Advanced Micro Devices (AMD) has unveiled a new artificial intelligence chip to level the playing field against industry heavyweight Nvidia (NVDA).

The latest offering from AMD, the Instinct MI325X microchip, is poised to compete head-on with Nvidia’s Blackwell lineup in the realm of AI applications in data centers. Renowned for its prowess in running AI, these graphics processing units (GPUs) are the cutting edge in this space.

Production of the Instinct MI325X microchip is set to kick off by the end of the year. Although details on pricing are scarce, this new AI chip succeeds the popular MI300X chip launched in late 2023, widely employed by tech giants like Meta Platforms (META) and Microsoft (MSFT) for their AI operations.

Challenging Nvidia’s Dominance

AMD’s leadership is unequivocal in its ambitions to snatch market share from Nvidia, which currently commands a 90% market share in data center GPUs. The company forecasts a $500 billion market size for GPU chips by 2028. Encouragingly, AMD’s data center sales for the second quarter doubled from the previous year to $2.8 billion.

A successful launch and robust sales of the new data center GPU chip could fuel an upsurge in AMD’s stock performance. While AMD’s shares have ascended by 11% this year, they significantly lag behind Nvidia, whose stock has surged by 173% year-to-date. AMD is due to announce its quarterly financial results on October 28.

Assessing AMD’s Investment Potential

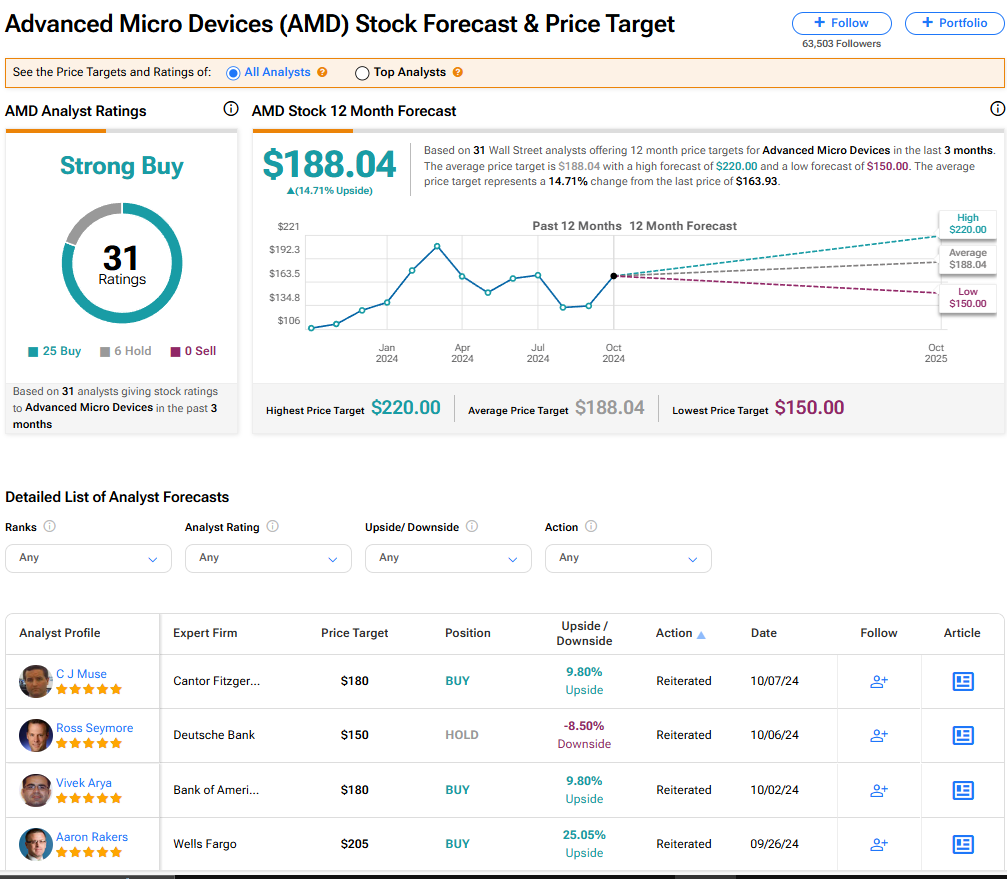

As AMD’s stock continues to garner momentum, 31 Wall Street analysts unanimously rate it as a Strong Buy. This consensus is underpinned by 25 Buy and six Hold recommendations over the past three months. The average price target for AMD stands at $188.04, implying a potential upside of 14.71% from current levels.