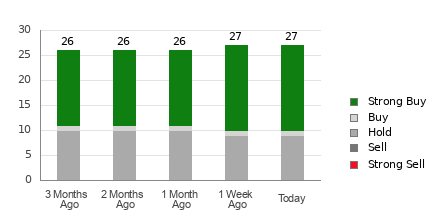

Accenture currently boasts an average brokerage recommendation (ABR) of 1.70, falling between Strong Buy and Buy on a scale of 1 to 5. This metric is a culmination of recommendations (Buy, Hold, Sell, etc.) from 27 different brokerage firms.

Of the 27 recommendations contributing to the ABR, 17 are labeled as Strong Buy, with one as Buy. These ratings make up 63% and 3.7% of all recommendations, respectively.

Interpreting Brokerage Recommendation Trends for ACN

The ABR suggests buying Accenture might be a prudent move, yet relying solely on this metric might not be the wisest strategy. Studies indicate that brokerage recommendations do not consistently lead investors to stocks with maximum price appreciation potential.

But why is that? Well, the analysts at brokerage firms tend to exhibit a strong positive bias towards the stocks they cover. This enthusiasm often results in an imbalance, with five “Strong Buy” ratings for every “Strong Sell.” So, the alignment of their interests with that of retail investors is questionable.

Therefore, using brokerage recommendations as a validation tool in conjunction with a reliable indicator can vastly enhance your investment decisions.

Distinguishing ABR from Zacks Rank

It’s essential to grasp the disparity between the ABR and the Zacks Rank. While both are rated on a scale of 1 to 5, they serve distinct purposes.

The ABR relies solely on brokerage recommendations, expressed in decimals (e.g., 1.28), whereas the Zacks Rank is anchored in a quantitative model that leverages earnings estimate revisions, presented in whole numbers from 1 to 5.

Historically, brokerage analysts have leaned towards optimistic recommendations due to their firms’ vested interests, which might mislead investors. On the contrary, the Zacks Rank is fueled by earnings estimate revisions, showcasing a strong correlation with short-term stock price movements.

Moreover, the Zacks Rank ensures proportionate distribution across all stocks that analysts provide earnings estimates for throughout the year, maintaining equilibrium among the five ranks it assigns.

Considering Investment in ACN

Reviewing Accenture’s earnings estimate revisions, the Zacks Consensus Estimate for the current year has experienced a 1.6% uptick to $12.75 in the past month.

The collective optimism among analysts in raising EPS estimates could propel the stock upward in the near future, leading to a Zacks Rank #2 (Buy) for Accenture.

Given the recent consensus estimate change and the bullish sentiment surrounding the company, the ABR equivalent for Accenture serves as a valuable guide for potential investors.